| ☐ | Preliminary Proxy Statement | |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

| ☒ | Definitive Proxy Statement | |

| ☐ | Definitive Additional Materials | |

| ☐ | Soliciting Material Pursuant to §240.14a-12 | |

| ☒ | No fee required. | |||

| ☐ | Fee paid previously with preliminary materials. | |||

| ☐ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11. | |||

LETTER TO OUR STOCKHOLDERS

April 4, 2024

Dear Fellow Stockholder:

We cordially invite you to attend the 2024 Annual Meeting of Stockholders of Wingstop Inc. to be held on Thursday, May 23, 2024, at 9:00 a.m. Central Time. We will be holding the Annual Meeting virtually via the Internet to maximize your ability to participate in the meeting. You will be able to attend and participate in the Annual Meeting online, vote your shares electronically and submit your questions prior to the Annual Meeting. The Notice of Annual Meeting of Stockholders and this Proxy Statement describe the business that will be acted upon at the meeting.

For your convenience, we will take advantage of the Securities and Exchange Commission rule allowing companies to furnish proxy materials to stockholders over the Internet. We believe that this e-proxy process expedites stockholders’ receipt of proxy materials while also lowering the costs and reducing the environmental impact of our Annual Meeting. On or about April 4, 2024, we will begin mailing a Notice of Internet Availability of Proxy Materials containing instructions on how to access our Proxy Statement and 2023 Annual Report and how to vote over the Internet or how to request and return a proxy card by mail. For information on how to vote your shares, please refer to the Notice of Internet Availability of Proxy Materials, proxy materials email, or proxy card you receive to assure that your shares will be represented and voted at the Annual Meeting even if you cannot attend. Copies of the Proxy Statement and 2023 Annual Report are available at www.proxydocs.com/WING.

Your vote is important. Even if you plan to attend the virtual meeting, please follow the instructions provided to you and vote your shares today. This will not prevent you from voting your shares during the virtual meeting if you are able to attend.

On behalf of your Board of Directors, thank you for your continued support of and interest in Wingstop.

Sincerely,

|

| |

| Lynn Crump-Caine | Michael J. Skipworth | |

| Chair of the Board of Directors | President and Chief Executive Officer |

WINGSTOP INC.

15505 Wright Brothers Drive

Addison, Texas 75001

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD MAY 23, 2024

| Time: | 9:00 a.m. Central Time | |||

| Date: | May 23, 2024 | |||

| Virtual Meeting Site*: | www.proxydocs.com/WING | |||

| Record Date: | Stockholders of record at the close of business on March 25, 2024 are entitled to notice of and to vote at the Annual Meeting or any adjournments, postponements, or recesses thereof. | |||

| Purpose: | (1) | Elect three Class III directors nominated by the Board of Directors for a term that expires at the 2027 Annual Meeting of Stockholders; | ||

| (2) | Ratify the appointment of KPMG LLP as our independent registered public accounting firm for fiscal year 2024; | |||

| (3) | Approve, on an advisory basis, the compensation of our named executive officers; | |||

| (4) | Approve, on an advisory basis, the frequency of future advisory votes to approve the compensation of our named executive officers; | |||

| (5) | Approve the Wingstop Inc. 2024 Omnibus Incentive Plan; | |||

| (6) | Vote on the stockholder proposal described in the accompanying proxy statement, if properly presented at the Annual Meeting; and | |||

| (7) | Consider and act upon such other business as may properly come before the Annual Meeting or any adjournments, postponements, or recesses thereof. | |||

| Stockholder Register: | A list of the stockholders entitled to vote at the Annual Meeting may be examined during regular business hours at our executive offices, 15505 Wright Brothers Drive, Addison, Texas 75001, during the ten-day period preceding the meeting. | |||

| Voting: | Your vote is important. Whether or not you plan to attend the Annual Meeting, we encourage you to read this Proxy Statement and submit your proxy or voting instructions as soon as possible. Please vote by telephone or electronically through the Internet or, if you requested a proxy card via mail, sign, date, and return the proxy card in the enclosed business reply envelope, to ensure your representation at the Annual Meeting. | |||

|

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE ANNUAL MEETING TO BE HELD ON MAY 23, 2024

This notice and the accompanying Proxy Statement, proxy card, and 2023 Annual Report are available at www.proxydocs.com/WING.

|

[Continued on next page]

| * | We have determined that the Annual Meeting will be held in a virtual meeting format only, via the Internet, with no physical in-person meeting. If you plan to participate in the virtual meeting, please see “Proxy Statement Summary—Virtual Annual Meeting of Stockholders” for more detailed information. Stockholders will be able to attend the Annual Meeting and vote from any location via the Internet. |

By order of the Board of Directors,

Albert G. McGrath

Senior Vice President, General Counsel & Secretary

April 4, 2024

| TABLE OF CONTENTS |

|

| EXECUTIVE OFFICERS | 41 | |||

| COMPENSATION DISCUSSION AND ANALYSIS | 43 | |||

| 43 | ||||

| 43 | ||||

| 43 | ||||

| 44 | ||||

| 44 | ||||

| 44 | ||||

| 51 | ||||

| 57 | ||||

| 58 | ||||

| 59 | ||||

| 59 | ||||

| 60 | ||||

| 61 | ||||

| EXECUTIVE COMPENSATION | 62 | |||

| 62 | ||||

| 64 | ||||

| 65 | ||||

| 67 | ||||

| 68 | ||||

| 68 | ||||

| 70 | ||||

| 72 | ||||

| 72 | ||||

| 73 | ||||

| PROPOSAL 4—ADVISORY VOTE ON THE FREQUENCY OF FUTURE ADVISORY VOTES ON EXECUTIVE COMPENSATION | 77 | |||

| PROPOSAL 5—APPROVAL OF THE WINGSTOP INC. 2024 OMNIBUS INCENTIVE PLAN | 78 | |||

| PROPOSAL 6—STOCKHOLDER PROPOSAL | 88 | |||

| NEXT ANNUAL MEETING—STOCKHOLDER PROPOSALS | 90 | |||

| 90 | ||||

| 90 | ||||

| 90 | ||||

| 90 | ||||

| OTHER MATTERS | 91 | |||

| 91 | ||||

| ANNEX A | A-1 | |||

| PROXY STATEMENT SUMMARY |

| |

|

WINGSTOP INC. 15505 Wright Brothers Drive Addison, Texas 75001 |

This summary highlights information contained elsewhere in this Proxy Statement. This summary does not contain all of the information that you should consider in making a voting decision, and you should read the entire Proxy Statement carefully before voting. Unless the context indicates otherwise, references to “Wingstop,” “we,” “our,” “us,” or the “Company” are to Wingstop Inc. and its consolidated subsidiaries. References to the “Board” or the “Board of Directors” are to the Board of Directors of Wingstop Inc.

Annual Meeting Information

| Time and Date: | May 23, 2024 at 9:00 a.m. Central Time | |

| Virtual Meeting Site*: | www.proxydocs.com/WING | |

| Record Date: | March 25, 2024 | |

| Proxy Materials Distribution Date:

|

On or about April 4, 2024 | |

| * | We have determined that the Annual Meeting will be held in a virtual meeting format only, via the Internet, with no physical in-person meeting. If you plan to participate in the virtual meeting, please see “Proxy Statement Summary—Virtual Annual Meeting of Stockholders” for more detailed information. Stockholders will be able to attend the Annual Meeting and vote online via the Internet. |

