FALSE2024Q10001823945--12-31http://fasb.org/us-gaap/2023#NonoperatingIncomeExpensehttp://fasb.org/us-gaap/2023#NonoperatingIncomeExpensehttp://fasb.org/us-gaap/2023#NonoperatingIncomeExpensehttp://fasb.org/us-gaap/2023#NonoperatingIncomeExpensehttp://fasb.org/us-gaap/2023#NonoperatingIncomeExpensehttp://fasb.org/us-gaap/2023#NonoperatingIncomeExpensehttp://fasb.org/us-gaap/2023#NonoperatingIncomeExpensehttp://fasb.org/us-gaap/2023#NonoperatingIncomeExpenseP3Y00018239452024-01-012024-03-310001823945us-gaap:CommonClassAMember2024-04-26xbrli:shares0001823945us-gaap:CommonClassBMember2024-04-260001823945us-gaap:CommonClassCMember2024-04-260001823945owl:CommonClassDMember2024-04-2600018239452024-03-31iso4217:USD00018239452023-12-310001823945us-gaap:CommonClassAMember2024-03-31iso4217:USDxbrli:shares0001823945us-gaap:CommonClassAMember2023-12-310001823945us-gaap:CommonClassCMember2023-12-310001823945us-gaap:CommonClassCMember2024-03-310001823945owl:CommonClassDMember2024-03-310001823945owl:CommonClassDMember2023-12-3100018239452023-01-012023-03-310001823945us-gaap:AssetManagement1Member2024-01-012024-03-310001823945us-gaap:AssetManagement1Member2023-01-012023-03-310001823945us-gaap:AdministrativeServiceMember2024-01-012024-03-310001823945us-gaap:AdministrativeServiceMember2023-01-012023-03-310001823945us-gaap:ManagementServiceIncentiveMember2024-01-012024-03-310001823945us-gaap:ManagementServiceIncentiveMember2023-01-012023-03-310001823945us-gaap:CommonStockMemberus-gaap:CommonClassAMember2023-12-310001823945us-gaap:CommonStockMemberus-gaap:CommonClassAMember2022-12-310001823945us-gaap:CommonStockMemberus-gaap:CommonClassAMember2024-01-012024-03-310001823945us-gaap:CommonStockMemberus-gaap:CommonClassAMember2023-01-012023-03-310001823945us-gaap:CommonStockMemberus-gaap:CommonClassAMember2024-03-310001823945us-gaap:CommonStockMemberus-gaap:CommonClassAMember2023-03-310001823945us-gaap:CommonStockMemberus-gaap:CommonClassCMember2023-12-310001823945us-gaap:CommonStockMemberus-gaap:CommonClassCMember2022-12-310001823945us-gaap:CommonStockMemberus-gaap:CommonClassCMember2024-01-012024-03-310001823945us-gaap:CommonStockMemberus-gaap:CommonClassCMember2023-01-012023-03-310001823945us-gaap:CommonStockMemberus-gaap:CommonClassCMember2024-03-310001823945us-gaap:CommonStockMemberus-gaap:CommonClassCMember2023-03-310001823945us-gaap:CommonStockMemberowl:CommonClassDMember2023-12-310001823945us-gaap:CommonStockMemberowl:CommonClassDMember2022-12-310001823945us-gaap:CommonStockMemberowl:CommonClassDMember2024-03-310001823945us-gaap:CommonStockMemberowl:CommonClassDMember2023-03-310001823945us-gaap:AdditionalPaidInCapitalMember2023-12-310001823945us-gaap:AdditionalPaidInCapitalMember2022-12-310001823945us-gaap:AdditionalPaidInCapitalMember2024-01-012024-03-310001823945us-gaap:AdditionalPaidInCapitalMember2023-01-012023-03-310001823945us-gaap:AdditionalPaidInCapitalMember2024-03-310001823945us-gaap:AdditionalPaidInCapitalMember2023-03-310001823945us-gaap:RetainedEarningsMember2023-12-310001823945us-gaap:RetainedEarningsMember2022-12-310001823945us-gaap:RetainedEarningsMember2024-01-012024-03-310001823945us-gaap:RetainedEarningsMember2023-01-012023-03-310001823945us-gaap:RetainedEarningsMember2024-03-310001823945us-gaap:RetainedEarningsMember2023-03-310001823945us-gaap:ParentMember2024-03-310001823945us-gaap:ParentMember2023-03-310001823945us-gaap:NoncontrollingInterestMember2023-12-310001823945us-gaap:NoncontrollingInterestMember2022-12-310001823945us-gaap:NoncontrollingInterestMember2024-01-012024-03-310001823945us-gaap:NoncontrollingInterestMember2023-01-012023-03-310001823945us-gaap:NoncontrollingInterestMember2024-03-310001823945us-gaap:NoncontrollingInterestMember2023-03-3100018239452023-03-310001823945us-gaap:CommonStockMemberowl:CommonClassDMember2024-01-012024-03-310001823945us-gaap:CommonStockMemberowl:CommonClassDMember2023-01-012023-03-3100018239452022-12-31owl:segment0001823945us-gaap:RestrictedStockUnitsRSUMember2024-03-310001823945us-gaap:PrivatePlacementMember2024-03-310001823945owl:CommonClassAAndCommonClassCMember2024-03-31xbrli:pure0001823945owl:CommonClassBAndCommonClassDMember2024-03-310001823945us-gaap:RestrictedStockUnitsRSUMember2021-01-012021-05-180001823945us-gaap:WarrantMember2021-05-190001823945us-gaap:WarrantMember2024-03-310001823945owl:GeneralPartnerUnitsMemberowl:BlueOwlOperatingGroupMember2024-03-310001823945owl:BlueOwlOperatingGroupMemberowl:CommonUnitsMember2024-03-310001823945owl:IncentiveUnitsMemberowl:BlueOwlOperatingGroupMember2024-03-310001823945us-gaap:CommonClassAMember2024-01-012024-03-310001823945owl:ShareRepurchaseProgramProgramOneMember2022-05-040001823945owl:ShareRepurchaseProgramProgramOneMember2024-01-012024-03-310001823945owl:ShareRepurchaseProgramProgramOneMember2023-01-012023-03-310001823945us-gaap:RestrictedStockUnitsRSUMember2024-01-012024-03-310001823945us-gaap:RestrictedStockUnitsRSUMember2023-01-012023-03-310001823945owl:OakStreetRealEstateCapitalLLCMember2024-03-31owl:tranche0001823945owl:WellfleetCreditPartnersLLCMember2024-03-310001823945owl:WellfleetCreditPartnersLLCMember2024-01-012024-03-310001823945us-gaap:CustomerContractsMember2024-03-310001823945us-gaap:CustomerContractsMember2023-12-310001823945us-gaap:CustomerRelationshipsMember2024-03-310001823945us-gaap:CustomerRelationshipsMember2023-12-310001823945us-gaap:RelatedPartyMember2024-03-310001823945us-gaap:RelatedPartyMember2023-12-310001823945us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel1Member2024-03-310001823945us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Member2024-03-310001823945us-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMember2024-03-310001823945us-gaap:FairValueMeasurementsRecurringMember2024-03-310001823945us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel1Member2023-12-310001823945us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Member2023-12-310001823945us-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMember2023-12-310001823945us-gaap:FairValueMeasurementsRecurringMember2023-12-310001823945us-gaap:CollateralizedLoanObligationsMemberus-gaap:FairValueInputsLevel3Member2023-12-310001823945us-gaap:CollateralizedLoanObligationsMemberus-gaap:FairValueInputsLevel3Member2022-12-310001823945us-gaap:CollateralizedLoanObligationsMemberus-gaap:FairValueInputsLevel3Member2024-01-012024-03-310001823945us-gaap:CollateralizedLoanObligationsMemberus-gaap:FairValueInputsLevel3Member2023-01-012023-03-310001823945us-gaap:CollateralizedLoanObligationsMemberus-gaap:FairValueInputsLevel3Member2024-03-310001823945us-gaap:CollateralizedLoanObligationsMemberus-gaap:FairValueInputsLevel3Member2023-03-310001823945owl:TaxReceivableAgreementMemberus-gaap:FairValueInputsLevel3Member2023-12-310001823945us-gaap:WarrantMemberus-gaap:FairValueInputsLevel3Member2023-12-310001823945us-gaap:FairValueInputsLevel3Memberowl:EarnoutSecuritiesLiabilityMember2023-12-310001823945us-gaap:FairValueInputsLevel3Member2023-12-310001823945owl:TaxReceivableAgreementMemberus-gaap:FairValueInputsLevel3Member2024-01-012024-03-310001823945us-gaap:WarrantMemberus-gaap:FairValueInputsLevel3Member2024-01-012024-03-310001823945us-gaap:FairValueInputsLevel3Memberowl:EarnoutSecuritiesLiabilityMember2024-01-012024-03-310001823945us-gaap:FairValueInputsLevel3Member2024-01-012024-03-310001823945owl:TaxReceivableAgreementMemberus-gaap:FairValueInputsLevel3Member2024-03-310001823945us-gaap:WarrantMemberus-gaap:FairValueInputsLevel3Member2024-03-310001823945us-gaap:FairValueInputsLevel3Memberowl:EarnoutSecuritiesLiabilityMember2024-03-310001823945us-gaap:FairValueInputsLevel3Member2024-03-310001823945owl:TaxReceivableAgreementMemberus-gaap:FairValueInputsLevel3Member2022-12-310001823945us-gaap:WarrantMemberus-gaap:FairValueInputsLevel3Member2022-12-310001823945us-gaap:FairValueInputsLevel3Memberowl:EarnoutSecuritiesLiabilityMember2022-12-310001823945us-gaap:FairValueInputsLevel3Member2022-12-310001823945owl:TaxReceivableAgreementMemberus-gaap:FairValueInputsLevel3Member2023-01-012023-03-310001823945us-gaap:WarrantMemberus-gaap:FairValueInputsLevel3Member2023-01-012023-03-310001823945us-gaap:FairValueInputsLevel3Memberowl:EarnoutSecuritiesLiabilityMember2023-01-012023-03-310001823945us-gaap:FairValueInputsLevel3Member2023-01-012023-03-310001823945owl:TaxReceivableAgreementMemberus-gaap:FairValueInputsLevel3Member2023-03-310001823945us-gaap:WarrantMemberus-gaap:FairValueInputsLevel3Member2023-03-310001823945us-gaap:FairValueInputsLevel3Memberowl:EarnoutSecuritiesLiabilityMember2023-03-310001823945us-gaap:FairValueInputsLevel3Member2023-03-310001823945us-gaap:ValuationTechniqueDiscountedCashFlowMemberus-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMember2024-03-310001823945us-gaap:ValuationTechniqueDiscountedCashFlowMembersrt:MinimumMemberus-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMemberowl:MeasurementInputYieldMember2024-03-310001823945us-gaap:ValuationTechniqueDiscountedCashFlowMemberus-gaap:FairValueInputsLevel3Membersrt:MaximumMemberus-gaap:FairValueMeasurementsRecurringMemberowl:MeasurementInputYieldMember2024-03-310001823945srt:WeightedAverageMemberus-gaap:ValuationTechniqueDiscountedCashFlowMemberus-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMemberowl:MeasurementInputYieldMember2024-03-310001823945us-gaap:ValuationTechniqueDiscountedCashFlowMembersrt:MinimumMemberus-gaap:FairValueInputsLevel3Memberus-gaap:MeasurementInputDiscountRateMemberus-gaap:FairValueMeasurementsRecurringMember2024-03-310001823945us-gaap:ValuationTechniqueDiscountedCashFlowMemberus-gaap:FairValueInputsLevel3Memberus-gaap:MeasurementInputDiscountRateMembersrt:MaximumMemberus-gaap:FairValueMeasurementsRecurringMember2024-03-310001823945srt:WeightedAverageMemberus-gaap:ValuationTechniqueDiscountedCashFlowMemberus-gaap:FairValueInputsLevel3Memberus-gaap:MeasurementInputDiscountRateMemberus-gaap:FairValueMeasurementsRecurringMember2024-03-310001823945us-gaap:FairValueInputsLevel3Memberus-gaap:ValuationTechniqueOptionPricingModelMemberus-gaap:FairValueMeasurementsRecurringMember2024-03-310001823945srt:MinimumMemberus-gaap:FairValueInputsLevel3Memberus-gaap:ValuationTechniqueOptionPricingModelMemberus-gaap:MeasurementInputPriceVolatilityMemberus-gaap:FairValueMeasurementsRecurringMember2024-03-310001823945us-gaap:FairValueInputsLevel3Memberus-gaap:ValuationTechniqueOptionPricingModelMemberus-gaap:MeasurementInputPriceVolatilityMembersrt:MaximumMemberus-gaap:FairValueMeasurementsRecurringMember2024-03-310001823945srt:WeightedAverageMemberus-gaap:FairValueInputsLevel3Memberus-gaap:ValuationTechniqueOptionPricingModelMemberus-gaap:MeasurementInputPriceVolatilityMemberus-gaap:FairValueMeasurementsRecurringMember2024-03-310001823945us-gaap:ValuationTechniqueDiscountedCashFlowMemberus-gaap:FairValueInputsLevel3Memberowl:WellfleetEarnoutSharesMemberus-gaap:FairValueMeasurementsRecurringMember2024-03-310001823945us-gaap:ValuationTechniqueDiscountedCashFlowMembersrt:MinimumMemberus-gaap:FairValueInputsLevel3Memberus-gaap:MeasurementInputDiscountRateMemberowl:WellfleetEarnoutSharesMemberus-gaap:FairValueMeasurementsRecurringMember2024-03-310001823945us-gaap:ValuationTechniqueDiscountedCashFlowMemberus-gaap:FairValueInputsLevel3Memberus-gaap:MeasurementInputDiscountRateMemberowl:WellfleetEarnoutSharesMembersrt:MaximumMemberus-gaap:FairValueMeasurementsRecurringMember2024-03-310001823945srt:WeightedAverageMemberus-gaap:ValuationTechniqueDiscountedCashFlowMemberus-gaap:FairValueInputsLevel3Memberus-gaap:MeasurementInputDiscountRateMemberowl:WellfleetEarnoutSharesMemberus-gaap:FairValueMeasurementsRecurringMember2024-03-310001823945us-gaap:ValuationTechniqueDiscountedCashFlowMemberus-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMember2023-12-310001823945us-gaap:ValuationTechniqueDiscountedCashFlowMembersrt:MinimumMemberus-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMemberowl:MeasurementInputYieldMember2023-12-310001823945us-gaap:ValuationTechniqueDiscountedCashFlowMemberus-gaap:FairValueInputsLevel3Membersrt:MaximumMemberus-gaap:FairValueMeasurementsRecurringMemberowl:MeasurementInputYieldMember2023-12-310001823945srt:WeightedAverageMemberus-gaap:ValuationTechniqueDiscountedCashFlowMemberus-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMemberowl:MeasurementInputYieldMember2023-12-310001823945us-gaap:ValuationTechniqueDiscountedCashFlowMembersrt:MinimumMemberus-gaap:FairValueInputsLevel3Memberus-gaap:MeasurementInputDiscountRateMemberus-gaap:FairValueMeasurementsRecurringMember2023-12-310001823945us-gaap:ValuationTechniqueDiscountedCashFlowMemberus-gaap:FairValueInputsLevel3Memberus-gaap:MeasurementInputDiscountRateMembersrt:MaximumMemberus-gaap:FairValueMeasurementsRecurringMember2023-12-310001823945srt:WeightedAverageMemberus-gaap:ValuationTechniqueDiscountedCashFlowMemberus-gaap:FairValueInputsLevel3Memberus-gaap:MeasurementInputDiscountRateMemberus-gaap:FairValueMeasurementsRecurringMember2023-12-310001823945us-gaap:FairValueInputsLevel3Memberus-gaap:ValuationTechniqueOptionPricingModelMemberus-gaap:FairValueMeasurementsRecurringMember2023-12-310001823945srt:MinimumMemberus-gaap:FairValueInputsLevel3Memberus-gaap:ValuationTechniqueOptionPricingModelMemberus-gaap:MeasurementInputPriceVolatilityMemberus-gaap:FairValueMeasurementsRecurringMember2023-12-310001823945us-gaap:FairValueInputsLevel3Memberus-gaap:ValuationTechniqueOptionPricingModelMemberus-gaap:MeasurementInputPriceVolatilityMembersrt:MaximumMemberus-gaap:FairValueMeasurementsRecurringMember2023-12-310001823945srt:WeightedAverageMemberus-gaap:FairValueInputsLevel3Memberus-gaap:ValuationTechniqueOptionPricingModelMemberus-gaap:MeasurementInputPriceVolatilityMemberus-gaap:FairValueMeasurementsRecurringMember2023-12-310001823945us-gaap:ValuationTechniqueDiscountedCashFlowMemberus-gaap:FairValueInputsLevel3Memberowl:OakStreetEarnoutsMemberus-gaap:FairValueMeasurementsRecurringMember2023-12-310001823945us-gaap:ValuationTechniqueDiscountedCashFlowMembersrt:MinimumMemberus-gaap:FairValueInputsLevel3Memberus-gaap:MeasurementInputDiscountRateMemberowl:OakStreetEarnoutsMemberus-gaap:FairValueMeasurementsRecurringMember2023-12-310001823945us-gaap:ValuationTechniqueDiscountedCashFlowMemberus-gaap:FairValueInputsLevel3Memberus-gaap:MeasurementInputDiscountRateMemberowl:OakStreetEarnoutsMembersrt:MaximumMemberus-gaap:FairValueMeasurementsRecurringMember2023-12-310001823945srt:WeightedAverageMemberus-gaap:ValuationTechniqueDiscountedCashFlowMemberus-gaap:FairValueInputsLevel3Memberus-gaap:MeasurementInputDiscountRateMemberowl:OakStreetEarnoutsMemberus-gaap:FairValueMeasurementsRecurringMember2023-12-310001823945us-gaap:ValuationTechniqueDiscountedCashFlowMemberus-gaap:FairValueInputsLevel3Memberowl:WellfleetEarnoutSharesMemberus-gaap:FairValueMeasurementsRecurringMember2023-12-310001823945us-gaap:ValuationTechniqueDiscountedCashFlowMembersrt:MinimumMemberus-gaap:FairValueInputsLevel3Memberus-gaap:MeasurementInputDiscountRateMemberowl:WellfleetEarnoutSharesMemberus-gaap:FairValueMeasurementsRecurringMember2023-12-310001823945us-gaap:ValuationTechniqueDiscountedCashFlowMemberus-gaap:FairValueInputsLevel3Memberus-gaap:MeasurementInputDiscountRateMemberowl:WellfleetEarnoutSharesMembersrt:MaximumMemberus-gaap:FairValueMeasurementsRecurringMember2023-12-310001823945srt:WeightedAverageMemberus-gaap:ValuationTechniqueDiscountedCashFlowMemberus-gaap:FairValueInputsLevel3Memberus-gaap:MeasurementInputDiscountRateMemberowl:WellfleetEarnoutSharesMemberus-gaap:FairValueMeasurementsRecurringMember2023-12-310001823945us-gaap:FairValueInputsLevel2Member2024-03-310001823945us-gaap:FairValueInputsLevel2Member2023-12-310001823945us-gaap:LeaseholdImprovementsMember2024-03-310001823945us-gaap:LeaseholdImprovementsMember2023-12-310001823945us-gaap:FurnitureAndFixturesMember2024-03-310001823945us-gaap:FurnitureAndFixturesMember2023-12-310001823945owl:ComputerHardwareAndSoftwareMember2024-03-310001823945owl:ComputerHardwareAndSoftwareMember2023-12-310001823945owl:A2028SeniorNotesMemberus-gaap:SeniorNotesMember2024-01-012024-03-310001823945owl:A2028SeniorNotesMemberus-gaap:SeniorNotesMember2024-03-310001823945us-gaap:SeniorNotesMemberowl:A2031SeniorNotesMember2024-01-012024-03-310001823945us-gaap:SeniorNotesMemberowl:A2031SeniorNotesMember2024-03-310001823945owl:A2032SeniorNotesMemberus-gaap:SeniorNotesMember2024-01-012024-03-310001823945owl:A2032SeniorNotesMemberus-gaap:SeniorNotesMember2024-03-310001823945owl:A2051SeniorNotesMemberus-gaap:SeniorNotesMember2024-01-012024-03-310001823945owl:A2051SeniorNotesMemberus-gaap:SeniorNotesMember2024-03-310001823945us-gaap:RevolvingCreditFacilityMemberus-gaap:LineOfCreditMemberowl:TheRevolvingCreditFacilityMember2024-01-012024-03-310001823945us-gaap:RevolvingCreditFacilityMemberus-gaap:LineOfCreditMemberowl:TheRevolvingCreditFacilityMember2024-03-310001823945owl:A2028SeniorNotesMemberus-gaap:SeniorNotesMember2023-01-012023-12-310001823945owl:A2028SeniorNotesMemberus-gaap:SeniorNotesMember2023-12-310001823945us-gaap:SeniorNotesMemberowl:A2031SeniorNotesMember2023-01-012023-12-310001823945us-gaap:SeniorNotesMemberowl:A2031SeniorNotesMember2023-12-310001823945owl:A2032SeniorNotesMemberus-gaap:SeniorNotesMember2023-01-012023-12-310001823945owl:A2032SeniorNotesMemberus-gaap:SeniorNotesMember2023-12-310001823945owl:A2051SeniorNotesMemberus-gaap:SeniorNotesMember2023-01-012023-12-310001823945owl:A2051SeniorNotesMemberus-gaap:SeniorNotesMember2023-12-310001823945us-gaap:RevolvingCreditFacilityMemberus-gaap:LineOfCreditMemberowl:TheRevolvingCreditFacilityMember2023-01-012023-12-310001823945us-gaap:RevolvingCreditFacilityMemberus-gaap:LineOfCreditMemberowl:TheRevolvingCreditFacilityMember2023-12-310001823945us-gaap:RevolvingCreditFacilityMemberus-gaap:LineOfCreditMemberowl:TheRevolvingCreditFacilityMember2023-06-300001823945us-gaap:RevolvingCreditFacilityMembersrt:MinimumMemberowl:SecuredOvernightFinancingRateSOFRMemberus-gaap:LineOfCreditMember2024-01-012024-03-310001823945us-gaap:RevolvingCreditFacilityMemberowl:SecuredOvernightFinancingRateSOFRMemberus-gaap:LineOfCreditMembersrt:MaximumMember2024-01-012024-03-310001823945us-gaap:RevolvingCreditFacilityMemberowl:SecuredOvernightFinancingRateSOFRMemberus-gaap:LineOfCreditMember2024-01-012024-03-310001823945us-gaap:RevolvingCreditFacilityMemberus-gaap:LineOfCreditMemberowl:NewYorkFederalBankRateMember2024-01-012024-03-310001823945us-gaap:RevolvingCreditFacilityMemberus-gaap:LineOfCreditMemberowl:AdjustedTermSecuredOvernightFinanceRateMember2024-01-012024-03-310001823945us-gaap:RevolvingCreditFacilityMembersrt:MinimumMemberus-gaap:LineOfCreditMemberowl:AdjustedTermSecuredOvernightFinanceRateMember2024-01-012024-03-310001823945us-gaap:RevolvingCreditFacilityMemberus-gaap:LineOfCreditMembersrt:MaximumMemberowl:AdjustedTermSecuredOvernightFinanceRateMember2024-01-012024-03-310001823945us-gaap:RevolvingCreditFacilityMembersrt:MinimumMemberus-gaap:LineOfCreditMemberowl:TheRevolvingCreditFacilityMember2024-01-012024-03-310001823945us-gaap:RevolvingCreditFacilityMemberus-gaap:LineOfCreditMembersrt:MaximumMemberowl:TheRevolvingCreditFacilityMember2024-01-012024-03-310001823945us-gaap:RelatedPartyMember2024-01-012024-03-310001823945owl:CreditPlatformMemberowl:DiversifiedLendingMember2024-01-012024-03-310001823945owl:CreditPlatformMemberowl:DiversifiedLendingMember2023-01-012023-03-310001823945owl:CreditPlatformMemberowl:TechnologyLendingMember2024-01-012024-03-310001823945owl:CreditPlatformMemberowl:TechnologyLendingMember2023-01-012023-03-310001823945owl:CreditPlatformMemberowl:FirstLienLendingMember2024-01-012024-03-310001823945owl:CreditPlatformMemberowl:FirstLienLendingMember2023-01-012023-03-310001823945owl:CreditPlatformMemberowl:OpportunisticLendingMember2024-01-012024-03-310001