UNITED STATES

SECURITIES AND EXCHANGE

COMMISSION

WASHINGTON, DC 20549

(RULE 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934 (Amendment No. _)

Filed by the Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

☐ | Preliminary Proxy Statement |

☐ | Confidential, For Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

☒ | Definitive Proxy Statement |

☐ | Definitive Additional Materials |

☐ | Soliciting Material under §240.14a-12 |

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement if Other than the Registrant)

Payment of Filing Fee (Check all boxes that apply):

☒ | No fee required | |

☐ | Fee paid previously with preliminary materials | |

☐ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11 | |

Notice of the 2024 Annual Meeting of Shareholders

| WHEN |

|

| WHERE |

|

| RECORD DATE |

May 17, 2024 9:00 a.m. Eastern Time | The Annual Meeting | Shareholders of record at the close of business on March 21, 2024 are entitled to notice of, and to attend and vote during the Annual Meeting |

ITEMS OF BUSINESS | ||||

1 | Election of director nominees | |||

2 | Ratification of the appointment of independent registered public accounting firm | |||

3 | Advisory vote to approve named executive officer compensation | |||

4 | Approval of the Macy’s, Inc. 2024 Equity and Incentive Compensation Plan | |||

PROXY VOTING FOR REGISTERED HOLDERS (shares are held in your own name) | ||||

Over the Internet during the Annual Meeting at |

By telephone 24/7 |

Over the Internet 24/7 at www.proxyvote.com |

By mailing your completed proxy to: Macy's, Inc. 51 Mercedes Way Edgewood, NY 11717 | |

If your shares are held in “street name” with a broker or similar party, you have a right to direct that organization on how to vote the shares held in your account. You can vote by signing, dating, completing and returning your voting instruction form by mail in the postage-paid envelope provided, or by following the instructions for voting via telephone or the internet set forth on the voting instruction form. Street name holders may vote online during the Annual Meeting only if they submit a legal proxy from their bank, broker or other nominee.

If you are a participant in our 401(k) Retirement Investment Plan, you may attend and participate in the Annual Meeting, but you will not be able to vote the shares held in this plan electronically during the Annual Meeting. You must vote in advance of the Annual Meeting online, by phone, or by mail.

Whether or not you plan to attend the Annual Meeting, we urge you to vote your shares by completing, signing, dating and returning your proxy card or voting instruction form promptly, or by voting by telephone or over the Internet, following the instructions set forth on the proxy card or voting instruction form. |

Virtual Annual Meeting Participation

Any shareholder of record can attend and participate in the Annual Meeting live via the Internet at www.virtualshareholdermeeting.com/M2024. You will need the 16-digit control number shown on your proxy card to vote and submit questions in advance of or during the Annual Meeting. Beneficial holders need to obtain and submit a legal proxy from their bank, broker or other nominee in order to vote at the Annual Meeting.

Additional information on how you can attend and participate in the virtual Annual Meeting is set forth under “Information About the Annual Meeting” in the accompanying proxy statement.

By Order of the Board, | |||

| |||

Tracy M. Preston | |||

Chief Legal Officer and Secretary | |||

April 15, 2024

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS |

The Notice of Annual Meeting of Shareholders, Proxy Statement and Annual Report on Form 10-K for the year |

Table of Contents

ITEM 4: Approval of Macy's, Inc. 2024 Equity and Incentive Compensation Plan | 62 | |

76 | ||

77 | ||

77 | ||

80 | ||

82 | ||

82 | ||

83 | ||

85 | ||

87 | ||

88 | ||

92 | ||

93 | ||

94 | ||

97 | ||

98 | ||

98 | ||

99 | ||

104 | ||

107 | ||

Change-in-Control Arrangements Specifically Triggered by Board Turnover | 114 | |

115 | ||

115 | ||

117 | ||

117 | ||

117 | ||

Securities Authorized for Issuance Under Equity Compensation Plans | 119 | |

121 | ||

122 | ||

126 | ||

127 | ||

Appendix A - Macy’s, Inc. 2024 Equity and Incentive Compensation Plan | 128 |

Forward Looking Statements

All statements in this proxy statement that are not statements of historical fact are forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Such statements are based upon the current beliefs and expectations of Macy’s management and are subject to significant risks and uncertainties. Actual results could differ materially from those expressed in or implied by the forward-looking statements contained in this proxy statement because of a variety of factors, including Macy’s ability to successfully implement A Bold New Chapter strategy, including the ability to realize the anticipated benefits within the expected time frame or at all, conditions to, or changes in the timing of proposed real estate and other transactions, prevailing interest rates and non-recurring charges, the effect of potential changes to trade policies, store closings, competitive pressures from specialty stores, general merchandise stores, off-price and discount stores, manufacturers’ outlets, the Internet and catalogs and general consumer spending levels, including the impact of the availability and level of consumer debt, possible systems failures and/or security breaches, the potential for the incurrence of charges in connection with the impairment of tangible and intangible assets, including goodwill, declines in credit card revenues, Macy’s reliance on foreign sources of production, including risks related to the disruption of imports by labor disputes, regional or global health pandemics, and regional political and economic conditions, the effect of weather, inflation, inventory shortage, labor shortages, the amount and timing of future dividends and share repurchases, our ability to execute on our strategies or achieve expectations related to environmental, social and governance matters, and other factors identified in documents filed by the Company with the U.S Securities and Exchange Commission, including under the captions “Forward-Looking Statements” and “Risk Factors” in the Company’s Annual Report on Form 10-K for the fiscal year ended February 3, 2024. Macy’s disclaims any intention or obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, except as required by law.