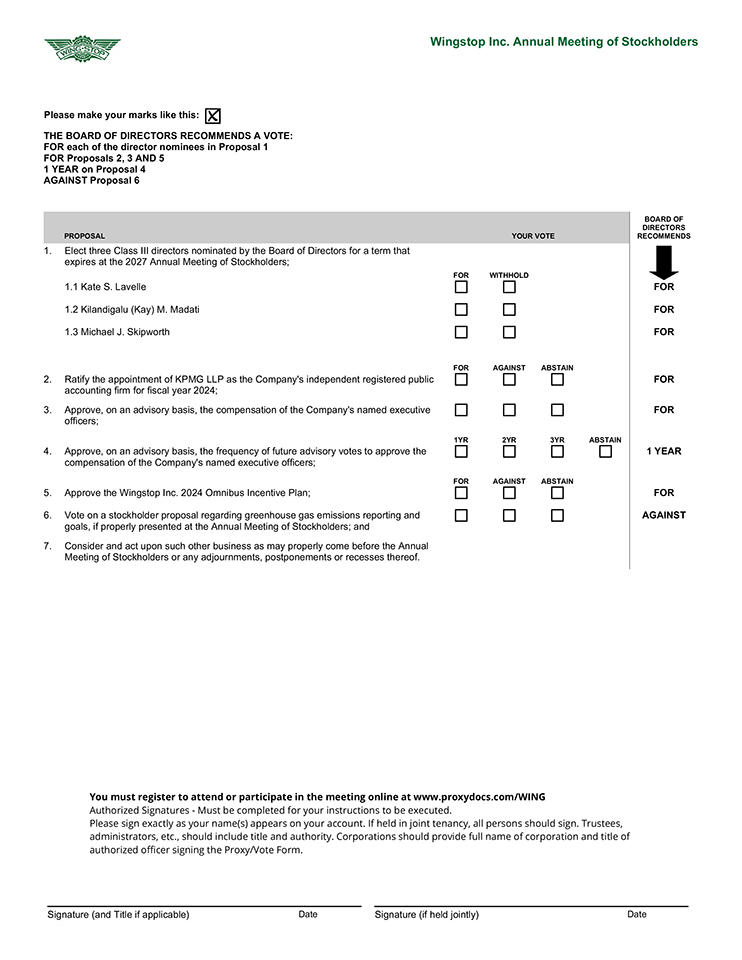

Items of Business and Voting Recommendations

| Agenda Items | Board’s Voting Recommendation |

Page Reference (for more detail) | ||

| 1. Election of three Class III directors (the “Director Election Proposal”)* |

FOR the election of each director nominee | 9 | ||

| 2. Ratification of the appointment of KPMG LLP (the “Auditor Ratification Proposal”) |

FOR | 37 | ||

| 3. Approval, on an advisory basis, of named executive officer compensation (the “Say-on-Pay Proposal”) |

FOR | 40 | ||

| 4. Approval, on an advisory basis, of the frequency of future advisory votes to approve named executive officer compensation (the “Say-on-Pay Frequency Proposal”) |

every “1 YEAR” | 77 | ||

| 5. Approval of the Wingstop Inc. 2024 Omnibus Incentive Plan (the “2024 Incentive Plan Proposal”) |

FOR | 78 | ||

| 6. Voting on a stockholder proposal regarding greenhouse gas emissions reporting and goals |

AGAINST | 88 | ||

| * | Pursuant to our Corporate Governance Guidelines, each of the director nominees has tendered an irrevocable resignation that becomes effective if (i) such nominee fails to receive more “FOR” votes than “WITHHELD” votes in an uncontested election of directors at an annual meeting and (ii) the Board accepts such resignation. For additional information concerning this policy, see “Proposal 1—Election of Directors—Vote Required; Director Resignation Policy for Failure to Receive Majority Vote in Election” on page 9. |

|

WINGSTOP INC. 2024 PROXY STATEMENT | 1 |

PROXY STATEMENT SUMMARY

|

HIGHLIGHTS FOR FISCAL YEAR 2023

|

Highlights of Wingstop’s performance during fiscal year 2023 (which included 52 operating weeks as compared to 53 operating weeks in fiscal year 2022) include, among other things:

| 1. | As of 12/30/2023. |

| 2. | For the period from the Company’s initial public offering on June 12, 2015 to December 30, 2023. |

| 3. | For the fiscal year ended 12/30/2023. |

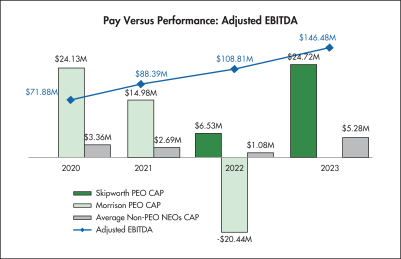

| 4. | For the fiscal year ended 12/30/2023. See notes 3 and 4 in “Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations—Key Performance Indicators” in our Form 10-K filed on February 21, 2024 for a reconciliation of Adjusted EBITDA and Adjusted EPS, non-GAAP financial measures, to net income as reported under GAAP. |

| 5. | As a percentage of Company-owned restaurant sales, cost of sales decreased to 73.7% from 79.3% in the prior fiscal year. |

Corporate Governance Highlights

Highlights of Wingstop’s corporate governance practices include, among other things, the following:

| • | the roles of Chair of the Board and Chief Executive Officer are held by separate individuals; |

| • | all directors, with the exception of our Chief Executive Officer, are independent, and we have 100% independent Board committees; |

| • | our Board conducts annual Board and committee self-evaluations; |

| • | our Nominating and Corporate Governance Committee and Board annually review committee composition; |

| • | directors tender contingent resignations that are considered by the Board when a director fails to receive more “FOR” votes than “WITHHELD” votes in an uncontested election of directors; |

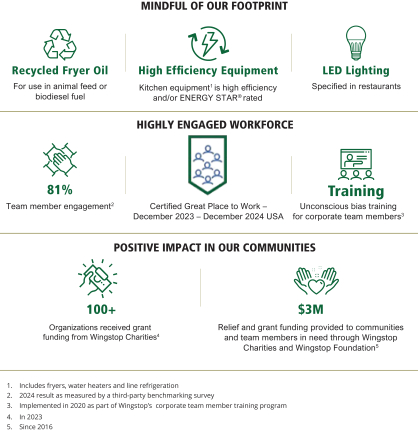

| • | we continue to track environmental, social, and governance metrics such as diversity, equity and inclusion, waste management and community involvement in an effort to operate and govern our Company in a socially responsible manner; |

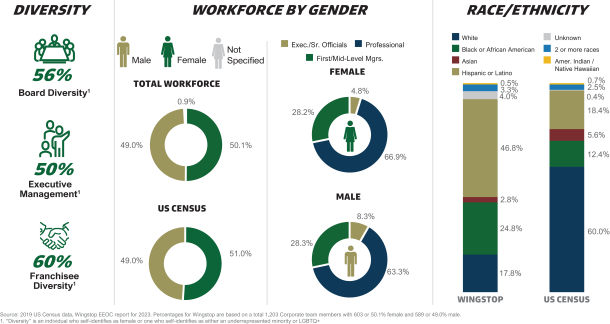

| • | we focus on diversity of our Board, and 56% of our Board classifies as diverse (with three female and three racially or ethnically diverse directors); and |

| • | we continue our efforts to give back through Wingstop Charities to the communities we serve, donating more than $3.0 million in grants since forming Wingstop Charities in 2016. |

| 2 | WINGSTOP INC. 2024 PROXY STATEMENT |

|

PROXY STATEMENT SUMMARY

Compensation Best Practices

The table below summarizes the Company’s key executive compensation practices, including practices the Company has implemented that the Compensation Committee believes will help drive corporate performance, as well as those practices that the Company has chosen not to implement because the Company believes they do not serve its stockholders’ interests.

|

What We Do

|

What We DON’T Do

| |||||

|

✓ |

Pay for performance. Tie pay to performance by ensuring that a significant portion of executive compensation is performance-based and at-risk. |

O |

Repricing. Stock option exercise prices are set equal to the grant date fair market value and may not be repriced, except for certain adjustments that may be made in connection with extraordinary transactions, such as dividend equivalency adjustments or a stock split. | |||

|

✓ |

Performance metrics tied to Company performance. The performance metrics for our performance-based cash bonus plan and performance-based equity awards are tied to the Company’s performance, aligning executive and stockholder interests. We believe that cash-based performance compensation emphasizes pay-for-performance and rewards our executives for achieving performance goals, while equity-based performance compensation emphasizes the Company’s long-term performance and further aligns the interests of our executives with those of our stockholders. |

O |

Excess golden parachute agreements. The termination benefits payable to our senior officers, other than our Chief Executive Officer, under our Executive Severance Plan range from only 1.0 to 2.0 times base salary and bonus (only 2.0 to 2.5 times base salary and bonus for our Chief Executive Officer). | |||

|

✓ |

Robust stock ownership and retention guidelines. Our stock ownership and retention policy has guidelines requiring our Chief Executive Officer to own five times his annual base salary in common stock or common stock derivatives and our executive vice presidents and senior vice presidents to own three and two times their annual base salary in common stock or common stock derivatives, respectively. |

O |

Tax gross-ups. Our equity award agreements do not provide for excise tax gross-ups. | |||

|

✓ |

Clawback policy. Our clawback policy provides that, if we are required to prepare an accounting restatement due to our material noncompliance with any financial reporting requirement under the federal securities laws, we will seek to recover certain incentive-based compensation received by any current or former executive officer during the three completed fiscal years preceding the restatement date (as defined in the policy). The amount to be recovered will be based on the excess of the amount paid under the award over the amount that would have been paid under the award had it been based on the restated amounts. |

O |

Share recycling. We do not recycle shares withheld for taxes or used to pay the exercise price for an outstanding award, or have other liberal share-counting features. | |||

|

✓ |

Independent compensation consultant. The Compensation Committee uses Frederic W. Cook & Co., Inc. (“FW Cook”), an independent compensation consultant, to assist in designing its compensation policies. |

O |

Hedging or pledging shares. Our insider trading compliance policy prohibits our directors and named executive officers from any hedging or pledging of Company securities. | |||

|

✓ |

Listen to our stockholders. We hold an advisory vote on executive compensation annually and actively review the results of these votes, as well as our discussions with our stockholders, when we make compensation decisions. |

O |

Single trigger change in control agreements. We have no single trigger change in control agreements. | |||

|

WINGSTOP INC. 2024 PROXY STATEMENT | 3 |

PROXY STATEMENT SUMMARY

Proposal 1—Director Election Proposal

Director Nominees

The Board of Directors is asking you to elect the three nominees named below as Class III directors for terms that expire at the 2027 annual meeting of stockholders. The following table provides summary information about the three director nominees. For more information about the director nominees, see pages 10 and 11.

| Name

|

Experience/Qualifications

|

Independence

|

Board Positions and Committees

|

End of

|

||||||

|

Kate S. Lavelle |

Corporate Governance, Executive Management, Financial and Accounting, International, Restaurant Industry, Risk Management, Strategy and Technology |

Independent |

Chair of the Audit |

|

2027 |

| ||||

|

Kilandigalu (Kay) M. Madati |

Corporate Governance, Executive Management, International, Marketing, Operations, Retail Industry, Risk Management, Strategy, Technology |

Independent |

Chair of the Technology |

|

2027 |

| ||||

|

Michael J. Skipworth |

Corporate Governance, Executive Management, Financial and Accounting, International, Operations, Restaurant Industry, Risk Management, Strategy, Technology |

Not Independent |

Director |

|

2027 |

| ||||

Vote Required

The election of the director nominees will be determined by a plurality of the votes cast at the 2024 Annual Meeting of Stockholders (the “Annual Meeting”). However, pursuant to our Corporate Governance Guidelines, each of the director nominees has tendered an irrevocable resignation that becomes effective if such nominee fails to receive more “FOR” votes than “WITHHELD” votes in an uncontested election of directors at an annual meeting and the Board accepts such resignation. For additional information concerning this policy, see “Proposal 1—Election of Directors—Vote Required; Director Resignation Policy for Failure to Receive Majority Vote in Election” on page 9.

Proposal 2—Auditor Ratification Proposal

Auditor Ratification

The Board is asking you to ratify the selection of KPMG LLP (“KPMG”) as our independent registered public accounting firm for the fiscal year ending December 28, 2024. Set forth on page 39 is summary information with respect to the fees for services provided to us by KPMG during the fiscal years ended December 30, 2023 and December 31, 2022.

Vote Required

The approval of the Auditor Ratification Proposal requires the affirmative vote of the holders of a majority in voting power of the shares of our common stock that are present in person or by proxy and entitled to vote at the Annual Meeting.

Proposal 3—Say-on-Pay Proposal

Say-on-Pay

Pursuant to Section 14A(a)(1) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), we are asking our stockholders to approve, on an advisory or non-binding basis, the compensation of our named executive officers as disclosed in this Proxy Statement. For a detailed description of our executive compensation program, see “Compensation Discussion and Analysis” beginning on page 43.

Vote Required

The approval of the Say-on-Pay Proposal, on a non-binding advisory basis, requires the affirmative vote of the holders of a majority in voting power of the shares of our common stock that are present in person or by proxy and entitled to vote at the Annual Meeting.

| 4 | WINGSTOP INC. 2024 PROXY STATEMENT |

|

PROXY STATEMENT SUMMARY

Proposal 4—Say-on-Pay Frequency Proposal

Say-on-Pay Frequency

Pursuant to Section 14A(a)(1) of the Exchange Act, we are asking you to approve, on a non-binding advisory basis, an ANNUAL frequency (stated as every “1 YEAR”) of future “say on pay” votes on named executive officer compensation. For additional information regarding this proposal, see “Proposal 4—Advisory Vote on the Frequency of Future Advisory Votes on Executive Compensation” on page 77.

Vote Required

The Board will consider the frequency that receives a plurality of votes cast on the Say-on-Pay Frequency Proposal as the non-binding, advisory vote of our stockholders.

Proposal 5—2024 Incentive Plan Proposal

Wingstop Inc. 2024 Omnibus Incentive Plan

The Board is asking you to approve the Company’s 2024 Omnibus Incentive Plan. For a detailed description of the 2024 Omnibus Incentive Plan, see “Proposal 5—Approval of the Wingstop Inc. 2024 Omnibus Incentive Plan” beginning on page 78.

Vote Required

The approval of the 2024 Incentive Plan Proposal requires the affirmative vote of the holders of a majority in voting power of the shares of our common stock that are present in person or by proxy and entitled to vote at the Annual Meeting.

Proposal 6—Stockholder Proposal

Greenhouse Gas Emissions Proposal

The Board is asking you to vote “AGAINST” a stockholder proposal regarding greenhouse gas emissions reporting and goals (the “Stockholder Proposal”). For the Board’s statement in opposition to this proposal, see “Statement in Opposition” beginning on page 88.

Vote Required

The approval of this proposal, on a non-binding advisory basis, requires the affirmative vote of the holders of a majority in voting power of the shares of our common stock that are present in person or by proxy and entitled to vote at the Annual Meeting.

Voting Procedures

Voting Rights of the Stockholders

Each share of our common stock is entitled to one vote on each matter to be acted upon at the Annual Meeting. Our stockholders are not entitled to cumulative voting rights, and dissenters’ rights are not applicable to the matters being voted upon at the Annual Meeting.

Only owners of record of shares of common stock at the close of business on March 25, 2024, the record date, are entitled to vote at the Annual Meeting, or at any adjournments, postponements, or recesses thereof. There were 29,369,817 shares of common stock issued and outstanding on the record date.

If your shares are held through a broker (typically referred to as being held in “street name”), you will receive separate voting instructions from your broker. You must follow the voting instructions provided to you by your broker in order to instruct your broker on how to vote your shares. Stockholders who hold shares in street name should generally be able to vote by returning the voting instruction card to their broker or by telephone or via the Internet. However, the availability of telephone or Internet voting will depend on the voting process of your broker.

|

WINGSTOP INC. 2024 PROXY STATEMENT | 5 |

PROXY STATEMENT SUMMARY

With respect to each of the proposals to be acted upon at the Annual Meeting, you may vote as follows:

| • | Director Election Proposal: “FOR” each of the nominees or “WITHHOLD” from each of the nominees; |

| • | Auditor Ratification Proposal: “FOR,” “AGAINST,” or “ABSTAIN”; |

| • | Say-on-Pay Proposal: “FOR,” “AGAINST,” or “ABSTAIN”; |

| • | Say-on-Pay Frequency Proposal: “1 YEAR,” “2 YEARS,” “3 YEARS,” or “ABSTAIN”; |

| • | 2024 Incentive Plan Proposal: “FOR,” “AGAINST,” or “ABSTAIN”; and |

| • | Stockholder Proposal: “FOR,” “AGAINST,” or “ABSTAIN”. |

All properly executed written proxies, and all properly completed proxies submitted by the Internet or telephone, that are delivered pursuant to this solicitation will be voted at the Annual Meeting in accordance with the directions given in the proxy, unless the proxy is revoked prior to completion of the voting at the Annual Meeting. For details regarding how to revoke your proxy, see “— Revocability of Proxy” below.

Quorum

The presence, in person, by a duly authorized representative in the case of a corporation or other legal entity, or through representation by proxy, of the holders of a majority of the combined voting power of the issued and outstanding shares of common stock entitled to vote at the Annual Meeting is necessary to constitute a quorum to transact business at the Annual Meeting. Virtual attendance at the Annual Meeting constitutes presence in person for purposes of a quorum at the meeting.

Effect of Votes Withheld, Abstentions and Broker Non-Votes

Abstentions, broker non-votes and votes withheld are included in the number of shares of common stock present for determining a quorum for all proposals.

The election of directors will be determined by a plurality of votes cast. As a result, votes “WITHHELD” will have no impact with respect to the election of directors, except that pursuant to our Corporate Governance Guidelines, each of the director nominees has tendered an irrevocable resignation that becomes effective if (i) such nominee fails to receive more “FOR” votes than “WITHHELD” votes in an uncontested election of directors at an annual meeting and (ii) the Board accepts such resignation. For additional information concerning this policy, see “Proposal 1—Election of Directors—Vote Required; Director Resignation Policy for Failure to Receive Majority Vote in Election” on page 9.