823945owl:CreditPlatformMemberowl:OpportunisticLendingMember2023-01-012023-03-310001823945owl:LiquidCreditMemberowl:CreditPlatformMember2024-01-012024-03-310001823945owl:LiquidCreditMemberowl:CreditPlatformMember2023-01-012023-03-310001823945owl:OtherMemberowl:CreditPlatformMember2024-01-012024-03-310001823945owl:OtherMemberowl:CreditPlatformMember2023-01-012023-03-310001823945us-gaap:AssetManagement1Memberowl:CreditPlatformMember2024-01-012024-03-310001823945us-gaap:AssetManagement1Memberowl:CreditPlatformMember2023-01-012023-03-310001823945owl:CreditPlatformMemberus-gaap:AdministrativeServiceMember2024-01-012024-03-310001823945owl:CreditPlatformMemberus-gaap:AdministrativeServiceMember2023-01-012023-03-310001823945owl:CreditPlatformMemberus-gaap:ManagementServiceIncentiveMember2024-01-012024-03-310001823945owl:CreditPlatformMemberus-gaap:ManagementServiceIncentiveMember2023-01-012023-03-310001823945owl:CreditPlatformMember2024-01-012024-03-310001823945owl:CreditPlatformMember2023-01-012023-03-310001823945owl:GPMinorityStakesMemberowl:GPStrategicCapitalPlatformMember2024-01-012024-03-310001823945owl:GPMinorityStakesMemberowl:GPStrategicCapitalPlatformMember2023-01-012023-03-310001823945owl:GPDebtFinancingMemberowl:GPStrategicCapitalPlatformMember2024-01-012024-03-310001823945owl:GPDebtFinancingMemberowl:GPStrategicCapitalPlatformMember2023-01-012023-03-310001823945owl:ProfessionalSportsMinorityStakesMemberowl:GPStrategicCapitalPlatformMember2024-01-012024-03-310001823945owl:ProfessionalSportsMinorityStakesMemberowl:GPStrategicCapitalPlatformMember2023-01-012023-03-310001823945owl:StrategicRevenueSharePurchaseConsiderationAmortizationMemberowl:GPStrategicCapitalPlatformMember2024-01-012024-03-310001823945owl:StrategicRevenueSharePurchaseConsiderationAmortizationMemberowl:GPStrategicCapitalPlatformMember2023-01-012023-03-310001823945us-gaap:AssetManagement1Memberowl:GPStrategicCapitalPlatformMember2024-01-012024-03-310001823945us-gaap:AssetManagement1Memberowl:GPStrategicCapitalPlatformMember2023-01-012023-03-310001823945owl:GPStrategicCapitalPlatformMemberus-gaap:AdministrativeServiceMember2024-01-012024-03-310001823945owl:GPStrategicCapitalPlatformMemberus-gaap:AdministrativeServiceMember2023-01-012023-03-310001823945owl:GPStrategicCapitalPlatformMember2024-01-012024-03-310001823945owl:GPStrategicCapitalPlatformMember2023-01-012023-03-310001823945owl:RealEstatePlatformMemberowl:NetLeaseMember2024-01-012024-03-310001823945owl:RealEstatePlatformMemberowl:NetLeaseMember2023-01-012023-03-310001823945owl:RealEstatePlatformMemberus-gaap:AssetManagement1Member2024-01-012024-03-310001823945owl:RealEstatePlatformMemberus-gaap:AssetManagement1Member2023-01-012023-03-310001823945owl:RealEstatePlatformMemberus-gaap:AdministrativeServiceMember2024-01-012024-03-310001823945owl:RealEstatePlatformMemberus-gaap:AdministrativeServiceMember2023-01-012023-03-310001823945owl:RealEstatePlatformMemberus-gaap:ManagementServiceIncentiveMember2024-01-012024-03-310001823945owl:RealEstatePlatformMemberus-gaap:ManagementServiceIncentiveMember2023-01-012023-03-310001823945owl:RealEstatePlatformMember2024-01-012024-03-310001823945owl:RealEstatePlatformMember2023-01-012023-03-310001823945us-gaap:AssetManagement1Member2023-12-310001823945us-gaap:AssetManagement1Member2022-12-310001823945us-gaap:AssetManagement1Member2024-03-310001823945us-gaap:AssetManagement1Member2023-03-310001823945us-gaap:AdministrativeServiceMember2023-12-310001823945us-gaap:AdministrativeServiceMember2022-12-310001823945us-gaap:AdministrativeServiceMember2024-03-310001823945us-gaap:AdministrativeServiceMember2023-03-310001823945us-gaap:ManagementServiceIncentiveMember2023-12-310001823945us-gaap:ManagementServiceIncentiveMember2022-12-310001823945us-gaap:ManagementServiceIncentiveMember2024-03-310001823945us-gaap:ManagementServiceIncentiveMember2023-03-310001823945owl:EquityInterestConsiderationMember2021-01-012021-12-310001823945owl:CashConsiderationMember2021-01-012021-12-3100018239452021-01-012021-12-310001823945srt:MinimumMemberowl:A2021OmnibusEquityIncentivePlanMember2024-01-012024-03-310001823945owl:A2021OmnibusEquityIncentivePlanMembersrt:MaximumMember2024-01-012024-03-310001823945owl:A2021OmnibusEquityIncentivePlanMember2024-03-310001823945owl:ContingentConsiderationCompensationMemberowl:CompensationAndBenefitsExpenseMember2024-01-012024-03-310001823945owl:ContingentConsiderationCompensationMemberowl:CompensationAndBenefitsExpenseMember2023-01-012023-03-310001823945owl:WellfleetEarnoutMemberowl:CompensationAndBenefitsExpenseMember2024-01-012024-03-310001823945owl:WellfleetEarnoutMemberowl:CompensationAndBenefitsExpenseMember2023-01-012023-03-310001823945owl:CompensationAndBenefitsExpenseMember2024-01-012024-03-310001823945owl:CompensationAndBenefitsExpenseMember2023-01-012023-03-310001823945owl:CompensationAndBenefitsExpenseMemberowl:UnvestedIncentiveUnitsMember2024-01-012024-03-310001823945owl:CompensationAndBenefitsExpenseMemberowl:UnvestedIncentiveUnitsMember2023-01-012023-03-310001823945us-gaap:RestrictedStockUnitsRSUMemberowl:CompensationAndBenefitsExpenseMember2024-01-012024-03-310001823945us-gaap:RestrictedStockUnitsRSUMemberowl:CompensationAndBenefitsExpenseMember2023-01-012023-03-310001823945us-gaap:RestrictedStockUnitsRSUMember2024-01-012024-03-310001823945us-gaap:WarrantMember2024-01-012024-03-310001823945owl:CommonUnitsMember2024-01-012024-03-310001823945owl:VestedIncentiveUnitsMember2024-01-012024-03-310001823945owl:UnvestedIncentiveUnitsMember2024-01-012024-03-310001823945us-gaap:RestrictedStockUnitsRSUMember2023-01-012023-03-310001823945us-gaap:WarrantMember2023-01-012023-03-310001823945owl:CompensationWellfleetEarnoutSharesMember2023-01-012023-03-310001823945owl:ContingentConsiderationWellfleetEarnoutSharesMember2023-01-012023-03-310001823945owl:CommonUnitsMember2023-01-012023-03-310001823945owl:VestedIncentiveUnitsMember2023-01-012023-03-310001823945owl:UnvestedIncentiveUnitsMember2023-01-012023-03-310001823945us-gaap:RelatedPartyMemberowl:ManagementFeesMember2024-03-310001823945us-gaap:RelatedPartyMemberowl:ManagementFeesMember2023-12-310001823945us-gaap:RelatedPartyMemberowl:RealizedPerformanceIncomeMember2024-03-310001823945us-gaap:RelatedPartyMemberowl:RealizedPerformanceIncomeMember2023-12-310001823945us-gaap:RelatedPartyMemberowl:AdministrativeFeesMember2024-03-310001823945us-gaap:RelatedPartyMemberowl:AdministrativeFeesMember2023-12-310001823945owl:RelatedPartyOtherExpensesPaidMemberus-gaap:RelatedPartyMember2024-03-310001823945owl:RelatedPartyOtherExpensesPaidMemberus-gaap:RelatedPartyMember2023-12-310001823945us-gaap:RelatedPartyMemberowl:AdministrativeFeesMember2024-01-012024-03-310001823945us-gaap:RelatedPartyMemberowl:AdministrativeFeesMember2023-01-012023-03-310001823945owl:DealerManagerRevenueMemberus-gaap:RelatedPartyMember2024-01-012024-03-310001823945owl:DealerManagerRevenueMemberus-gaap:RelatedPartyMember2023-01-012023-03-310001823945owl:ExpenseSupportAndCapsArrangementsMemberus-gaap:RelatedPartyMember2024-01-012024-03-310001823945owl:ExpenseSupportAndCapsArrangementsMemberus-gaap:RelatedPartyMember2023-01-012023-03-310001823945us-gaap:RelatedPartyMemberowl:AircraftServicesMember2023-01-012023-03-310001823945us-gaap:RelatedPartyMemberowl:AircraftServicesMember2024-01-012024-03-310001823945owl:CounterpartyNameManagedProductOneMemberus-gaap:RelatedPartyMemberowl:RelatedPartyPromissoryNoteMember2022-08-080001823945owl:CounterpartyNameManagedProductOneMemberus-gaap:RelatedPartyMemberowl:RelatedPartyPromissoryNoteMember2023-11-090001823945owl:CounterpartyNameManagedProductOneMemberus-gaap:RelatedPartyMemberowl:SecuredOvernightFinancingRateSOFRMemberowl:RelatedPartyPromissoryNoteMember2024-03-310001823945owl:CounterpartyNameManagedProductOneMemberus-gaap:RelatedPartyMemberowl:RelatedPartyPromissoryNoteMember2024-03-310001823945owl:CounterpartyNameManagedProductOneMemberus-gaap:RelatedPartyMemberowl:RelatedPartyPromissoryNoteMember2024-01-012024-03-310001823945owl:CounterpartyNameManagedProductOneMemberus-gaap:RelatedPartyMemberowl:RelatedPartyPromissoryNoteMember2023-03-310001823945owl:CounterpartyNameManagedProductOneMemberus-gaap:RelatedPartyMemberowl:RelatedPartyPromissoryNoteMember2023-01-012023-03-310001823945us-gaap:RelatedPartyMemberowl:CounterpartyNameManagedProductTwoMemberowl:RelatedPartyPromissoryNoteMember2022-11-150001823945us-gaap:RelatedPartyMemberowl:CounterpartyNameManagedProductTwoMemberowl:SecuredOvernightFinancingRateSOFRMemberowl:RelatedPartyPromissoryNoteMember2024-03-310001823945us-gaap:RelatedPartyMemberowl:CounterpartyNameManagedProductTwoMemberowl:SecuredOvernightFinancingRateSOFRMemberowl:RelatedPartyPromissoryNoteMember2022-11-150001823945us-gaap:RelatedPartyMemberowl:CounterpartyNameManagedProductTwoMemberowl:RelatedPartyPromissoryNoteMember2024-03-310001823945us-gaap:RelatedPartyMemberowl:CounterpartyNameManagedProductTwoMemberowl:RelatedPartyPromissoryNoteMember2024-01-012024-03-310001823945us-gaap:RelatedPartyMemberowl:CounterpartyNameManagedProductTwoMemberowl:RelatedPartyPromissoryNoteMember2023-03-310001823945us-gaap:RelatedPartyMemberowl:CounterpartyNameManagedProductTwoMemberowl:RelatedPartyPromissoryNoteMember2023-01-012023-03-310001823945us-gaap:SubsequentEventMember2024-05-022024-05-020001823945us-gaap:SubsequentEventMemberowl:KAMAcquisitionMember2024-04-012024-04-300001823945us-gaap:SubsequentEventMemberowl:KAMAcquisitionMember2024-04-300001823945us-gaap:SubsequentEventMemberowl:KuvareUKHoldingsMember2024-04-012024-04-300001823945us-gaap:SubsequentEventMemberowl:PrimaAcquisitionMember2024-04-012024-04-300001823945us-gaap:SubsequentEventMemberowl:PrimaAcquisitionMember2024-04-300001823945owl:A2034NotesMemberus-gaap:SubsequentEventMemberus-gaap:SeniorNotesMember2024-04-110001823945owl:A2034NotesMemberus-gaap:SubsequentEventMemberus-gaap:SeniorNotesMember2024-04-112024-04-11