PROXY SUMMARY

Proxy Summary

We are providing the enclosed proxy materials in connection with the solicitation by the board of directors (the Board) of Macy’s, Inc. (Macy’s or the Company) of proxies to be voted at the Annual Meeting of Shareholders to be held on May 17, 2024 (the Annual Meeting). We began giving these proxy materials to our shareholders on April 15, 2024.

This summary highlights certain information contained elsewhere in our proxy statement. This summary does not contain all the information you should consider. You should read the entire proxy statement carefully before voting.

Voting Matters

ITEMS | BOARD’S RECOMMENDATION | SEE PAGE | ||

1 | Election of director nominees |

| FOR each nominee | 11 |

2 | Ratification of the appointment of independent registered public accounting firm |

| FOR | 55 |

3 | Advisory vote to approve named executive officer compensation |

| FOR | 60 |

4 | Approval of the Macy’s, Inc. 2024 Equity and Incentive Compensation Plan |

| FOR | 62 |

Corporate Governance Highlights

We believe that good governance is integral to achieving long-term shareholder value. We are committed to governance policies and practices that serve the interests of the Company and our shareholders. Our corporate governance policies and practices include:

HIGHLIGHTS OF CORPORATE GOVERNANCE | |||||

| 14 of 15 Director nominees are independent |

| Lead independent director | ||

| Annual Board and Committee evaluations |

| Majority voting in uncontested director elections | ||

| Annual election of all directors |

| No shareholder rights plan | ||

| Board and Committee oversight of risk |

| Policy prohibiting pledging and hedging ownership of Macy’s stock | ||

| Confidential shareholder voting policy |

| Proxy access | ||

| Director resignation policy |

| Regular executive sessions of independent directors | ||

| Director retirement policy |

| Share ownership guidelines for directors and executive officers | ||

| Diverse Board in terms of gender, ethnicity, experience and skills |

| One share, one vote policy | ||

| Independent Board Committees | ||||

PROXY SUMMARY

Macy’s Nominees for Director

The following tables provide summary information (as of April 10, 2024) about Macy’s director nominees. The Board unanimously recommends that you vote “FOR” each of our Board’s director nominees:

DIRECTOR | PRINCIPAL | OTHER | KEY COMMITTEE | ||||||||

NAME/AGE | EXPERIENCE | SINCE | OCCUPATION | INDEPENDENT | BOARDS | A | CMD | F | NCG | ||

| Emilie Arel | ● Senior Leadership ● Retail ● Technology | ● Marketing/Brand Management ● Risk Management | 2022 | Former President and CEO, Casper Sleep Inc. | ✓ | 0 |

|

| ||

| Torrence N. Boone | ● Senior Leadership ● Retail ● Technology | ● Marketing/Brand Management ● Investment Banking | 2019 | Vice President, Global Client Partnerships, Google, Inc. | ✓ | 0 |

|

| ||

| Ashley Buchanan | ● Senior Leadership ● Finance/Accounting ● Retail | ● Marketing/Brand Management ● Supply Chain ● Technology | 2021 | CEO, The Michaels Companies, Inc. | ✓ | 0 |

|

| ||

| Marie Chandoha | ● Senior Leadership ● Finance/Accounting ● Investment Banking | ● Risk Management ● Technology | 2022 | Former President and CEO, Charles Schwab Investment Management, Inc. | ✓ | 1 |

|

| ||

| Naveen K. Chopra (50) | ● Senior Leadership ● Finance/Accounting | ● Marketing/Brand Management ● M&A/Strategy | 2023 | Executive Vice President and CFO, Paramount Global | ✓ | 0 |

|

| ||

| Richard Clark (65) | ● Senior Leadership ● Real Estate | ● M&A/Strategy ● Capital Markets | 2024 | Co-Founder, Managing Partner, WatermanCLARK | ✓ | 0 |

| |||

| Deirdre P. Connelly | ● Senior Leadership ● Human Resources | ● Marketing/Brand Management | 2008 | Former President, North American Pharmaceuticals, GlaxoSmithKline | ✓ | 2 |

|

| ||

| Jill Granoff | ● Senior Leadership ● Retail | ● Brand Management ● Asset Management | 2022 | Senior Advisor, Eurazeo Brands | ✓ | 0 |

|

| ||

| William H. Lenehan | ● Senior Leadership ● Finance/Accounting | ● Investment Banking & Real Estate ● Risk Management | 2016 | President and CEO, Four Corners Property Trust, Inc. | ✓ | 1 |

|

| ||

| Sara Levinson | ● Senior Leadership ● Technology | ● Marketing/Brand Management | 1997 | Former Director, Katapult | ✓ | 1 |

|

| ||

| Richard L. Markee (70) | ● Senior Leadership ● Retail | ● Marketing/Brand Management | 2024 | Former Executive Chairman, Vitamin Shoppe, Inc. | ✓ | 1 |