Pursuant to our Bylaws, except as otherwise required by applicable law or regulation or by the Certificate of Incorporation, all matters before the Annual Meeting other than the election of directors are determined by the affirmative vote of the holders of a majority in voting power of the shares of our common stock that are present in person or by proxy and entitled to vote at the Annual Meeting. However, because it is possible that no frequency will receive this vote on the Say-on-Pay Frequency Proposal, the Board will consider the frequency choice that receives a plurality of votes cast as the non-binding advisory vote of our stockholders. An abstention is not an “affirmative vote,” but an abstaining stockholder is considered “entitled to vote” at the Annual Meeting. Accordingly, an abstention will have the effect of a vote against the Auditor Ratification Proposal, the Say-on-Pay Proposal, the 2024 Incentive Plan Proposal, and the Stockholder Proposal, as applicable, and such abstention will have no effect on the Say-on-Pay Frequency Proposal.

Under applicable stock exchange rules, brokers who hold shares on behalf of beneficial owners have the authority to vote on certain proposals when they have not received instructions from the beneficial owners. A broker non-vote occurs when a broker holding shares for a beneficial owner does not vote on a particular proposal because the broker does not have discretionary voting power with respect to that item under applicable stock exchange rules and has not received voting instructions from the beneficial owner.

Your broker does not have discretionary authority to vote your common stock with respect to any proposal other than the Auditor Ratification Proposal in the absence of specific instructions from you. Where a broker does not have discretionary

| 6 | WINGSTOP INC. 2024 PROXY STATEMENT |

|

PROXY STATEMENT SUMMARY

authority to vote your common stock, such broker is not considered “entitled to vote” with respect to a particular proposal at the Annual Meeting. Accordingly, a broker non-vote will have no effect on any proposal other than the Auditor Ratification Proposal. Broker non-votes are not applicable to the Auditor Ratification Proposal because your broker has discretionary authority to vote your common stock with respect to such proposals.

Revocability of Proxy

Your proxy is revocable at any time before the polls close at the Annual Meeting. If you wish to revoke your proxy and change your vote, you may:

| • | vote again by the Internet or by telephone, if available, prior to the start of the Annual Meeting; |

| • | give written notice to our Corporate Secretary prior to the start of the Annual Meeting that you wish to revoke your proxy and change your vote; |

| • | submit a later dated proxy with new voting instructions by mail, so long as such proxy card is received prior to the start of the Annual Meeting; or |

| • | vote again electronically at the Annual Meeting. |

If you are a beneficial owner of your shares and your shares are held through a broker, you must contact your brokerage firm, bank or other custodian to revoke any prior voting instructions.

Virtual Annual Meeting of Stockholders

This year’s Annual Meeting will be completely virtual and will be conducted online only via live webcast. You are entitled to participate in the Annual Meeting only if you were a stockholder as of the Record Date or if you hold a valid proxy for the Annual Meeting. You will be able to participate in the Annual Meeting online and submit your questions prior to the meeting by visiting www.proxydocs.com/WING. You also will be able to vote your shares electronically at the Annual Meeting.

In order to attend the virtual Annual Meeting, you must register in advance at www.proxydocs.com/WING prior to the deadline of May 20, 2024 at 5:00 p.m. Eastern Time. The control number located in the green box on the upper-right corner of your proxy card and/or voting authorization form will be required to register. Upon completing your registration, you will receive further instructions via email, including your unique link that will allow you access to the meeting, and you will have the ability to submit questions prior to the Annual Meeting. Please be sure to follow the instructions found on your proxy card and/or voting authorization form and subsequent instructions that will be delivered to you via email.

You can submit questions electronically prior to the Annual Meeting. During the Q&A session of the meeting, members of our management will answer the questions that were submitted in advance of the meeting, as time permits. To ensure the Annual Meeting is conducted in a manner that is fair to all stockholders, we reserve the right, in our sole discretion, to edit or reject questions we deem profane, repetitive, not relevant to the business of the Company, or otherwise inappropriate.

2025 Annual Meeting of Stockholders

Stockholder proposals submitted for inclusion in the proxy statement for our annual meeting of stockholders expected to be held in May 2025 pursuant to SEC Rule 14a-8 must be received by us by December 5, 2024. Director nominations or other business to be brought before the 2025 Annual Meeting of Stockholders by a stockholder, other than Rule 14a-8 proposals described above, must be received by us between January 23, 2025 and February 22, 2025. In addition to satisfying the requirements under our Bylaws, stockholders who intend to solicit proxies in support of director nominees other than the Company’s nominees must provide notice that sets forth the information required by Rule 14a-19 under the Exchange Act, no later than March 24, 2025. For more information, see “Next Annual Meeting—Stockholder Proposals” on page 90.

Solicitation Matters

Proxies are being solicited by the Board of Directors on behalf of the Company. We have hired Innisfree M&A Inc. (“Innisfree”) to provide us with consulting and analytic services and solicitation services for banks, brokers, institutional

|

WINGSTOP INC. 2024 PROXY STATEMENT | 7 |

PROXY STATEMENT SUMMARY

investors, and individual stockholders. Innisfree’s fee for these services is $20,000, plus reimbursement of reasonable out-of-pocket expenses. All costs of solicitation will ultimately be borne by the Company. We have agreed to indemnify Innisfree against certain liabilities and expenses, including liabilities under the federal securities laws.

Our officers, directors, and employees may also solicit proxies personally or in writing, by telephone, email, or otherwise. These officers and employees will not receive additional compensation but will be reimbursed for out-of-pocket expenses. Brokerage houses and other custodians, nominees, and fiduciaries, in connection with shares of the common stock registered in their names, will be asked to forward solicitation material to the beneficial owners of shares of common stock. We will reimburse brokerage houses and other custodians, nominees, and fiduciaries for their reasonable out-of-pocket expenses for forwarding solicitation materials and collecting voting instructions.

Householding

In an effort to reduce our printing costs, mailing costs, and fees, we have elected to adopt the practice of “householding” proxy materials. Under this approach, if paper copies are requested, we will deliver only one copy of our fiscal 2023 Annual Report, this Proxy Statement, and/or Notice of Internet Availability of Proxy Materials, as applicable, to multiple stockholders who share the same address (if they appear to be members of the same family) unless we have received contrary instructions from the stockholders. Stockholders who participate in householding will continue to receive separate proxy cards if they receive a paper copy of proxy materials in the mail.

Upon written or oral request, we will promptly deliver a separate copy of our fiscal 2023 Annual Report, this Proxy Statement, and/or Notice of Internet Availability of Proxy Materials, as applicable, to a stockholder at a shared address to which a single copy of the documents has been delivered.

If you are (i) a stockholder, share an address and last name with one or more other stockholders, currently receive only one copy of proxy materials, and would like to revoke your householding consent and receive a separate copy of proxy materials, or (ii) you are a stockholder eligible for householding and would like to participate in householding, please contact Investor Relations at IR@wingstop.com, (972) 686-6500 or Wingstop Inc., 15505 Wright Brothers Drive, Addison, Texas 75001. You will be removed from the householding program within 30 days of receipt of the revocation of your consent.

A number of brokerage firms have instituted householding. If you hold your shares in “street name,” please contact your bank, broker or other holder of record to request information about householding.

Annual Report on Form 10-K

The Company’s Annual Report on Form 10-K for the fiscal year ended December 30, 2023 is included in the 2023 Annual Report that is being delivered, or made available electronically via the Internet, to stockholders with this Proxy Statement. Additional copies of the 2023 Form 10-K may be obtained free of charge by sending a written request to our Investor Relations department at the email or mailing address provided above under the caption “Householding.” The 2023 Form 10-K is also available on our Investor Relations website at https://ir.wingstop.com.

| 8 | WINGSTOP INC. 2024 PROXY STATEMENT |

|

| PROPOSAL 1— ELECTION OF DIRECTORS |

|

Our business and affairs are managed under the direction of our Board and its committees. Pursuant to the Certificate of Incorporation and our Bylaws, our Board is required to consist of between three and fifteen directors divided into three classes, with the number of directors serving in each class to consist, as nearly as possible, of one-third of the total number of directors constituting the entire Board. The directors within each class serve on the Board for staggered three-year terms.

Currently, our Board consists of nine directors, with three directors in each class. The three director classes are as follows:

| • | Class I, consisting of Krishnan (Kandy) Anand, David L. Goebel, and Michael J. Hislop, whose terms will expire at the annual meeting of stockholders to be held in 2025; |

| • | Class II, consisting of Lynn Crump-Caine, Wesley S. McDonald, and Anna (Ania) M. Smith, whose terms will expire at the annual meeting of stockholders to be held in 2026; and |

| • | Class III, consisting of Kate S. Lavelle, Kilandigalu (Kay) M. Madati, and Michael J. Skipworth, whose terms expire at the Annual Meeting and, therefore, are standing for election to the Board. |

Directors hold office until their successor is duly elected and qualified or until their earlier death, resignation, or removal. Our directors may only be removed for cause by the affirmative vote of the holders of at least sixty-six and two-thirds percent (66 2/3%) of our voting stock at a meeting of the stockholders called for that purpose.