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

___________________________

FORM 10-Q

___________________________

(Mark One)

| | | | | |

| ☒ | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the quarterly period ended March 31, 2024

or

| | | | | |

| ☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission File Number: 001-39653

___________________________

BLUE OWL CAPITAL INC.

(Exact name of registrant as specified in its charter)

___________________________

| | | | | | | | | | | | | | |

| Delaware | | 86-3906032 |

(State or other jurisdiction of

incorporation or organization) | | (I.R.S. Employer

Identification No.) |

| | | | | | | | | | | |

| 399 Park Avenue, | New York, | NY | 10022 |

| (address of principal executive offices) |

(212) 419-3000

(Registrant’s telephone number, including area code)

___________________________

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading symbol(s) | | Name of each exchange on which registered |

| Class A common stock | | OWL | | New York Stock Exchange |

| | | | |

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No o

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ☒ No o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| | | | | | | | | | | | | | |

| Large accelerated filer | ☒ | | Accelerated filer | o |

| Non-accelerated filer | o | | Smaller reporting company | o |

| | | Emerging growth company | o |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ☐ No ☒

Indicate the number of shares outstanding of each of the issuer’s classes of common stock, as of the latest practicable date.

| | | | | | | | |

| Class | | Outstanding at April 26, 2024 |

| Class A common stock, par value $0.0001 | | 500,879,131 | |

| Class B common stock, par value $0.0001 | | — | |

| Class C common stock, par value $0.0001 | | 611,908,856 | |

| Class D common stock, par value $0.0001 | | 316,016,619 | |

TABLE OF CONTENTS

DEFINED TERMS

| | | | | | | | |

| Assets Under Management or AUM | | Refers to the assets that we manage, and is generally equal to the sum of (i) net asset value (“NAV”); (ii) drawn and undrawn debt; (iii) uncalled capital commitments; (iv) total managed assets for certain Real Estate products; and (v) par value of collateral for collateralized loan obligations (“CLOs”). |

| | |

| Annual Report | | Refers to our annual report for the year ended December 31, 2023, filed with the SEC on Form 10-K on February 23, 2024. |

| | |

| our BDCs | | Refers to the business development companies (“BDCs”) we manage, as regulated under the Investment Company Act of 1940, as amended: Blue Owl Capital Corporation (NYSE: OBDC) (“OBDC”), Blue Owl Capital Corporation II (“OBDC II”), Blue Owl Capital Corporation III (NYSE: OBDE) (“OBDC III”), Blue Owl Technology Finance Corp. (“OTF”), Blue Owl Technology Finance Corp. II (“OTF II”), Blue Owl Credit Income Corp. (“OCIC”) and Blue Owl Technology Income Corp. (“OTIC”). |

| | |

| Blue Owl, the Company, the firm, we, us, and our | | Refers to the Registrant and its consolidated subsidiaries. |

| | |

| Blue Owl Carry | | Refers to Blue Owl Capital Carry LP. |

| | |

| Blue Owl GP | | Refers collectively to Blue Owl Capital GP Holdings LLC and Blue Owl Capital GP LLC, which are directly or indirectly wholly owned subsidiaries of the Registrant that hold the Registrants interests in the Blue Owl Operating Partnerships. |

| | |

| Blue Owl Holdings | | Refers to Blue Owl Capital Holdings LP. |

| | |

| Blue Owl Operating Group | | Refers collectively to the Blue Owl Operating Partnerships and their consolidated subsidiaries. |

| | |

| Blue Owl Operating Group Units | | Refers collectively to a unit in each of the Blue Owl Operating Partnerships. |

| | |

| Blue Owl Operating Partnerships | | Refers to Blue Owl Carry and Blue Owl Holdings, collectively. |

| | |

| Blue Owl Securities | | Refers to Blue Owl Securities LLC, a Delaware limited liability company. Blue Owl Securities is a broker-dealer registered with the SEC, a member of Financial Industry Regulatory Authority, Inc. (“FINRA”) and the Securities Investor Protection Corporation (“SIPC”). Blue Owl Securities is wholly owned by Blue Owl and provides distribution services to all Blue Owl platforms. |