| |||

| Douglas W. Sesler (62) | ● Senior Leadership ● Finance/Accounting ● Retail | ● Real Estate ● M&A/Strategy | 2024 | Founder and President, Fair Street Partners | ✓ | 1 | ||||

| Tony Spring (59) | ● Senior Leadership ● Retail ● Risk Management | ● Marketing/Brand Management | 2023 | Chairman and Chief Executive Officer, Macy’s, Inc. | 0 | |||||

| Paul C. Varga | ● Senior Leadership ● Finance/Accounting ● Retail | ● Marketing/Brand Management ● Risk Management | 2012 | Former Chairman and CEO, Brown-Forman Corporation | ✓ | 1 |

|

| ||

| Tracey Zhen | ● Senior Leadership ● Finance/Accounting | ● Investment Banking ● Technology | 2021 | Former President, Zipcar, a subsidiary of Avis Budget Group, Inc. | ✓ | 0 |

|

| ||

Legend | A | Audit Committee |

| Committee Chair |

CMD | Compensation and Management Development Committee | |||

F | Finance Committee | |||

NCG | Nominating and Corporate Governance Committee |

| Committee Member | |

|

| ||

6 |

|

PROXY SUMMARY

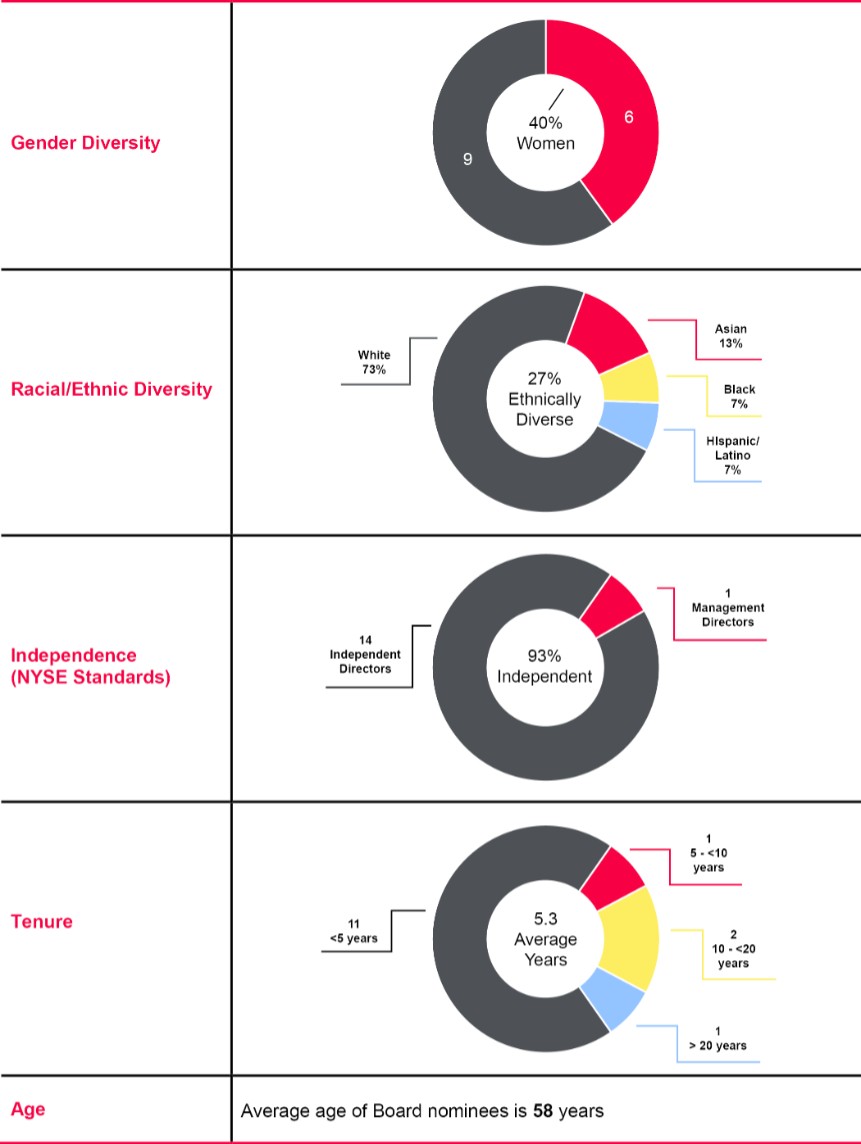

Our director nominees provide an effective mix of experience and perspectives, as well as gender, age and racial/ethnic diversity.