Board Nominees for Election at the Annual Meeting

The terms of Ms. Lavelle and Messrs. Madati and Skipworth, each a Class III director, expire at the Annual Meeting. Upon the recommendation of our Nominating and Corporate Governance Committee, Ms. Lavelle and Messrs. Madati and Skipworth have been nominated for re-election. If elected, Ms. Lavelle and Messrs. Madati and Skipworth will hold office for a three-year term expiring at the annual meeting of stockholders to be held in 2027.

Each director nominee has consented to being named in this Proxy Statement and to serve as a director if elected.

The persons named on the accompanying proxy card, or their substitutes, will vote for the election of the three nominees listed herein, except to the extent authority to vote for one or all of the nominees is withheld. No proposed nominee is being elected pursuant to any arrangement or understanding between the nominee and any other person or persons. If any of the nominees becomes unable or unwilling to serve, the persons named as proxies on the accompanying proxy card, or their substitutes, shall have full discretion and authority to vote or refrain from voting for any substitute nominees in accordance with their judgment.

Vote Required; Director Resignation Policy for Failure to Receive Majority Vote in Election

To be elected as a director, each director nominee must receive a plurality of the votes cast at the Annual Meeting. Nonetheless, pursuant to our Corporate Governance Guidelines, each of the director nominees has tendered an irrevocable resignation that becomes effective if (i) such nominee fails to receive more “FOR” votes than “WITHHELD” votes in an uncontested election of directors at an annual meeting and (ii) the Board accepts such resignation.

The Nominating and Corporate Governance Committee must consider the resignation and recommend to the Board the action to be taken with respect to the resignation. The director whose resignation is under consideration shall not participate in the Nominating and Corporate Governance Committee’s recommendation with respect to the resignation. The Board is required to consider and act on the recommendation within ninety days following certification of the stockholder vote and will publicly disclose its decision whether to accept the resignation offer.

A copy of our Corporate Governance Guidelines is available on the investor relations section of our website at https://ir.wingstop.com.

|

WINGSTOP INC. 2024 PROXY STATEMENT | 9 |

PROPOSAL 1—ELECTION OF DIRECTORS

Director Nominees for Terms Expiring at the 2027 Annual Meeting

|

KATE S. LAVELLE

| ||

|

|

Director Since 2019

Age: 58

Independent

Audit (Chair) and Technology Committees

| |

| Favorite Wingstop Flavor:

|

| |

Ms. Lavelle has been a member of our Board since March 2019. Ms. Lavelle has over 20 years of experience in finance and accounting, including 12 years in the restaurant and food service industry. Ms. Lavelle served as the Executive Vice President and Chief Financial Officer of Dunkin’ Brands, Inc. from December 2004 until July 2010. Prior to that, she was Global Senior Vice President for Finance and Chief Accounting Officer of LSG Sky Chefs, a wholly owned subsidiary of Lufthansa Airlines, from January 2003 until August 2004, and also served in various other management positions for LSG Sky Chefs from March 1998 until January 2003. She began her career at Arthur Andersen LLP where for more than 10 years she served as Senior Audit Manager in charge of administration of audits and other professional engagements. Ms. Lavelle served on the board of directors of Sonic Inc. from 2012 until 2018. Ms. Lavelle has also previously served as a director of Jones Lang LaSalle, a global financial and professional services firm.

Director Qualifications

Ms. Lavelle’s significant financial and accounting experience as chief financial officer and in other senior leadership roles with restaurant and other companies, as well as her experience as a director for a publicly traded restaurant company, make her a valued member of our Board. She has knowledge of complex financial and accounting matters that enables her to provide guidance on matters such as corporate administration, strategic planning, corporate finance, financial reporting, mergers and acquisitions, and leadership of complex organizations.

|

KILANDIGALU (KAY) M. MADATI

| ||

|

|

Director Since 2017

Age: 51

Independent

Audit and Technology (Chair) Committees

| |

| Favorite Wingstop Flavor:

|

| |

Mr. Madati has been a member of our Board since March 2017. Mr. Madati is an accomplished digital, marketing, and media executive, with global management and business-transformation experience at some of the world’s most renowned companies. Mr. Madati most recently served as the Chief Commercial Officer for FIFA, the international governing body of association football, futsal and beach soccer, from July 2021 to August 2022. Formerly, he was Global VP and Head of Content Partnerships of Twitter, Inc. from 2017 to 2020 and Executive Vice President and Chief Digital Officer of BET Networks, a subsidiary of Viacom, Inc., from 2014 to late 2017. Prior to that, he was Head, Entertainment & Media, Global Marketing Solutions for Facebook, an online social media and social networking service, from 2011 to 2014, and Vice President, Audience Experience & Engagement, at CNN Worldwide, a television news channel, from 2008 to 2011. Prior to that, he served in various leadership roles with Community Connect, a social-networking company, Octagon Worldwide, a leader in sports entertainment marketing, and BMW of North America, a worldwide automaker.

Director Qualifications

Mr. Madati’s experience as a chief commercial officer, head of content partnerships, chief digital officer, and other senior executive leadership roles working with media companies across a broad spectrum of industries, and knowledge of complex digital marketing and audience engagement matters provide him with valuable and relevant experience in digital media, strategic planning, marketing, and leadership of complex organizations, and provide him with the qualifications and skills to serve as a director.

| 10 | WINGSTOP INC. 2024 PROXY STATEMENT |

|

PROPOSAL 1—ELECTION OF DIRECTORS

|

MICHAEL J. SKIPWORTH

| ||

|

|

Director Since 2022

Age: 46

Not Independent

President and Chief Executive Officer

| |

| Favorite Wingstop Flavor:

|

| |

Mr. Skipworth has served as our Chief Executive Officer and a member of our Board since March 2022. He has served as our President since August 2021. Prior to being appointed as Chief Executive Officer, Mr. Skipworth served as our Chief Operating Officer from August 2021 until March 2022 and, prior to that, served as Executive Vice President and Chief Financial Officer from February 2018 to August 2021 and Senior Vice President and Chief Financial Officer from August 2017 to February 2018. He joined Wingstop in December 2014 as Vice President, Corporate Controller, and served as Vice President of Finance from January 2016 to June 2017. In June 2017, Mr. Skipworth was appointed as our interim Chief Financial Officer and served in that role until his appointment as Chief Financial Officer in August 2017. Prior to joining Wingstop, Mr. Skipworth served as Senior Vice President of Finance and Accounting and Vice President, Corporate Controller at Cardinal Logistics Holdings, LLC, and as an audit senior manager at KPMG LLP.

Director Qualifications

Mr. Skipworth’s extensive experience in the restaurant industry, including his prior service as our Chief Operating Officer, Chief Financial Officer and his current service as our President and Chief Executive Officer, provide the Board with valuable insights into the Company and its industry.

|

The Board of Directors recommends that you vote FOR each director nominee.

|

|

WINGSTOP INC. 2024 PROXY STATEMENT | 11 |

PROPOSAL 1—ELECTION OF DIRECTORS

Continuing Directors with Terms Expiring at the 2025 or 2026 Annual Meetings

The directors listed below will continue in office for the remainder of their terms and until their respective successor is duly elected and qualified or until their earlier death, resignation, or removal.

|

LYNN CRUMP-CAINE

| ||

|

|

Director Since 2017

Age: 67

Independent Chair of the Board of Directors

Audit and Nominating and Corporate Governance Committees

| |

| Favorite Wingstop Flavor:

|

| |

Ms. Crump-Caine is our Board Chair and has been a member of our Board since January 2017. Ms. Crump-Caine brings 30 years of restaurant industry experience to our Board, having previously served as Executive Vice President of Worldwide Operations for McDonald’s Corporation, where her responsibilities included developing growth strategies, standards and systems, global supply chain, real estate development, and innovation worldwide. Prior to this role, she held numerous executive level positions including Executive Vice President, U.S. Restaurant Systems and Senior Vice President of U.S. Operations. Previously, Ms. Crump-Caine founded, and was Chief Executive Officer of, OutsideIn Consulting, an organizational performance and strategy development consulting firm. Ms. Crump-Caine brings substantial public company governance experience, having served on several public company and nonprofit company boards. Her current directorships include Thrivent Financial and Advocate Health (previously Advocate Aurora Health). Her former directorships include G&K Services and Krispy Kreme Doughnuts, Inc. Ms. Crump-Caine also serves as the Chair of the Board and a mentor with The ExCo Group (formerly known as Merryck & Co.), a global firm providing executive coaching and mentoring services.