| | |

| Business Combination | | Refers to the transactions contemplated by the business combination agreement dated as of December 23, 2020 (as the same has been or may be amended, modified, supplemented or waived from time to time), by and among Altimar Acquisition Corporation, Owl Rock Capital Group LLC, Owl Rock Capital Feeder LLC, Owl Rock Capital Partners LP and Neuberger Berman Group LLC, which transactions were completed on May 19, 2021. |

| | |

| Business Combination Date | | Refers to May 19, 2021, the date on which the Business Combination was completed. |

| | |

| | |

| | |

| Class A Shares | | Refers to the Class A common stock, par value $0.0001 per share, of the Registrant. |

| | |

| Class B Shares | | Refers to the Class B common stock, par value $0.0001 per share, of the Registrant. |

| | |

| Class C Shares | | Refers to the Class C common stock, par value $0.0001 per share, of the Registrant. |

| | |

| Class D Shares | | Refers to the Class D common stock, par value $0.0001 per share, of the Registrant. |

| | |

| | |

| | |

| Credit | | Refers to our Credit platform that offers private credit solutions to middle-market companies through our investment strategies: diversified lending, technology lending, first lien lending, opportunistic lending. Our Credit platform also includes our adjacent investment strategy, liquid credit, which focuses on the management of CLOs, and other investment strategies (e.g. strategic equity and healthcare opportunities). |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | | | | | | | |

| Fee-Paying AUM or FPAUM | | Refers to the AUM on which management fees or FRE performance revenues are earned. For our BDCs, FPAUM is generally equal to total assets (including assets acquired with debt but excluding cash). For our other Credit products, excluding CLOs, FPAUM is generally equal to NAV or investment cost. FPAUM also includes uncalled committed capital for products where we earn management fees on such uncalled committed capital. For CLOs, FPAUM is generally equal to the par value of collateral. For our GP Strategic Capital products, FPAUM for the GP minority stakes strategy is generally equal to capital commitments during the investment period and the cost of unrealized investments after the investment period. For GP Strategic Capitals’ other strategies, FPAUM is generally equal to investment cost. For Real Estate, FPAUM is generally equal to a combination of capital commitments and cost of unrealized investments during the investment period and the cost of unrealized investments after the investment period; however, for certain Real Estate products FPAUM is based on NAV. |

| | |

| | |

| | |

| Financial Statements | | Refers to our consolidated financial statements included in this report. |

| | |

| GAAP | | Refers to U.S. generally accepted accounting principles. |

| | |

| GP Strategic Capital | | Refers to our GP Strategic Capital platform that primarily focuses on acquiring equity stakes in, and providing debt financing to, large, multi-product private equity and private credit firms through two existing investment strategies: GP minority stakes and GP debt financing, and also includes our professional sports minority stakes strategy. |

| | |

| NYSE | | Refers to the New York Stock Exchange. |

| | |

| | |

| | |

| | |

| | |

| our products | | Refers to the products that we manage, including our BDCs, private funds, CLOs, managed accounts and real estate investment trusts. |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| Part I Fees | | Refers to quarterly performance income on the net investment income of our BDCs and similarly structured products, subject to a fixed hurdle rate. These fees are classified as management fees throughout this report, as they are predictable and recurring in nature, not subject to repayment, and cash-settled each quarter. |

| | |

| Part II Fees | | Generally refers to fees from our BDCs and similarly structured products that are paid in arrears as of the end of each measurement period when the cumulative aggregate realized capital gains exceed the cumulative aggregate realized capital losses and aggregate unrealized capital depreciation, less the aggregate amount of Part II Fees paid in all prior years since inception. Part II Fees are classified as performance revenues throughout this report. |

| | |

| Partner Manager | | Refers to alternative asset management firms in which the GP Strategic Capital products invest. |

| | |

| Permanent Capital | | Refers to AUM in products that do not have ordinary redemption provisions or a requirement to exit investments and return the proceeds to investors after a prescribed period of time. Some of these products, however, may be required or can elect to return all or a portion of capital gains and investment income, and some may have periodic tender offers or redemptions. Permanent Capital includes certain products that are subject to management fee step downs or roll-offs or both over time. |

| | |

| Principals | | Refers to our founders and senior members of management who hold, or in the future may hold, Class B Shares and Class D Shares. Class B Shares and Class D Shares collectively represent 80% of the total voting power of all shares. |

| | |

| Real Estate | | Refers, unless context indicates otherwise, to our Real Estate platform that primarily focuses on acquiring triple net lease real estate occupied by investment grade or creditworthy tenants. |

| | |

| Registrant | | Refers to Blue Owl Capital Inc. |

| | |

| SEC | | Refers to the U.S. Securities and Exchange Commission. |

| | |

| Tax Receivable Agreement or TRA | | Refers to the Amended and Restated Tax Receivable Agreement, dated as of October 22, 2021, as may be amended from time to time by and among the Registrant, Blue Owl Capital GP LLC, the Blue Owl Operating Partnerships and each of the Partners (as defined therein) party thereto. |

| | |

| | |

| | |

| | |

AVAILABLE INFORMATION

We file annual, quarterly and current reports, proxy statements and other information required by the Securities Exchange Act of 1934, as amended (the “Exchange Act”) with the SEC. We make available free of charge on our website (www.blueowl.com) our annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K, proxy statements and other filing as soon as reasonably practicable after such material is electronically filed with or furnished to the SEC. We also use our website to distribute company information, including assets under management and performance information, and such information may be deemed material. Accordingly, investors should monitor our website, in addition to our press releases, SEC filings and public conference calls and webcasts.

Also posted on our website in the “Shareholders—Governance” section is the charter for our Audit Committee, as well as our Corporate Governance Guidelines and Code of Business Conduct governing our directors, officers and employees. Information on or accessible through our website is not a part of or incorporated into this report or any other SEC filing. Copies of our SEC filings or corporate governance materials are available without charge upon written request to Blue Owl Capital Inc., 399 Park Avenue, 37th Floor, New York, New York 10022, Attention: Office of the Secretary. Any materials we file with the SEC are also publicly available through the SEC’s website (www.sec.gov).

No statements herein, available on our website or in any of the materials we file with the SEC constitute, or should be viewed as constituting, an offer of any fund.

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

This report contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of the Exchange Act, which reflect our current views with respect to, among other things, future events, operations and financial performance. You can identify these forward-looking statements by the use of forward-looking words such as “outlook,” “believes,” “expects,” “potential,” “continues,” “may,” “will,” “should,” “seeks,” “approximately,” “predicts,” “projects,” “intends,” “plans,” “estimates,” “anticipates” or the negative version of those words, other comparable words or other statements that do not relate to historical or factual matters. The forward-looking statements are based on our beliefs, assumptions and expectations of our future performance, taking into account all information currently available to us. Such forward-looking statements are subject to various risks, uncertainties (some of which are beyond our control) or other assumptions relating to our operations, financial results, financial condition, business prospects, growth strategy and liquidity that may cause actual results or performance to be materially different from those expressed or implied by these forward-looking statements. Some of these factors are described under the headings “Item 1A. Risk Factors” and “Item 2. Management’s Discussion and Analysis of Financial Condition and Results of Operations.” These factors should not be construed as exhaustive and should be read in conjunction with the risk factors and other cautionary statements that are included in this report and in our other periodic filings. If one or more of these or other risks or uncertainties materialize, or if our underlying assumptions prove to be incorrect, our actual results may vary materially from those indicated in these forward-looking statements. New risks and uncertainties arise over time, and it is not possible for us to predict those events or how they may affect us. Therefore, you should not place undue reliance on these forward-looking statements. Any forward-looking statement speaks only as of the date on which it is made. We do not undertake any obligation to publicly update or review any forward-looking statement, whether as a result of new information, future developments or otherwise, except as required by law.

PART I - FINANCIAL INFORMATION

Item 1. Financial Statements.

The information required by this item is included in the Financial Statements set forth in the F-pages of this report. Item 2. Management’s Discussion and Analysis of Financial Condition and Results of Operations.

The following Management’s Discussion and Analysis of Financial Condition and Results of Operations (“MD&A”), should be read in conjunction with the Financial Statements. For a description of our business, please see “Item 1. Business” in the Annual Report.

2024 First Quarter Overview

| | | | | | | | | | | | | | | |

| | | Three Months Ended March 31, |

| (dollars in thousands) | | | | | 2024 | | 2023 |

| Net Income Attributable to Blue Owl Capital Inc. | | | | | $ | 25,091 | | | $ | 8,317 | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

Fee-Related Earnings(1) | | | | | $ | 289,698 | | | $ | 225,899 | |

| | | | | | | |

Distributable Earnings(1) | | | | | $ | 240,099 | | | $ | 209,014 | |

(1) For the specific components and calculations of these Non-GAAP measures, as well as a reconciliation of these measures to the most comparable measure in accordance with GAAP, see “—Non-GAAP Analysis” and “—Non-GAAP Reconciliations.”

Please see “—GAAP Results of Operations Analysis” and “—Non-GAAP Analysis” for a detailed discussion of the underlying drivers of our results.

Acquisitions

In April 2024, we announced our entry into an agreement to acquire Kuvare Insurance Services LP (dba Kuvare Asset Management) (“KAM”), a boutique investment management firm focused on providing asset management services to the insurance industry, including Kuvare UK Holdings (“Kuvare”), for $750 million (the “KAM Acquisition”). We will fund the KAM Acquisition through a combination of $325 million in cash and $425 million in Blue Owl Class A common stock. The KAM Acquisition is expected to close in the second or third quarter of 2024 and remains subject to customary regulatory approvals and other closing conditions and specified termination rights. Separately, we made a long-term investment in Kuvare, purchasing $250 million of preferred equity.

In April 2024, we announced our entry into an agreement to acquire Prima Capital Advisors (“Prima”) for $170 million (the “Prima Acquisition”). The Prima Acquisition will be funded through a combination of approximately $157 million of Class A Shares, Class C Shares and Blue Owl Operating Group Units and approximately $13 million in cash, subject to certain closing consideration adjustments. The Prima Acquisition is expected to close in the second or third quarter of 2024, subject to customary closing conditions.