|

| ||

MACY’S, INC. | 7 |

PROXY SUMMARY

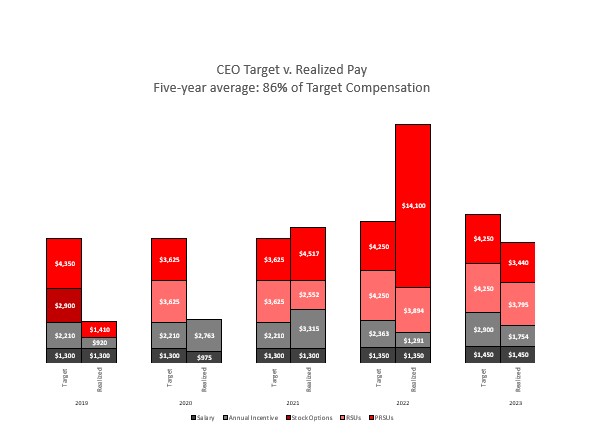

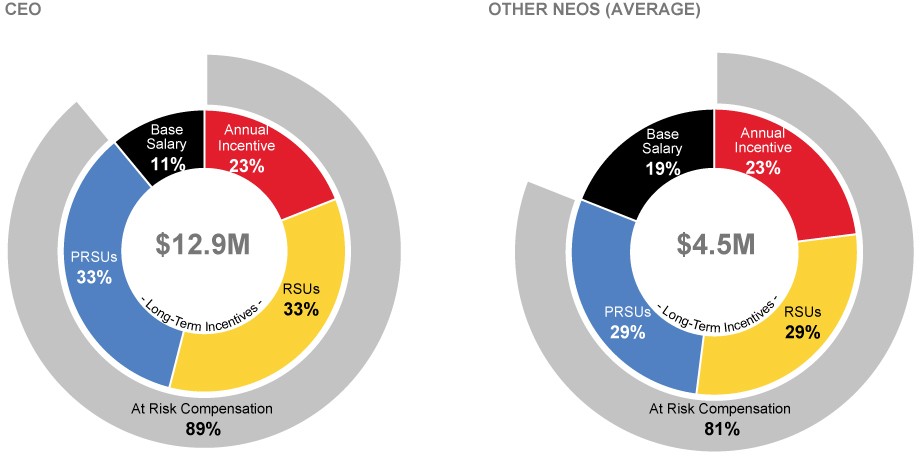

Executive Compensation Program

Our compensation program objectives are to provide competitive and reasonable compensation opportunities through programs aligned with key business strategies and plans, foster a performance-based culture, and attract, motivate, reward and retain key executives. Balancing these primary program objectives helps ensure accountability to our shareholders. For a detailed discussion of our short- and long-term incentive programs, see page 85.

2023 Compensation Program Design

The 2023 executive compensation program focused on 2023 financial objectives and key priorities, consistent with focus areas discussed during our earnings calls, as well as absolute and relative stock price appreciation. The plan framework and goals reflect our commitment to a pay-for-performance compensation philosophy while accounting for the heightened uncertainty surrounding both the consumer and macro environment at the time the plans were set.

| ● | The incentive plans were designed to motivate and engage the organization and leadership with linkage between strategy, business plan and incentives. |

| ● | Plan design focused on Growth, Profit and Colleague. These elements were to support key business priorities and promote strong operating financial performance. |

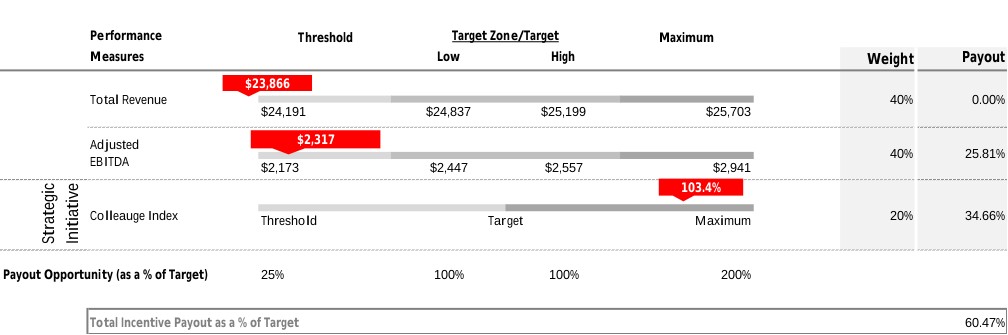

Annual Incentive Plan

The annual incentive plan design reflected a focus on key 2023 business priorities.

| ● | Metrics were weighted 80% on the financial goals of Adjusted EBITDA and total revenue (weighted 40% each) and 20% on a Culture Index. |

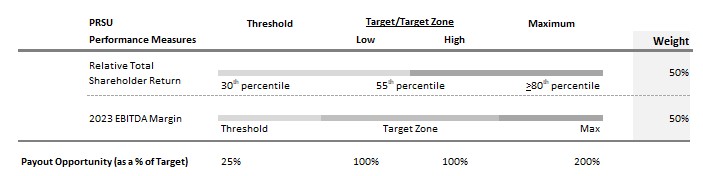

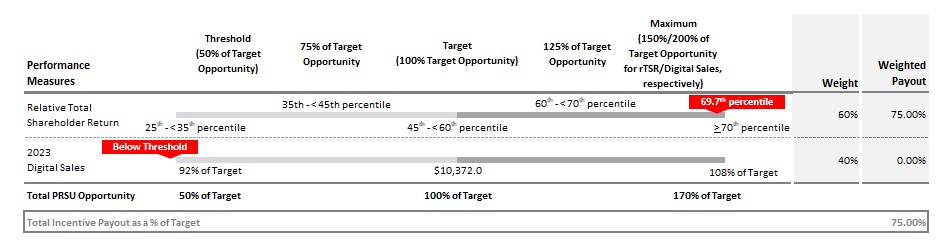

Long-term Incentive Plan

We continued to use performance-based restricted stock units (PRSUs) and time-based restricted stock units (RSUs) in the long-term incentive plan with a mix of 50% each for all NEOs. The 2023 PRSU awards had two equally weighted metrics: 2023 – 2025 relative total shareholder return (rTSR) and 2023 Adjusted EBITDA margin.