Director Qualifications

Ms. Crump-Caine’s far-reaching restaurant industry knowledge and operational experience, including in various senior positions with McDonald’s Corporation, provides her with valuable and relevant experience in understanding and advising on complex operating systems, growth strategies, training, and brand development. In addition, her many years of public company board service provide her with valuable experience in corporate governance and risk management.

Ms. Crump-Caine’s term will expire at the annual meeting of stockholders to be held in 2026.

|

KRISHNAN (KANDY) ANAND

| ||

|

|

Director Since 2018

Age: 66

Independent

Nominating and Corporate Governance (Chair) and Technology Committees

| |

| Favorite Wingstop Flavor:

|

| |

Mr. Anand has been a member of our Board since August 2018. He currently serves as the Chief Executive Officer of Igniting Business Growth, a business consulting company, and as Chairman and Chief Executive Officer of Igniting Consumer Growth Acquisition Company, a special purpose acquisition company. Mr. Anand retired from Molson Coors Brewing Company in November 2019, where, prior to his retirement, he served as Chief Growth Officer beginning in 2016 and President and Chief Executive Officer of Molson Coors International LP from December 2009 to October 2016. Before joining Molson Coors, Mr. Anand held a variety of positions at The Coca-Cola Company, including president of Coca-Cola’s Philippine business from 2007 to 2009. He also served as vice president of Coca-Cola’s Global Commercial Leadership from 2004 to 2007 and as vice president of global brands strategy. He also served in various senior marketing strategy roles with Unilever in India from 1980 to 1996. Mr. Anand has served on the board of directors of British American Tobacco (NYSE: BTI), an international tobacco group, since February 2022. He served on the board of directors of Popeyes Louisiana Kitchen Inc. (NASDAQ: PLKI) from November 2010 to 2017 and Empower, Ltd., a NYSE-listed special purpose acquisition company (NYSE: EMPW), between October 2020 and July 2021.

Director Qualifications

Mr. Anand’s experience as a chief growth officer, executive leader of international operations and other marketing, M&A and strategy roles enables him to provide valuable guidance on business leadership, growth strategies, branding and operations. He also has experience on other public company boards, including a restaurant in the chicken category, which enables him to bring industry, corporate governance, compensation and other insights to our Board.

Mr. Anand’s term will expire at the annual meeting of stockholders to be held in 2025.

| 12 | WINGSTOP INC. 2024 PROXY STATEMENT |

|

PROPOSAL 1—ELECTION OF DIRECTORS

|

DAVID L. GOEBEL

| ||

|

|

Director Since 2017

Age: 73

Independent

Compensation (Chair) and Nominating and Corporate Governance Committees

| |

| Favorite Wingstop Flavor:

|

| |

Mr. Goebel has been a member of our Board since November 2017. He is the founding principal and President of Santoku, Inc., a private company formed in 2008 that operates a fast-casual pizza concept under the name Pie Five Pizza Company and Cultivare Greens & Grains. He also served as acting President and Chief Executive Officer of Mr. Goodcents Franchise Systems, Inc., the franchisor of Goodcents Deli Fresh Subs, from 2010 until December 2014. From 2001 to 2007, he served in various executive positions at Applebee’s International, Inc., including as President and Chief Executive Officer in 2006 and 2007, during which time it operated nearly 2,000 restaurants in the United States and abroad. Prior to that, Mr. Goebel was President of Summit Management, Inc., a consulting group specializing in executive development and strategic planning. Prior to that, he was the Chief Operating Officer of Finest Foodservice, LLC, a Boston Chicken/Boston Market franchise that he founded and co-owned, which was responsible for developing 80 restaurants within a seven-state area from 1994 to 1998. He currently serves as Chairman of the Board, and was previously Lead Director, of Jack In the Box Inc. (NASDAQ: JACK), and as a board member of Murphy USA Inc., a gas/convenience food company (NYSE: MUSA). Mr. Goebel has been a partner and faculty member for The ExCo Group (formerly known as Merryck & Co.), a global firm providing executive coaching and mentoring services, since May 2008.

Director Qualifications

Mr. Goebel’s more than 40 years of experience in the retail, food service, and hospitality industries provides him with extensive business, operational, management, and leadership development experience, as well as unique insights into restaurant operations, restaurant and concept development, supply chain management, franchising, executive development, risk assessment, risk management, succession planning, executive compensation, and strategic planning that enable him to provide valuable guidance to the Board.

Mr. Goebel’s term will expire at the annual meeting of stockholders to be held in 2025.

|

MICHAEL J. HISLOP

| ||

|

|

Director Since 2011

Age: 69

Independent

Compensation and Technology Committees

| |

| Favorite Wingstop Flavor:

|

| |

Mr. Hislop has been a member of our Board since October 2011. He served as Chairman of Corner Bakery, a national bakery-cafe chain, from February 2006 to March 2020 and served as its Chief Executive Officer from February 2006 to October 2015. In addition, Mr. Hislop was the Chairman of Il Fornaio from 2001 until June 2020, served as its Chief Executive Officer from 1998 until October 2015, and prior to that, served as President and Chief Operating Officer of Il Fornaio beginning in 1995. Prior to Il Fornaio, he was Chairman and Chief Executive Officer for Chevys Mexican Restaurants, where he built the company’s infrastructure in preparation for taking it public. He has also served in a number of operating positions at El Torito Mexican Restaurants and T.G.I. Friday’s. In 2010, Mr. Hislop was recognized by the International Foodservice Manufacturers Association with the Silver Plate award, which pays tribute to the most outstanding and innovative talents in foodservice operations, and in 2013, he received Nation’s Restaurant News’ Golden Chain Award, an honor bestowed on those representing the very best that the restaurant industry has to offer.

Director Qualifications

Mr. Hislop’s experience as a chief executive officer and chief operating officer in the restaurant industry and vast knowledge of franchise operations provide him with valuable and relevant experience in operations, brand management, consumer strategy, and leadership of complex organizations. This expertise, as well as his knowledge of corporate governance gained from service on a number of boards, make him an excellent resource for, and valued member of, the Board.

Mr. Hislop’s term will expire at the annual meeting of stockholders to be held in 2025.

|

WINGSTOP INC. 2024 PROXY STATEMENT | 13 |

PROPOSAL 1—ELECTION OF DIRECTORS

|

WESLEY S. MCDONALD

| ||

|

|

Director Since 2016

Age: 61

Independent

Audit and Compensation Committees

| |

| Favorite Wingstop Flavor:

|

| |

Mr. McDonald has been a member of our Board since May 2016. From 2003 to 2017, he served as an officer of Kohl’s Corporation, where he oversaw financial planning and analysis, investor relations, financial reporting, accounting operations, tax, treasury, non-merchandise purchasing, credit, and capital investment. He was promoted to Senior Executive Vice President, Chief Financial Officer in 2010 and to Principal Officer, Chief Financial Officer in 2015. Prior to joining Kohl’s, Mr. McDonald served as Chief Financial Officer and Vice President of Abercrombie & Fitch Co. Earlier in his career, he held several positions of increasing responsibility at Target Corporation. Mr. McDonald has been a member of the board of directors of Urban Outfitters, Inc. (NASDAQ: URBN) since May 2019, currently serves as its audit committee chair and is a member of its compensation committee. Mr. McDonald previously served on the board of The Children’s Place (NASDAQ: PLCE) between May 2023 and May 2024.

Director Qualifications

Mr. McDonald’s experience as a chief financial officer and in other senior executive leadership roles working with publicly traded consumer products companies, and knowledge of complex financial matters provide him with valuable and relevant experience in corporate administration, strategic planning, corporate finance, financial reporting, mergers and acquisitions, and leadership of complex organizations, and provide him with the qualifications and skills to serve as a director.

Mr. McDonald’s term will expire at the annual meeting of stockholders to be held in 2026.

|

ANNA (ANIA) M. SMITH

| ||

|

|

Director Since 2022

Age: 49

Independent

Compensation and Technology Committees

| |

| Favorite Wingstop Flavor:

|

| |

Ms. Smith has been a member of our Board since July 2022. She has served as Chief Executive Officer at Taskrabbit, a global digital platform owned by Ingka (IKEA) that connects people seeking help with household tasks such as furniture assembly, handy work and moving services with those who can provide such assistance, since August 2020. Prior to joining Taskrabbit, she was Director, Head of Courier Operations at Uber from August 2019 to June 2020. From April 2015 to May 2018, Ms. Smith held several positions at Airbnb including Head of Business Operations, North America; Operations, Host Services; and Senior Lead, Host Growth.

Director Qualifications

Ms. Smith’s experience as a chief executive officer and head of operations at multiple eCommerce companies provides her with valuable and relevant global experience in operations, marketplace platforms, technology, human resources, business development and strategy with broad-based skills spanning product, marketing, and operational execution, particularly for marketplaces, all of which provide her with the qualifications and skills to serve as a director.