Assets Under Management

| | | | | | | | | | | | | | |

Blue Owl AUM: $174.3 billion FPAUM: $105.4 billion |

| | | | |

Credit AUM: $91.3 billion FPAUM: $58.8 billion | | GP Strategic Capital AUM: $55.8 billion FPAUM: $31.8 billion | | Real Estate AUM: $27.2 billion FPAUM: $14.9 billion |

| | | | |

Diversified Lending Commenced 2016 AUM: $53.6 billion FPAUM: $31.2 billion | | GP Minority Stakes Commenced 2010 AUM: $53.5 billion FPAUM: $30.4 billion | | Net Lease Commenced 2009 AUM: $27.2 billion FPAUM: $14.9 billion |

Technology Lending Commenced 2018 AUM: $21.5 billion FPAUM: $14.9 billion | | GP Debt Financing Commenced 2019 AUM: $1.6 billion FPAUM: $1.1 billion | | |

First Lien Lending Commenced 2018 AUM: $4.5 billion FPAUM: $2.1 billion | | Professional Sports Minority Stakes Commenced 2021 AUM: $0.8 billion FPAUM: $0.3 billion | | |

Opportunistic Lending Commenced 2020 AUM: $2.5 billion FPAUM: $1.5 billion | | | | |

Liquid Credit Commenced 2022 AUM: $7.9 billion FPAUM: $7.8 billion | | | | |

Other AUM: $1.5 billion FPAUM: $1.3 billion | | | | |

All amounts shown as of March 31, 2024, totals may not sum due to rounding.

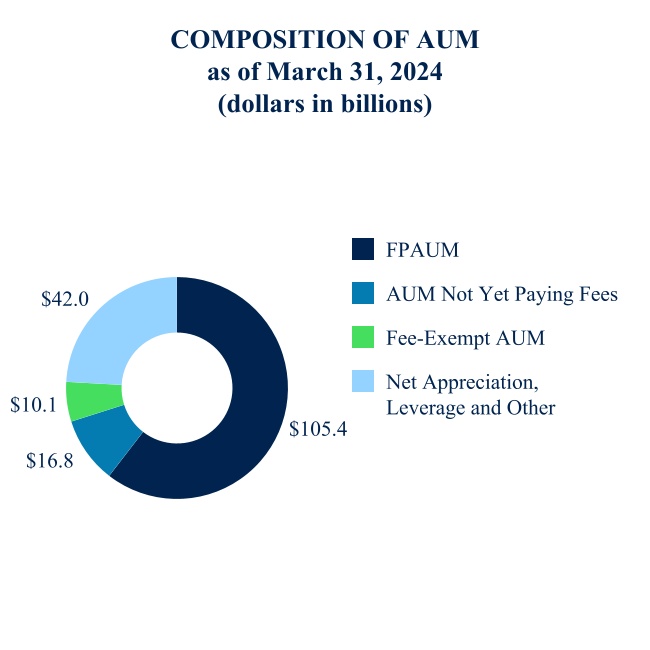

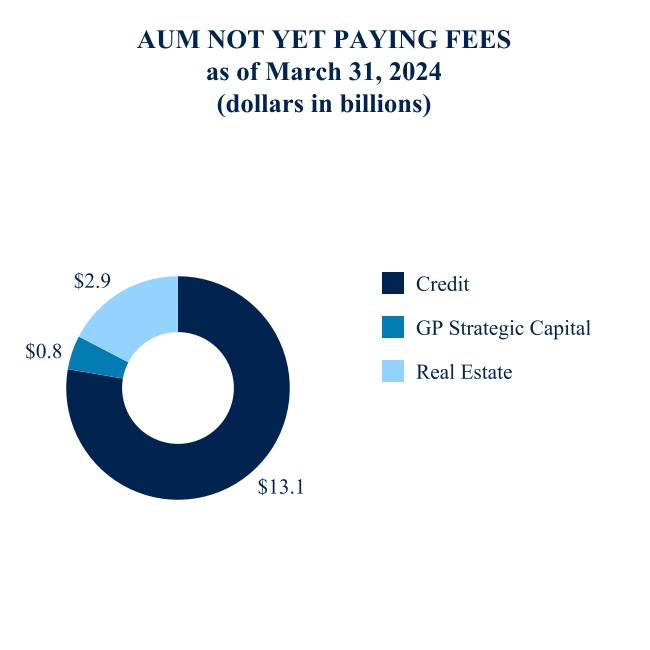

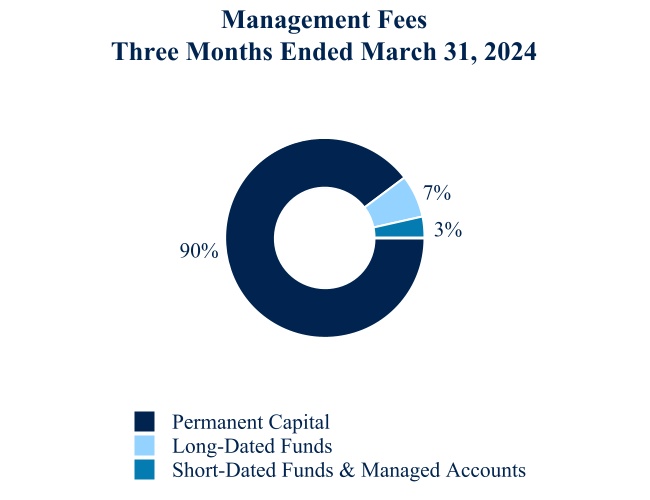

As of March 31, 2024, our AUM was $174.3 billion, which included $105.4 billion of FPAUM. For the three months ended March 31, 2024, approximately 90% of our management fees were earned on AUM from Permanent Capital. As of March 31, 2024, we have $16.8 billion in AUM not yet paying fees, providing over $240 million of annualized management fees once deployed. See “—Assets Under Management” for additional information, including important information on how we define these metrics.

Business Environment

Our business is impacted by conditions in the financial markets and economic conditions in the U.S., and to a lesser extent, globally.

We believe that our management-fee centric business model and base of Permanent Capital contribute to the resiliency of our earnings and the strength of our business growth, including during periods of market uncertainty and volatility. During the first quarter of 2024, industry M&A and capital markets activity remained moderately constructive, a continuation of the improvement relative to late 2022 and early 2023.

Over the past twelve months, 92% of our management fees were generated by Permanent Capital and the remainder predominantly from long-dated capital, with no meaningful pressure to our asset base from redemptions. Fundraising and capital deployment contributed to management fee growth of 22% over the last twelve months. We ended the first quarter of 2024 with substantial available capital to deploy, reporting $16.8 billion of AUM not yet paying fees.

Activity in the loan market improved during the quarter, with direct lenders continuing to play a significant role in new financings alongside syndicated market activity, which recovered meaningfully from low levels in 2023. Industry-wide, refinancings accelerated with greater capital availability, offsetting some of the new origination volume. For Blue Owl, positive net deployment, ongoing capital raising, and the listing of OBDE on the NYSE continued to drive management fees higher.

We continue to see attractive deployment opportunities for our GP Strategic Capital products, as capital needs across the private alternative asset management sector remain elevated, particularly in the current challenging fundraising and realization environment. In addition to our leading franchise in larger-cap GP stakes, we recently launched a strategy intended to finance mid-cap alternative asset managers, further expanding our suite of solutions.

In Real Estate, industry transaction volumes increased slightly, in conjunction with higher commercial mortgage-backed securities issuances. Our Real Estate business, focused on single tenant triple net lease to primarily investment grade tenants, continued to deploy capital across four major themes: digital infrastructure, onshoring, healthcare real estate, and essential retail. Investors in our Real Estate products continue to benefit from the inflation-mitigating characteristics of the net lease structure, highly predictable net rent growth, and long-duration contractual income across the portfolio, and we are raising capital through various new products across institutional and wealth channels.

We are continuing to closely monitor developments related to the macroeconomic factors that have contributed to market volatility, and to assess the impact of these factors on financial markets and on our business. Our future results may be adversely affected by slowdowns in fundraising activity and the pace of capital deployment, which could result in delayed management fees. It is currently not possible to predict the ultimate effects of these events on the financial markets, overall economy and our Financial Statements. See “Item 1A. Risk Factors —Risks Related to Macroeconomic Factors.” in our Annual Report.

Additionally, we intend to pursue strategic acquisitions and investments to accelerate our growth and broaden our product offerings. Our acquisition strategy is centered around driving additional scale or expanding capabilities that complement or augment our existing products.

Assets Under Management

We present information regarding our AUM, FPAUM and various other related metrics throughout this MD&A to provide context around our fee generating revenues results, as well as indicators of the potential for future earnings from existing and new products. Our calculations of AUM and FPAUM may differ from the calculation methodologies of other asset managers, and as a result these measures may not be comparable to similar measures presented by other asset managers. In addition, our calculation of AUM includes amounts that are fee exempt (i.e., not subject to fees).

As of March 31, 2024, assets under management related to us, our executives and other employees totaled approximately $3.6 billion (including $1.8 billion related to accrued carried interest). A portion of these assets under management are not charged fees.

Composition of Assets Under Management

Our AUM consists of FPAUM, AUM not yet paying fees, fee-exempt AUM and net appreciation and leverage in products on which fees are based on commitments or investment cost. AUM not yet paying fees generally relates to unfunded capital commitments (to the extent such commitments are not already subject to fees), undeployed debt (to the extent we earn fees based on total asset values or investment cost, inclusive of assets purchased using debt) and AUM that is subject to a temporary fee holiday. Fee-exempt AUM represents certain investments by us, our employees, other related parties and third parties, as well as certain co-investment vehicles on which we never earn fees.

Management uses AUM not yet paying fees as an indicator of management fees that will be coming online as we deploy existing assets in products that charge fees based on deployed and not uncalled capital, as well as AUM that is currently subject to a fee holiday that will expire in the future. AUM not yet paying fees could provide over $240 million of additional annualized management fees once deployed or upon the expiration of the relevant fee holidays.

Permanency and Duration of Assets Under Management

Our capital base is heavily weighted toward Permanent Capital. We view the permanency and duration of the products that we manage as a differentiator in our industry and as a means of measuring the stability of our future revenues stream. The chart below presents the composition of our management fees by remaining product duration. Changes in these relative percentages will occur over time as the mix of products we offer changes. For example, our Real Estate products have a higher concentration in what we refer to as “long-dated” funds, or funds in which the contractual remaining life is five years or more, which in isolation may cause our percentage of management fees from Permanent Capital to decline.