| ● | Given the uncertainty in the macro environment and the volatility of the retail industry, the CMD Committee made the decision to use 2023 Adjusted EBITDA margin in the PRSU plan. Following the one-year performance period, there is an additional two-year vesting period to align with our historic vesting practices and help ensure retention. This approach enabled us to set meaningful performance targets that maintained the rigor of the PRSU program during a year in which the Company completed a transition of the Chief Executive Officer role and incentivized the leadership team’s focus on profitable sales growth, inventory management, cost discipline and strengthening the balance sheet. As a part of its annual review of the compensation program, the CMD Committee resolved to revert to using a 3-year performance period for all metrics in the 2024 PRSU plan. |

| ● | The rTSR metric continues to be based on a three-year performance period and uses the S&P Retail Select Industry Index as the benchmark group. |

The payout ranges in both the annual and long-term incentive plans were 25% to 200% of target, consistent with 2022.

|

| ||

8 |

|

PROXY SUMMARY

Compensation Mix

Within our primary pay elements of base salary, performance-based annual incentive and long-term incentives, we emphasize at risk pay over fixed pay with at least 70% of our NEOs’ target compensation linked to a variety of metrics, including pre-determined performance objectives (financial and strategic) and/or stock price performance. The program also balances the importance of the achievement of short-term and long-term objectives.

Our executive compensation program and our methodology for setting pay opportunities and approving payouts are further discussed in the Compensation Discussion and Analysis (CD&A) on page 77.

Corporate Responsibility

We believe we have a responsibility to manage our resources, maximize our positive social impact and proactively engage on issues that span the breadth of our operations including through transparency, product responsibility and supply chain management, energy management, diversity, equity and inclusion and building resilient communities.

Consumers have a rising expectation that how companies do business is as important as what they sell. Our social purpose is a strategy and framework that supports our business and empowers more voice, choice and ownership of our colleagues, customers, and communities.

Our Mission Every One social purpose platform is working to create a brighter future with bold representation for all. Our initial commitment of $5 billion through 2025 will be directed to our people, partners, products and programs to create a more equitable and sustainable future. A portion of the Company’s overall $5 billion commitment will support retail and non-retail diverse-owned or underrepresented businesses, investments in diverse and inclusive development programs and expand the sustainable products backed by third-party certifications that we offer. Across Macy’s, Bloomingdale’s, and Bluemercury, digital shopping through online and app experiences, and new smaller off-mall store formats, Macy’s fosters a comprehensive supplier ecosystem that advocates for businesses at all levels of growth and across a vast array of categories and size.

OUR COMMITMENT PILLARS INCLUDE:

PEOPLE | PLANET | COMMUNITY |

We seek to recognize and reward our colleagues and partners to fuel mutual growth, innovation, and impact. | We strive to curate and create sustainable products and services so people and planet can thrive together. | We endeavor to empower the curiosity and confidence of young people on their journey to become the leaders of tomorrow. |

This work is brought to life by initiatives across diversity, equity and inclusion, sustainability, and corporate giving matters. | ||

People

In 2023, we continued our efforts to enhance diversity and inclusion across all levels of our organization to enable us to more closely and effectively engage with all of our customers. Our accomplishments included:

| ● | 30.1% ethnically diverse representation at the director+ levels |

| ● | Improved retention and focused on building pipelines for internal promotions and talent pools for external hiring of diverse colleagues at the director+ levels |

| ● | Maintained female representation in leadership roles |

|

| ||

MACY’S, INC. | 9 |

PROXY SUMMARY

Planet

During 2023, we enhanced our environmental initiatives by disclosing certain environmental performance metrics and designing programs to reduce our carbon emissions impact:

Submitted fiscal year 2022 (FY22) CDP Climate Change Report in July 2023 that included the following highlights:

| ● | Installed LED lighting at 61 retail spaces in 2022, reducing electric power consumption by 12.5M kWh and avoiding 4,764 metric tons of CO2e |

| ● | Provided approximately 4 million miles of free electric vehicle charging at a total of 126 stations, avoiding 974 metric tons of driver-related emissions in FY22 |

| ● | Published comprehensive Scope 3 greenhouse gas emissions |

| ● | In November 2022, Macy’s committed to set near-term company-wide emission reductions in line with the Science Based Targets initiative (SBTi) |

We took steps to extend our efforts in environmental stewardship to our product sales:

| ● | Increased customer sales of environmentally-responsible products while expanding related programs within private brand products managed by the Macy’s Sourcing team |

| ● | Expanded the assortment of environmentally-responsible products on macys.com and bloomingdales.com |

| ● | Furthered environmentally-responsible initiatives for Private Brands Products Managed by the Macy’s Sourcing Teams: |