Ms. Smith’s term will expire at the annual meeting of stockholders to be held in 2026.

| 14 | WINGSTOP INC. 2024 PROXY STATEMENT |

|

| CORPORATE GOVERNANCE |

|

Board Composition and Director Independence

The following table provides information about each director currently serving on our Board of Directors, including the director nominees, and the composition of the Board committees.

|

Committee Membership | ||||||||||||||||

| Name

|

Independent

|

Director

|

Director Class

|

Audit

|

Compensation

|

Nominating

|

Technology

| |||||||||

| Lynn Crump-Caine

|

✓

|

2017 | Class II (2026)

|

●

|

●

|

|||||||||||

| Krishnan (Kandy) Anand |

✓

|

2018 | Class I (2025)

|

|

●

| |||||||||||

| David L. Goebel |

✓

|

2017 | Class I (2025)

|

|

●

|

|||||||||||

| Michael J. Hislop |

✓

|

2011 | Class I (2025)

|

● |

●

| |||||||||||

| Kate S. Lavelle

|

✓

|

2019 | Class III (2024)

|

|

●

| |||||||||||

| Kilandigalu (Kay) M. Madati |

✓

|

2017 | Class III (2024)

|

●

|

| |||||||||||

| Wesley S. McDonald

|

✓

|

2016 | Class II (2026)

|

●

|

●

|

|||||||||||

| Michael J. Skipworth |

2022 | Class III (2024)

|

||||||||||||||

| Ania M. Smith |

✓

|

2022 | Class II (2026)

|

●

|

●

| |||||||||||

|

|

|

● Member |

|

WINGSTOP INC. 2024 PROXY STATEMENT | 15 |

CORPORATE GOVERNANCE

We follow the director independence standards set forth in The Nasdaq Stock Market (“Nasdaq”) corporate governance standards and the federal securities laws. The Board has reviewed and analyzed the independence of each director based on these criteria and affirmatively determined that each of Mses. Crump-Caine, Lavelle, and Smith and Messrs. Anand, Goebel, Hislop, Madati, and McDonald qualifies as “independent” and also meets the definition of “non-employee director” for purposes of Rule 16b-3 promulgated under the Exchange Act, as applicable. In making this determination, the Board considered:

| • | relationships and transactions involving directors or their affiliates or immediate family members that would be required to be disclosed as related party transactions and described under “Certain Relationships and Related Party Transactions” on page 33; and |

| • | other relationships and transactions involving directors or their affiliates or immediate family members that did not rise to the level of requiring such disclosure, of which there were none. |

There are no family relationships between any of our directors or executive officers.

Sunsetting the Classified Board

When the Company went public in 2015, the Board determined that a classified board structure was important to support the Company’s stability. As a maturing public company, our Board currently intends to submit for stockholder approval at the 2025 annual meeting of stockholders a proposal to amend the Company’s amended and restated certificate of incorporation to transition to a declassified Board beginning with our 2026 annual meeting of stockholders. This would result in the entire Board of Directors being elected annually at our 2028 annual meeting of stockholders.

| 16 | WINGSTOP INC. 2024 PROXY STATEMENT |

|

CORPORATE GOVERNANCE

Director Skills and Experience

Our Nominating and Corporate Governance Committee regularly evaluates the skills, qualifications, and competencies that we believe are important for directors to provide effective oversight to our Company. The matrix below shows the areas of experience and expertise that our Nominating and Corporate Governance Committee have identified that our directors bring to the Board.

|

|

|

|

|

|

|

|

|

||||||||||||

| Corporate Governance experience supports our goals of strong accountability, transparency, and stockholder value protection

|

✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | |||||||||||

|

Executive Management experience is important for leadership ability and talent development

|

✓

|

✓

|

✓ (CEO) |

✓ (CEO) |

✓

|

✓

|

✓

|

✓ (CEO) |

|

✓ (CEO) |

| |||||||||

|

Financial & Accounting experience is important for overseeing our financial reporting and internal controls and for evaluating our capital structure

|

✓

|

✓

|

✓ (CFO) |

✓ (CFO) |

✓ (CFO) |

|||||||||||||||

|

International experience is valuable as the Company continues to extend its presence outside the U.S.

|

✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | |||||||||||||

|

Marketing experience is important in maintaining brand relevance and consumer engagement |

✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | |||||||||||||

|

Operations experience is important for ensuring best practices and executing initiatives

|

✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ||||||||||||

|

Restaurant Industry experience is important because it is the Company’s core business

|

✓ | ✓ | ✓ | ✓ | ✓ | |||||||||||||||

|

Retail Industry experience is relevant for understanding consumer behavior

|

✓ | ✓ | ✓ | ✓ | ✓ | |||||||||||||||

|

Risk Management experience is important for overseeing risks facing the Company

|

✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | |||||||||||

|

Strategy is especially important for competing in a dynamic market

|

✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | |||||||||||

|

Technology experience is important for enhancing consumer experience and internal operations

|

✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ||||||||||||||

|

WINGSTOP INC. 2024 PROXY STATEMENT | 17 |

CORPORATE GOVERNANCE

Board Diversity Matrix

The table below provides certain information with respect to the composition of Wingstop’s board of directors, 56% of which classifies as diverse. Each of the categories listed in the table has the meaning ascribed to it in NASDAQ Listing Rule 5605(f).

| Board Diversity Matrix (as of April 4, 2024) | ||||||||

| Total Number of Directors: |

9 (8 of whom are independent) | |||||||

| Part I: Gender Identity | Female | Male | Non-Binary | Did Not Disclose Gender | ||||

| Directors |

3 | 6 | 0 | 0 | ||||

| Part II: Demographic Background | ||||||||

| African American or Black |

1 | 1 | 0 | 0 | ||||

| Alaskan Native or Native American |

0 | 0 | 0 | 0 | ||||

| Asian |

0 | 1 | 0 | 0 | ||||

| Hispanic or Latinx |

0 | 0 | 0 | 0 | ||||

| Native Hawaiian or Pacific Islander |

0 | 0 | 0 | 0 | ||||

| White |

2 | 4 | 0 | 0 | ||||

| Two or More Races or Ethnicities |

0 | 0 | 0 | 0 | ||||

| LGBTQ+ |

0 | 0 | 0 | 0 | ||||

| Did Not Disclose Demographic Background |

0 | 0 | 0 | 0 | ||||

| Independence

|

Diversity

| |

| 89%

|

33% of our board members are female

| |

| of our board members are independent

|

56% of our board members are diverse

| |

| 18 | WINGSTOP INC. 2024 PROXY STATEMENT |

|

CORPORATE GOVERNANCE

Board Leadership Structure

Our Board is led by the Chair of the Board. Our Bylaws provide that the Board appoints the Chair of the Board to preside at all meetings of the Board and stockholders and perform such other duties and exercise such powers as our Bylaws or the Board may prescribe. Our Bylaws and Corporate Governance Guidelines each provide that the Chair may also hold the position of Chief Executive Officer; however, the Chair and Chief Executive Officer positions were separated in March 2022. In accordance with our Corporate Governance Guidelines, the Board considers from time to time whether it is in the best interests of the Company to have the same person occupy the offices of Chair of the Board and Chief Executive Officer, using its business judgment after considering all relevant circumstances.

The Board believes, at this time, that separation of the Chair and CEO positions is appropriate and in the best interests of the Company and its stockholders. The Board believes that separating these positions enables our Chair to lead the Board of Directors in its oversight and advisory roles and allows our CEO to focus on the Company’s day-to-day business operations and developing and implementing the Company’s business strategies. The Board believes that, at this time, the separation of the roles enhances the ability of each person to discharge their duties effectively. As noted earlier, the Board assesses its leadership structure from time to time and would reconsider the structure as conditions and circumstances warrant.

The Company’s Corporate Governance Guidelines provide that, in the event the Chief Executive Officer of the Company also serves as Chair of the Board, the Company will appoint a Lead Independent Director, who will preside over each executive session of the non-management directors. The primary role of the Lead Independent Director is to ensure independent leadership of the Board, as well as to act as a liaison between the non-management directors and our Chief Executive Officer. The Lead Independent Director also assists the Chair of the Board and the remainder of the Board in assuring effective governance in overseeing the direction and management of the Company. Lynn Crump-Caine served as Lead Independent Director from March 2017 to March 2022 until she was appointed to serve as the Chair of the Board.

Pursuant to the Company’s Corporate Governance Guidelines, the non-management directors meet in executive session at least twice each year without any non-independent directors or members of management being present. Ms. Crump-Caine presides at these

meetings of our non-management directors and provides significant outside perspective and leadership. In 2023, the non-management directors met in executive sessions at

certain scheduled meetings of the Board without any non-independent directors or members of management being present.