Changes in AUM

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| Three Months Ended March 31, 2024 | | Three Months Ended March 31, 2023 |

| (dollars in millions) | Credit | | GP Strategic Capital | | Real Estate | | Total | | Credit | | GP Strategic Capital | | Real Estate | | Total |

| Beginning Balance | $ | 84,632 | | | $ | 54,199 | | | $ | 26,856 | | | $ | 165,687 | | | $ | 68,607 | | | $ | 48,510 | | | $ | 21,085 | | | $ | 138,202 | |

| | | | | | | | | | | | | | | |

| New capital raised | 3,030 | | | 662 | | | 1,049 | | | 4,741 | | | 1,940 | | | 320 | | | 1,539 | | | 3,799 | |

| Change in debt | 3,897 | | | — | | | 127 | | | 4,024 | | | 939 | | | — | | | 495 | | | 1,434 | |

| Distributions | (1,249) | | | (86) | | | (198) | | | (1,533) | | | (763) | | | (702) | | | (207) | | | (1,672) | |

| Change in value / other | 979 | | | 1,018 | | | (596) | | | 1,401 | | | 894 | | | 1,039 | | | 678 | | | 2,611 | |

| Ending Balance | $ | 91,289 | | | $ | 55,793 | | | $ | 27,238 | | | $ | 174,320 | | | $ | 71,617 | | | $ | 49,167 | | | $ | 23,590 | | | $ | 144,374 | |

Credit. The increase in AUM for the three months ended March 31, 2024 was driven by the following:

•$1.3 billion new capital raised in diversified lending, primarily driven by continued private wealth fundraising in OCIC.

•$1.3 billion new capital raised in first lien lending, primarily driven by recently launched products.

•$0.3 billion new capital raised in technology lending, primarily driven by continued private wealth fundraising in OTIC.

•$3.9 billion of additional net debt commitments primarily in diversified lending and technology lending strategies, as we continue to opportunistically manage leverage in our BDCs.

•$1.2 billion offsetting decrease in distributions, which primarily relate to dividends paid from our BDCs. Redemptions and repurchases from these products were not material.

•$1.0 billion of overall appreciation across the platform.

GP Strategic Capital. The increase in AUM for the three months ended March 31, 2024 was driven by overall appreciation primarily in our GP minority stakes strategy of $1.0 billion and new capital raised of $0.7 billion, primarily from our new mid-cap minority equity stakes product.

Real Estate. The increase in AUM for the three months ended March 31, 2024 was driven by new capital raised of $1.0 billion across various products, primarily Blue Owl Real Estate Net Lease Trust (“ORENT”), our real estate investment trust, and Blue Owl Real Estate Fund VI (“OREF VI”), our triple net-lease drawdown fund, partially offset by dispositions of certain assets of $0.6 billion.

Changes in FPAUM

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| Three Months Ended March 31, 2024 | | Three Months Ended March 31, 2023 |

| (dollars in millions) | Credit | | GP Strategic Capital | | Real Estate | | Total | | Credit | | GP Strategic Capital | | Real Estate | | Total |

| Beginning Balance | $ | 57,074 | | | $ | 31,075 | | | $ | 14,547 | | | $ | 102,696 | | | $ | 49,041 | | | $ | 28,772 | | | $ | 10,997 | | | $ | 88,810 | |

| | | | | | | | | | | | | | | |

| New capital raised / deployed | 2,090 | | | 688 | | | 939 | | | 3,717 | | | 2,021 | | | (8) | | | 1,078 | | | 3,091 | |

| | | | | | | | | | | | | | | |

| Distributions | (1,157) | | | — | | | (198) | | | (1,355) | | | (732) | | | (203) | | | (151) | | | (1,086) | |

| Change in value / other | 772 | | | — | | | (393) | | | 379 | | | 820 | | | — | | | (2) | | | 818 | |

| Ending Balance | $ | 58,779 | | | $ | 31,763 | | | $ | 14,895 | | | $ | 105,437 | | | $ | 51,150 | | | $ | 28,561 | | | $ | 11,922 | | | $ | 91,633 | |

Credit. The increase in FPAUM for the three months ended March 31, 2024 was driven by the following:

•$1.3 billion new capital raised in diversified lending, primarily driven by continued private wealth fundraising in OCIC.

•$0.4 billion new capital raised in our strategic equity investment strategy.

•$0.3 billion new capital raised in technology lending, driven by continued private wealth fundraising in OTIC.

•$1.2 billion offsetting decrease in distributions, which primarily relate to dividends paid from our BDCs. Redemptions and repurchases from these products were not material.

•$0.8 billion of overall appreciation across the platform.

GP Strategic Capital. The increase in FPAUM for the three months ended March 31, 2024 was driven by new capital raised of $0.7 billion, primarily from our new mid-cap minority equity stakes product.

Real Estate. The increase in FPAUM for the three months ended March 31, 2024 was driven primarily by capital raised and deployment in ORENT and OREF VI, partially offset by dispositions of certain assets.

Product Performance

Product performance for certain of our products is included throughout this discussion with analysis to facilitate an understanding of our results of operations for the periods presented. The performance information of our products reflected is not indicative of Blue Owl’s performance. An investment in Blue Owl is not an investment in any of our products. Past performance is not indicative of future results. As with any investment, there is always the potential for gains as well as the possibility of losses. There can be no assurance that any of these products or our other existing and future products will achieve similar returns. Multiple of invested capital (“MoIC”) and internal rate of return (“IRR”) data has not been presented for products that have launched within the last two years as such information is generally not meaningful (“NM”).

Credit

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | MoIC | | IRR |

| (dollars in millions) | Year of

Inception | | AUM | | Capital

Raised

(4) | | Invested

Capital

(5) | | Realized

Proceeds

(6) | | Unrealized

Value

(7) | | Total

Value | | Gross (8) | | Net (9) | | Gross (10) | | Net (11) |

| Diversified Lending (1) | | | | | | | | | | | | | | | | | | | | | |

| Blue Owl Capital Corporation | 2016 | | $ | 14,845 | | | $ | 5,970 | | | $ | 5,970 | | | $ | 3,029 | | | $ | 6,021 | | | $ | 9,050 | | | 1.76x | | 1.54x | | 13.6 | % | | 9.8 | % |

| Blue Owl Capital Corporation II (2) | 2017 | | $ | 2,570 | | | $ | 1,293 | | | $ | 1,262 | | | $ | 447 | | | $ | 1,263 | | | $ | 1,710 | | | NM | | 1.39x | | NM | | 7.6 | % |

| Blue Owl Capital Corporation III | 2020 | | $ | 4,493 | | | $ | 1,832 | | | $ | 1,832 | | | $ | 461 | | | $ | 1,911 | | | $ | 2,372 | | | 1.35x | | 1.32x | | 13.4 | % | | 12.6 | % |

| Blue Owl Credit Income Corp. (2) | 2020 | | $ | 19,694 | | | $ | 9,252 | | | $ | 8,661 | | | $ | 1,028 | | | $ | 8,893 | | | $ | 9,921 | | | NM | | 1.16x | | NM | | 11.5 | % |

| | | | | | | | | | | | | | | | | | | | | |

| Technology Lending (1) | | | | | | | | | | | | | | | | | | | | | |

| Blue Owl Technology Finance Corp. | 2018 | | $ | 7,310 | | | $ | 3,309 | | | $ | 3,309 | | | $ | 741 | | | $ | 3,529 | | | $ | 4,270 | | | 1.42x | | 1.31x | | 12.4 | % | | 9.1 | % |

| Blue Owl Technology Finance Corp. II | 2021 | | $ | 7,176 | | | $ | 4,159 | | | $ | 1,732 | | | $ | 135 | | | $ | 1,818 | | | $ | 1,953 | | | 1.20x | | 1.14x | | 16.4 | % | | 11.4 | % |

| | | | | | | | | | | | | | | | | | | | | |

| First Lien Lending (3) | | | | | | | | | | | | | | | | | | | | | |

| Blue Owl First Lien Fund Levered | 2018 | | $ | 2,185 | | | $ | 1,161 | | | $ | 912 | | | $ | 306 | | | $ | 916 | | | $ | 1,222 | | | 1.42x | | 1.35x | | 10.9 | % | | 9.0 | % |

| Blue Owl First Lien Fund Unlevered | 2019 | | $ | 613 | | | $ | 363 | | | $ | 156 | | | $ | 69 | | | $ | 117 | | | $ | 186 | | | 1.24x | | 1.20x | | 6.5 | % | | 5.2 | % |

(1)Information presented in the AUM through Total Value columns for these vehicles is presented on a quarter lag due to these vehicles being public filers with the SEC and not yet filing their quarterly information as of our filing date. Additional information related to these vehicles can be found in their filings with the SEC, which are not part of this report.

(2)For the purposes of calculating Gross IRR, the expense support provided to the fund would be impacted when assuming a performance excluding management fees (including Part I Fees) and Part II Fees, and therefore is not meaningful for OBDC II and OCIC.

(3)Blue Owl First Lien Fund is comprised of three feeder funds: Onshore Levered, Offshore Levered and Insurance Unlevered. The gross and net MoIC and IRR presented in the chart are for Onshore Levered and Insurance Unlevered as those are the largest of the levered and unlevered feeder funds. The gross and net MoIC for the Offshore Levered feeder fund is 1.39x and 1.29x, respectively. The gross and net IRR for the Offshore Levered feeder is 10.2% and 7.4%, respectively. All other values for Blue Owl First Lien Fund Levered are for Onshore Levered and Offshore Levered combined. AUM is presented as the aggregate of the three Blue Owl First Lien Fund feeders. Blue Owl First Lien Fund Unlevered Investor equity and note commitments are both treated as capital for all values.

(4)Includes reinvested dividends and share repurchases, if applicable.

(5)Invested capital includes capital calls, reinvested dividends and periodic investor closes, as applicable.

(6)Realized proceeds represent the sum of all cash distributions to investors.

(7)Unrealized value represents the product’s NAV. There can be no assurance that unrealized values will be realized at the valuations indicated.

(8)Gross MoIC is calculated by adding total realized proceeds and unrealized values of a product’s investments and dividing by the total amount of invested capital. Gross MoIC is calculated before giving effect to management fees (including Part I Fees) and Part II Fees, as applicable.

(9)Net MoIC measures the aggregate value generated by a product’s investments in absolute terms. Net MoIC is calculated by adding total realized proceeds and unrealized values of a product’s investments and dividing by the total amount of invested capital. Net MoIC is calculated after giving effect to management fees (including Part I Fees) and Part II Fees, as applicable, and all other expenses.

(10)Gross IRR is an annualized since inception gross internal rate of return of cash flows to and from the product and the product’s residual value at the end of the measurement period. Gross IRRs are calculated before giving effect to management fees (including Part I Fees) and Part II Fees, as applicable.