– | Joined US Cotton Trust Protocol |

– | Partnered with World Wildlife Fund (WWF) to publish Water Stewardship Policy |

– | Published an Animal Welfare Policy, an updated Fur Policy, an Exotic Skins Policy, and a preferred material policy to include synthetic fibers |

In addition, we took steps to extend our efforts in responsible sourcing:

| ● | Participated in RISE: Reimagining Industry to Support Equality, formerly HERproject, an initiative to support collaborative industry action at scale to advance gender equality in global garment, footwear and home-textiles supply chains |

| ● | Published Human Rights policy |

Community

| ● | During 2023, we continued to drive impact through relationships that reflect our goals and values and deepened relationships with existing partners aligned with Mission Every One and CEO Action for Racial Equity |

| ● | Raised and directed over $33 million to nonprofit partners and colleagues volunteered 66,000 hours to support our communities |

| ● | Maintained our $1 million commitment to organizations advancing social justice and racial equity |

| ● | Committed $750,000 to various education and research foundations of The Divine Nine sororities to support youth scholarships, leadership and development programs in celebration of the apparel collection at Macy’s |

| ● | Furthered commitment to Future of Style Fund – providing funding to nonprofits to support the creation of scholarships, programming (design/styling) and to support real-life sustainability projects |

|

| ||

10 |

|

ITEM 1 |

Election of Directors |

The Board recommends that you vote “FOR” the election of each of the following director nominees, and your proxy will be so voted |

•Emilie Arel |

•Torrence N. Boone |

•Ashley Buchanan |

•Marie Chandoha •Naveen K. Chopra •Richard Clark •Deirdre P. Connelly •Jill Granoff •William H. Lenehan •Sara Levinson •Richard L. Markee •Douglas W. Sesler •Tony Spring |

•Paul C. Varga •Tracey Zhen |

ITEM 1: ELECTION OF DIRECTORS

In accordance with the recommendation of the Nominating and Corporate Governance (NCG) Committee, the Board has nominated the following individuals for election as directors. Each nominee is currently a member of the Board. If elected, each nominee will serve for a one-year term expiring at our annual meeting of shareholders in 2025 or until his or her successor is duly elected and qualified.

Francis S. Blake, who has served as a director since November 2015, retired from the Board effective April 10, 2024. Jeff Gennette, who has served as a director since 2016, served as Chief Executive Officer of Macy’s from March 2017 until February 2024, and previously served as Non-Executive Chairman of the Board, retired from the Board effective April 10, 2024. We thank Mr. Blake and Mr. Gennette for their many years of service to Macy’s and our shareholders.

We also recently appointed three new directors to our Board: Richard Clark, Richard L. Markee and Douglas W. Sesler. Mr. Clark and Mr. Markee were identified as potential directors by our shareholder Arkhouse Management Co. LP and certain of its affiliates (together, Arkhouse) and were appointed to the Board in accordance with our previously disclosed agreement with Arkhouse.

The Board has fixed the size of the Board at 15 Directors.

Information regarding Macy’s director nominees is set forth below. Ages are as of April 10, 2024. The criteria considered and process undertaken by the NCG Committee in recommending qualified director candidates is described under “Further Information Concerning the Board of Directors — Director Nomination and Qualifications.”

Each Macy’s nominee has agreed to serve if elected. If any nominee becomes unavailable to serve before the Annual Meeting, the Board may designate a substitute nominee and the persons named as proxies may, in their discretion, vote your shares for the substitute nominee. Alternatively, the Board may reduce the number of directors to be elected at the Annual Meeting. At this time, the Board knows of no reason why any of the Board’s nominees would not be able to serve as a director if elected.

ITEM 1: ELECTION OF DIRECTORS

Nominees for Election as Directors:

| ||

Emilie Arel Former President and Chief Executive Officer of Casper Sleep Inc. Independent Age: 46 Director Since: 2022 Race/Ethnicity: White Committees: ● CMD ● NCG Previous Public Directorships During Casper Sleep Inc. | Professional Background

● Chief Executive Officer, Casper Sleep Inc. (2021 to 2024), President (2019 to 2024) ● Chief Commercial Officer, Casper Sleep Inc. (2019 to 2021) ● Chief Executive Officer, FULLBEAUTY Brands Inc. (2017 to 2019) ● Chief Executive Officer, Quidsi Inc. (2015 to 2017), Senior Vice President, Retail, Merchandising and Supply Chain (2014 to 2015) ● Various leadership positions, The Gap, Inc. (2007 to 2014) including Vice President and General Manager, Kids and Brand Licensing, Old Navy (2013 to 2014), Vice President, Stores, Old Navy (2012 to 2013) ● Various leadership positions, Target Corporation (2001 to 2004)