A copy of our Corporate Governance Guidelines is available on the investor relations section of our website at https://ir.wingstop.com.

Succession Planning

Our Board leadership structure was the result of substantial succession planning efforts. Our Board has worked to recruit highly qualified directors and establish a board structure that meets the needs of the Company and its stockholders. As a result of the Board’s succession planning efforts, our Board currently consists of nine members, all of whom are independent, with the exception of Mr. Skipworth who serves as President and Chief Executive Officer.

The Board has overall responsibility for executive officer succession planning and discusses and reviews succession planning on a regular basis. In addition, the Board has established and regularly reviews a formal emergency governance plan to address succession planning in the event of a crisis.

Meetings of the Board of Directors

During the fiscal year ended December 30, 2023, our Board met six times. All of our directors attended greater than 75% of the total meetings held by the Board and any committee on which the director served during the period of the fiscal year that the director was a member of the Board. Each member of the Board attended the virtual annual meeting of stockholders in 2023. We expect that each director will attend the Annual Meeting, absent a valid reason, despite no formal policy requiring attendance at annual meetings.

Board Committees and Membership

Our Board has established an Audit Committee, a Compensation Committee, a Nominating and Corporate Governance Committee and a Technology Committee. Each committee reports to the Board as it deems appropriate and as the Board may request. The composition, duties, and responsibilities of these committees are described below.

|

WINGSTOP INC. 2024 PROXY STATEMENT | 19 |

CORPORATE GOVERNANCE

Audit Committee

The Audit Committee, in its oversight role, is responsible for, among other matters: (i) oversight of our accounting and financial reporting processes and audits of our financial statements; (ii) determinations regarding the appointment, retention, or termination of the independent auditors and approval of audit engagement fees and terms; (iii) monitoring and evaluating the qualifications, performance, and independence of the independent auditors on an ongoing basis, and oversight of the work and independence of the independent auditors; (iv) reviewing significant changes in our selection or application of accounting principles, and major issues as to the adequacy of our internal controls; (v) reviewing significant legal, compliance, or regulatory matters that may have a material impact on our business, financial statements, or compliance policies; (vi) discussing with management our guidelines, policies and processes relied upon and used by management to assess and manage our exposure to risk; (vii) oversight of our policy on related party transactions and reviewing related party transactions as required by such policy; (viii) establishment of procedures for the receipt, retention, and treatment of complaints regarding accounting, internal accounting controls or auditing matters; (ix) oversight of our business conduct and compliance program; (x) reporting regularly to the Board summarizing the committee’s actions and any significant issues considered by the committee, including any issues as to the quality or integrity of our financial statements, our compliance with legal or regulatory requirements, the performance and independence of our independent auditors, or the performance of our internal audit function; and (xi) annually reviewing the charter and the performance of the Audit Committee.

Our Board has affirmatively determined that Mses. Lavelle and Crump-Caine, and Messrs. Madati and McDonald, meet the definition of “independent director” for purposes of serving on an Audit Committee under applicable SEC and Nasdaq rules. In addition, Ms. Lavelle and Mr. McDonald each qualifies and has been designated as an “audit committee financial expert,” as such term is defined in Item 407(d)(5) of Regulation S-K.

Our Board has adopted a written charter for the Audit Committee, a copy of which is available on the investor relations section of our website at https://ir.wingstop.com. Under the terms of the Audit Committee Charter, the Audit Committee may form subcommittees and delegate its authority to those subcommittees as it deems appropriate. The Audit Committee held seven meetings during the 2023 fiscal year.

Compensation Committee

The Compensation Committee is responsible for, among other matters: (i) setting the overall compensation philosophy, strategy, and policies for our executive officers and non-employee directors; (ii) reviewing and approving corporate goals and objectives relevant to the compensation of our Chief Executive Officer and other executive officers and evaluating performance in light of those goals and objectives; (iii) reviewing and determining the compensation of our non-employee directors, Chief Executive Officer, and other executive officers; (iv) making recommendations to the Board of Directors with respect to our incentive and equity-based compensation plans; (v) reviewing and approving compensatory agreements and other similar arrangements between us and our executive officers; (vi) interpreting, administering and making determinations under the Company’s incentive-based compensation recoupment policies; and (vii) annually reviewing the charter and the performance of the Compensation Committee.

Our Board has affirmatively determined that Messrs. Goebel, Hislop and McDonald and Ms. Smith meet the definition of “independent director” for purposes of serving on a compensation committee under applicable SEC and Nasdaq rules, as well as the definition of “non-employee director” for purposes of Rule 16b-3 promulgated under the Exchange Act.

Our Board has adopted a written charter for the Compensation Committee, a copy of which is available on the investor relations section of our website at https://ir.wingstop.com. The Compensation Committee held five meetings during the 2023 fiscal year.

Under the terms of the Compensation Committee charter, the Compensation Committee is authorized to engage independent advisors, at the Company’s expense, to advise the Compensation Committee on certain matters. The Compensation Committee may also form subcommittees and delegate its authority to those subcommittees as it deems appropriate. A description of the considerations and determinations of the Compensation Committee regarding the compensation of our named executive officers is contained in “Compensation Discussion and Analysis” below.

Nominating and Corporate Governance Committee

Our Nominating and Corporate Governance Committee is responsible for, among other matters: (i) recommending to the Board the qualifications, qualities, skills, and expertise required for Board membership; (ii) identifying potential

| 20 | WINGSTOP INC. 2024 PROXY STATEMENT |

|

CORPORATE GOVERNANCE

members of the Board consistent with the criteria approved by our Board and selecting and recommending to the Board the director nominees for election at annual meetings of stockholders or otherwise filling vacancies; (iii) evaluating and making recommendations regarding the structure, membership, and governance of the committees of the Board; (iv) developing and making recommendations to the Board with regard to our corporate governance policies and principles, including development of a set of corporate governance guidelines and principles; (v) reviewing and assessing the Company’s sustainability and environmental, social, and governance (“ESG”) policies, goals, and initiatives; (vi) overseeing the annual review of the Board’s performance; and (vii) annually reviewing the charter and the performance of the Nominating and Corporate Governance Committee.

Our Board has affirmatively determined that Mr. Anand, Ms. Crump-Caine and Mr. Goebel meet the definition of “independent director” for purposes of serving on a nominating and corporate governance committee under applicable SEC and Nasdaq rules.

Our Board has adopted a written charter for the Nominating and Corporate Governance Committee, a copy of which is available on the investor relations section of our website at https://ir.wingstop.com. Under the terms of the Nominating and Corporate Governance Committee charter, the Nominating and Corporate Governance Committee may, in its discretion, delegate all or a portion of its duties and responsibilities to a subcommittee of the Committee, with any actions taken being reported to the Committee at the next scheduled meeting. The Nominating and Corporate Governance Committee held four meetings during the 2023 fiscal year.

Technology Committee

In March 2021, our Board established a Technology Committee, which is responsible for, among other matters, oversight of: (i) the Company’s information technology strategy; (ii) the Company’s cybersecurity and technology-related risks and management efforts to monitor and mitigate those risks; (iii) the Company’s significant technology investments in support of our evolving global business needs; and (iv) the Company’s response to technology-based threats and opportunities.

Though not required under applicable SEC and Nasdaq rules for purposes of serving on a technology committee, the Board has affirmatively determined that Messrs. Madati, Anand, and Hislop and Mses. Lavelle and Smith meet the definition of “independent director” under applicable rules.

Our Board has adopted a written charter for the Technology Committee, a copy of which is available on the investor relations section of our website at https://ir.wingstop.com. Under the terms of the Technology Committee charter, the Technology Committee may form subcommittees and delegate its authority to those subcommittees as it deems appropriate. The Technology Committee held three meetings during the 2023 fiscal year.

Board Oversight of Long-Term Growth Strategy

Our Board is responsible for overseeing our Company’s strategy for creating long-term growth. The Board recognizes that the restaurant industry is extremely competitive and rapidly evolving and that to generate long-term growth our strategy must allow us to quickly adapt to meet the demands of our customers. Our vision is to become a Top 10 Global Restaurant Brand. Based on our internal analysis, we believe there is opportunity for our brand to grow to 7,000+ restaurants globally. Our strategy is built upon the foundation of our culture, the Wingstop Way (which we discuss in more detail below in “Environmental, Social and Governance — The Wingstop Way”), investing in people as our competitive advantage, and our global mindset. This strategy consists of three pillars:

| (1) | Sustaining same-store sales growth by building brand awareness and working to close the awareness gap to top quick-service restaurant peers, expanding our data-driven marketing, and leveraging our digital platform and first party database of digital guests. |