(11)Net IRRs are calculated consistent with gross IRRs, but after giving effect to management fees (including Part I Fees) and Part II Fees, as applicable, and all other expenses. An individual investor’s IRR may differ from the reported IRR based on the timing of capital transactions.

GP Strategic Capital | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | MoIC | | IRR |

| (dollars in millions) | Year of

Inception | | AUM | | Capital

Raised | | Invested

Capital

(2) | | Realized

Proceeds

(3) | | Unrealized

Value

(4) | | Total

Value | | Gross (5) | | Net (6) | | Gross (7) | | Net (8) |

| GP Minority Stakes (1) | | | | | | | | | | | | | | | | | | | | | |

| Blue Owl GP Stakes I | 2011 | | $ | 706 | | | $ | 1,284 | | | $ | 1,266 | | | $ | 723 | | | $ | 493 | | | $ | 1,216 | | | 1.11x | | 0.96x | | 2.0 | % | | -0.7 | % |

| Blue Owl GP Stakes II | 2014 | | $ | 2,908 | | | $ | 2,153 | | | $ | 1,961 | | | $ | 908 | | | $ | 2,149 | | | $ | 3,057 | | | 1.85x | | 1.56x | | 13.7 | % | | 9.1 | % |

| Blue Owl GP Stakes III | 2015 | | $ | 9,827 | | | $ | 5,318 | | | $ | 3,275 | | | $ | 3,447 | | | $ | 5,255 | | | $ | 8,702 | | | 3.24x | | 2.66x | | 30.2 | % | | 23.4 | % |

| Blue Owl GP Stakes IV | 2018 | | $ | 15,715 | | | $ | 9,041 | | | $ | 6,533 | | | $ | 4,370 | | | $ | 8,049 | | | $ | 12,419 | | | 2.27x | | 1.90x | | 64.9 | % | | 42.0 | % |

| Blue Owl GP Stakes V | 2020 | | $ | 13,627 | | | $ | 12,852 | | | $ | 4,581 | | | $ | 2,009 | | | $ | 3,239 | | | $ | 5,248 | | | 1.31x | | 1.15x | | 34.1 | % | | 15.1 | % |

(1)Information presented in the Invested Capital through IRR columns for these vehicles is presented on a quarter lag and is exclusive of investments made by the related carried interest vehicles of the respective products.

(2)Invested capital includes capital calls.

(3)Realized proceeds represent the sum of all cash distributions to investors.

(4)Unrealized value represents the product’s NAV. There can be no assurance that unrealized values will be realized at the valuations indicated.

(5)Gross MoIC is calculated by adding total realized proceeds and unrealized values of a product’s investments and dividing by the total amount of invested capital. Gross MoIC is calculated before giving effect to management fees and carried interest, as applicable.

(6)Net MoIC measures the aggregate value generated by a product’s investments in absolute terms. Net MoIC is calculated by adding total realized proceeds and unrealized values of a product’s investments and dividing by the total amount of invested capital. Net MoIC is calculated after giving effect to management fees and carried interest, as applicable, and all other expenses.

(7)Gross IRR is an annualized since inception gross internal rate of return of cash flows to and from the product and the product’s residual value at the end of the measurement period. Gross IRRs are calculated before giving effect to management fees and carried interest, as applicable.

(8)Net IRR is an annualized since inception net internal rate of return of cash flows to and from the product and the product’s residual value at the end of the measurement period. Net IRRs reflect returns to all investors. Net IRRs are calculated after giving effect to management fees and carried interest, as applicable, and all other expenses. An individual investor’s IRR may differ from the reported IRR based on the timing of capital transactions.

Real Estate

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | MoIC | | IRR |

| (dollars in millions) | Year of Inception | | AUM | | Capital Raised | | Invested Capital

(3) | | Realized

Proceeds

(4) | | Unrealized

Value

(5) | | Total

Value | | Gross (6) | | Net (7) | | Gross (8) | | Net (9) |

| Net Lease | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

| Blue Owl Real Estate Fund IV (1) | 2017 | | $ | 1,076 | | | $ | 1,250 | | | $ | 1,260 | | | $ | 1,487 | | | $ | 475 | | | $ | 1,962 | | | 1.73x | | 1.56x | | 24.2 | % | | 19.4 | % |

| Blue Owl Real Estate Net Lease Property Fund | 2019 | | $ | 6,718 | | | $ | 3,523 | | | $ | 3,796 | | | $ | 1,143 | | | $ | 3,616 | | | $ | 4,759 | | | 1.28x | | 1.25x | | 12.1 | % | | 10.9 | % |

| Blue Owl Real Estate Fund V (1) | 2020 | | $ | 4,044 | | | $ | 2,500 | | | $ | 2,500 | | | $ | 814 | | | $ | 2,485 | | | $ | 3,299 | | | 1.44x | | 1.32x | | 26.6 | % | | 21.3 | % |

| | | | | | | | | | | | | | | | | | | | | |

| Blue Owl Real Estate Net Lease Trust (2) | 2022 | | $ | 4,731 | | | $ | 2,473 | | | $ | 2,473 | | | $ | 92 | | | $ | 2,337 | | | $ | 2,429 | | | NM | | NM | | NM | | NM |

| Blue Owl Real Estate Fund VI (1) | 2023 | | $ | 5,821 | | | $ | 5,163 | | | $ | 438 | | | $ | 13 | | | $ | 393 | | | $ | 406 | | | NM | | NM | | NM | | NM |

| | | | | | | | | | | | | | | | | | | | | |

(1)Information presented in the Invested Capital through IRR columns for these vehicles is presented on a quarter lag.

(2)Information presented in the AUM through Total Value columns for this vehicle is presented on a quarter lag due to the vehicle being a public filer with the SEC and not yet filing its quarterly information as of our filing date. Additional information related to this vehicle can be found in its filings with the SEC, which are not part of this report.

(3)Invested capital includes investments by the general partner, capital calls, dividends reinvested, recallable capital which has been reinvested and periodic investor closes, as applicable.

(4)Realized proceeds represent the sum of all cash distributions to all investors.

(5)Unrealized value represents the fund’s NAV. There can be no assurance that unrealized values will be realized at the valuations indicated.

(6)Gross MoIC is calculated by adding total realized proceeds and unrealized values of a product’s investments and dividing by the total amount of invested capital. Gross MoIC is calculated before giving effect to management fees and carried interest, as applicable.

(7)Net MoIC measures the aggregate value generated by a product’s investments in absolute terms. Net MoIC is calculated by adding total realized proceeds and unrealized values of a product’s investments and dividing by the total amount of invested capital. Net MoIC is calculated after giving effect to management fees and carried interest, as applicable, and all other expenses.

(8)Gross IRR is an annualized since inception gross internal rate of return of cash flows to and from the product and the product’s residual value at the end of the measurement period. Gross IRRs are calculated before giving effect to management fees and carried interest, as applicable.

(9)Net IRR is an annualized since inception net internal rate of return of cash flows to and from the product and the product’s residual value at the end of the measurement period. Net IRRs reflect returns to all investors. Net IRRs are calculated after giving effect to management fees and carried interest, as applicable, and all other expenses. An individual investor’s IRR may differ from the reported IRR based on the timing of capital transactions.

GAAP Results of Operations Analysis

Three Months Ended March 31, 2024, Compared to the Three Months Ended March 31, 2023

| | | | | | | | | | | | | | | | | | |

| Three Months Ended March 31, | | | |

| (dollars in thousands) | 2024 | | 2023 | | $ Change | |

| Revenues | | | | | | |

Management fees, net (includes Part I Fees of $120,161 and $85,864) | $ | 447,898 | | | $ | 358,825 | | | $ | 89,073 | | |

| Administrative, transaction and other fees | 63,397 | | | 31,655 | | | 31,742 | | |

| Performance revenues | 2,045 | | | 506 | | | 1,539 | | |

| Total Revenues, Net | 513,340 | | | 390,986 | | | 122,354 | | |

| Expenses | | | | | | |

| Compensation and benefits | 224,791 | | | 197,618 | | | 27,173 | | |

| Amortization of intangible assets | 56,195 | | | 70,891 | | | (14,696) | | |

| General, administrative and other expenses | 76,748 | | | 56,134 | | | 20,614 | | |

| Total Expenses | 357,734 | | | 324,643 | | | 33,091 | | |

| Other Loss | | | | | | |

| Net gains on investments | 3,173 | | | 612 | | | 2,561 | | |

| | | | | | |

| Interest and dividend income | 4,755 | | | 4,789 | | | (34) | | |

| Interest expense | (22,484) | | | (18,362) | | | (4,122) | | |

| Change in TRA liability | 1,019 | | | (1,964) | | | 2,983 | | |

| Change in warrant liability | (14,700) | | | (1,950) | | | (12,750) | | |

| Change in earnout liability | (585) | | | (994) | | | 409 | | |

| Total Other Loss | (28,822) | | | (17,869) | | | (10,953) | | |

| Income Before Income Taxes | 126,784 | | | 48,474 | | | 78,310 | | |

| Income tax expense | 14,771 | | | 6,440 | | | 8,331 | | |

| Consolidated Net Income | 112,013 | | | 42,034 | | | 69,979 | | |

| Net income attributable to noncontrolling interests | (86,922) | | | (33,717) | | | (53,205) | | |

| Net Income Attributable to Blue Owl Capital Inc. | $ | 25,091 | | | $ | 8,317 | | | $ | 16,774 | | |

Revenues, Net

Management Fees. The increase in management fees was primarily due to the drivers below. See Note 9 to our Financial Statements for additional details on our GAAP management fees by strategy.

•Credit increased $62.6 million, including an increase in Part I Fees of $33.2 million, due to continued fundraising and deployment of capital within new and existing Credit products.

•GP Strategic Capital increased $11.1 million, primarily driven by fundraising in our sixth flagship minority equity stakes product.

•Real Estate increased $15.4 million, attributable to continued fundraising and deployment of capital within new and existing Real Estate products, primarily OREF VI and ORENT.

Administrative, Transaction and Other Fees. The increase in administrative, transaction and other fees was driven primarily by the following:

•$16.3 million increase in fee income earned for services provided to portfolio companies, reflecting an increase in volume of transactions on which we earn such fees.

•$8.0 million increase in dealer manager revenues, due primarily to growth in the distribution of our retail BDCs.