Relevant Skills and Experience ● Leadership Experience – Ms. Arel is a three-time CEO with over two decades of experience serving in senior leadership positions at large publicly traded companies. As CEO of Casper Sleep, she oversaw multiple transactions including its IPO and subsequent go-private transaction, and while the CEO of FULLBEAUTY Brands, she led the company through a successful restructuring. Ms. Arel spent seven years with The Gap Inc. where she held multiple merchandising and licensing positions and led a team of 12,000+ employees and 220+ stores. ● Industry Knowledge and Experience – Ms. Arel brings experience leading complex omnichannel retail businesses and brick-and-mortar retail stores, including Target, The Gap Inc., FULLBEAUTY Brands and Quidsi. She also has retail merchandising expertise, and a proven ability to develop retail partnerships and maximize the customer experience via omnichannel strategies. ● Sales and Marketing and Technology Experience – Ms. Arel has extensive experience across digital-first marketing, e-commerce, commercial and brand strategy and digital transformation. In her role as President and CEO at Casper Sleep, Ms. Arel oversaw the company’s comprehensive business strategy and was responsible for implementing complex e-commerce and omnichannel strategies to drive consistency for consumers. During her tenure as CEO of FULLBEAUTY Brands, she successfully led its digital transformation from 2017 – 2019. |

ITEM 1: ELECTION OF DIRECTORS

| ||

Torrence N. Boone Vice President, Global Client Partnerships, Google, Inc. Independent Age: 54 Director Since: 2019 Race/Ethnicity: Black Committees: ● Audit ● NCG | Professional Background ● Vice President, Global Client Partnerships, Google, Inc. (2010 to current) ● Chief Executive Officer, Team Dell, a division of WPP (2008 to 2010) ● President and General Manager, Digitas (2001 to 2008) and Avenue A, now Razorfish (1999-2000) ● Senior Manager, Bain & Company (1995 to 2000) Relevant Skills and Experience ● Leadership Experience – Mr. Boone has served as the Vice President of Global Client Partnerships at Google, Inc. since 2010, and leads a team focused on large scale global strategic partnerships across a portfolio of the world’s largest global advertisers, spanning the tech, health, beauty and consumer packaged goods industries, to achieve breakthrough marketing results. Mr. Boone previously held senior agency leadership positions at WPP & Publicis. He has been recognized as an advocate for ethnic diversity and inclusion in education and business and was named by Savoy Magazine as one of the Top 100 Most Influential Blacks in Corporate America and one of the Most Influential Black Corporate Directors. Mr. Boone has also been named to the Financial Times UPstanding Leaders' List and the Crain’s NY Power 25 List. ● Sales and Marketing and Technology Experience – Mr. Boone possesses over two decades of experience in advertising, marketing and technology, most recently in his role at Google, a multinational technology company. Mr. Boone is a well-respected leader in the advertising industry, with a depth of knowledge and experience particularly in digital marketing. ● Industry Knowledge and Experience – Through his experience at Google, Mr. Boone brings multigenerational knowledge and a global view of the consumer. He was also a senior manager at Bain & Company, where he advised a broad range of clients on corporate and business strategy, mergers and acquisitions, new product development and interactive strategy for five years. | |

|

| ||

14 |

|

ITEM 1: ELECTION OF DIRECTORS

| ||

Ashley Buchanan Chief Executive Officer of The Michaels Companies, Inc. Independent Age: 50 Director Since: 2021 Race/Ethnicity: White Committees: ● Audit ● NCG Previous Public Directorships During TreeHouse Foods, Inc. The Michaels Companies, Inc. | Professional Background ● Chief Executive Officer, The Michaels Companies, Inc. (2020 to current) ● Executive Vice President and Chief Merchandising Officer, U.S. eCommerce, Walmart, Inc. (2019 to 2020) ● Executive Vice President and Chief Merchandising Officer, Sam’s Club (2017 to 2019) ● Senior Vice President, Walmart, Dry Grocery (2016 to 2017), Senior Vice President, Snacks and Beverages (2014 to 2016), Vice President, Walmart Innovations (2007 to 2014) ● Finance Manager, Dell, Inc. (2004 to 2007) ● Manager, Retail Practice at Accenture LLP (1999 to 2004) Relevant Skills and Experience ● Leadership Experience – Mr. Buchanan’s leadership experience as a Chief Executive Officer and senior executive of large publicly traded companies with global operations greatly contributes to our Board. Notably, since his appointment as The Michaels Companies, Inc.’s CEO in 2020, the company has experienced record growth, financial and operational performance. Mr. Buchanan also had a distinctive and successful career at Walmart, serving in various roles of increased leadership and responsibility that culminated in the role of Chief Merchandising and Chief Operating Officer for Walmart U.S. eCommerce. ● Industry Knowledge and Experience – Mr. Buchanan brings significant knowledge of the retail industry given his extensive background in merchandising and general management of large retail organizations. ● Technology Experience – Mr. Buchanan is also recognized for his expertise in successfully leading traditional, established retail corporations through complex digital transformations, first at Walmart and currently at The Michaels Companies, Inc. | |

|

| ||

MACY’S, INC. | 15 |

ITEM 1: ELECTION OF DIRECTORS

| ||

Marie Chandoha Former President and Chief Executive Officer, Charles Schwab Investment Management, Inc. Independent Age: 62 Director Since: 2022 Race/Ethnicity: White Committees: ● Audit (Chair) ● Finance Other Current Public Directorships: State Street Corporation | Professional Background: ● President and Chief Executive Officer, Charles Schwab Investment Management, Inc (2010 to retirement in 2019) ● Managing Director and Global Head, Fixed Income Business of BlackRock, Inc. (2009 to 2010) ● Global Head, Fixed Income Business of Barclays Global Investors, Inc. (acquired by BlackRock, Inc. in 2009) (2007 to 2009) ● Co-Head and Senior Portfolio Manager, Montgomery Fixed Income, Wells Capital Management Incorporated (1999 to 2007) ● Senior Bond Strategist, The Goldman Sachs Group, Inc. (1996 to 1999) ● Various leadership positions, Credit Suisse Group AG (1986 to 1996) Relevant Skills and Experience ● Leadership Experience – Ms. Chandoha has over 35 years of leadership experience as a former Chief Executive Officer and senior executive in the financial services industry, in addition to currently serving on public company boards. She has a track record of transforming previously underperforming businesses, scaling them and creating value. Most recently, she served as President and Chief Executive Officer of Charles Schwab Investment Management for nearly ten years, where she led the company’s product and technology transformation, improving profitability and more than doubling the firm’s assets under management. ● Finance Experience – Beyond Charles Schwab Investment Management, Ms. Chandoha’s career in financial services has spanned executive roles at major global financial institutions, including leading the fixed income business of Barclays Global Investors and BlackRock. Her core competencies include finance, investment management, strategy, regulatory dynamics and risk management, among others. Ms. Chandoha serves as Chair of the Risk Committee and Member of the Audit Committee on the State Street Corporation board, and American Banker recognized her each year from 2014 to 2018 as one of the 20 Most Powerful Women in Finance. ● ESG Experience – Ms. Chandoha has built a reputation for developing diverse, high performing teams and organizations. As Chief Executive Officer of Charles Schwab Investment Management, Inc., Ms. Chandoha reorganized the leadership team and added strong governance and risk management policies. In addition, Ms. Chandoha has served on the board of trustees of the Nature Conservancy of California for the last 12 years, becoming Chairwoman in 2023. | |

|

| ||

16 |

|

ITEM 1: ELECTION OF DIRECTORS

| ||

Naveen K. Chopra Executive Vice President and Chief Financial Officer of Paramount Global Independent Age: 50 Director Since: 2023 Race/Ethnicity: Asian Indian Committees: ● Audit ● Finance Previous Public Directorships During Vonage Holdings Corp. (acquired by Telefonaktiebolaget LM Ericsson) | Professional Background ● Executive Vice President and Chief Financial Officer, Paramount Global (2020 to current) ● Vice President and Chief Financial Officer, Devices and Services Worldwide, Amazon.com, Inc. (2019 to 2020) ● Chief Financial Officer, Pandora Media, Inc. (acquired by Sirius XM Holdings in 2019) (2017 to 2019), Interim Chief Executive Officer (during 2017) ● Various leaderships positions, TiVo Corporation (2003 to 2016) including Interim Chief Executive Officer and Chief Financial Officer (2016), Chief Financial Officer and Senior Vice President, Corporate Development and Strategy (2012 to 2016), Senior Vice President, Corporate Development (2009 to 2012), Vice President, Global Business Development (2006 to 2009), Director, Business Development (2003 to 2006) Relevant Skills and Experience ● Leadership Experience – Mr. Chopra brings over 20 years of experience as a senior executive of large publicly traded companies across the consumer, technology and media industries through phases of growth and transformation. Chopra spent several years across a variety of leadership roles at TiVo, including interim CEO, CFO, and head of Corporate and Business Development. He also served as interim CEO at Pandora Media. Mr. Chopra was previously a board member at Vonage Holdings, a publicly traded multi-billion-dollar cloud-communications company, and where the stock rose close to 200% during his tenure. ● Finance Experience – Mr. Chopra is an established financial and operational leader with proven expertise managing and overseeing treasury, tax, accounting, investor relations and information security functions for high-growth, innovative companies. Notably, in his Chief Financial Officer role, he oversaw some of Amazon’s fastest-growing businesses, including Alexa and Echo, FireTV, Ring and Kindle. At Vonage, he served on the audit and compensation committees. ● Real Estate Experience – As Executive Vice President, Chief Financial Officer of Paramount, Mr. Chopra oversees the company’s financial operations, including its real estate, as well as global corporate development and strategy. Additionally, Mr. Chopra managed the real estate division of Pandora Media during his tenure as CFO. | |

|

| ||

MACY’S, INC. | 17 |

ITEM 1: ELECTION OF DIRECTORS

| ||

Richard Clark Co-Founder and Managing Partner, WatermanCLARK Independent Age: 65 Director Since: 2024 Race/Ethnicity: White Committee: ● Finance | Professional Background ● Co-Founder and Managing Partner of WatermanCLARK (2020 to Present) ● Chairman and Chief Executive Officer of Brookfield Property Group, Brookfield Property Partners (NASDAQ: BPYPP) and Brookfield Office Properties (2013 to 2021) ● President and Chief Executive Officer, Brookfield Office Properties (2002 to 2012) ● Senior leadership positions, Brookfield Corp. and its predecessors (1984 to 2002) ● Chairman, Alliance for Downtown New York and the Downtown-Lower Manhattan Association (2017 to Present) ● Executive Committee, Real Estate Board of New York (2014 to 2023) ● Board of Directors, Real Estate Roundtable (2015 to 2021) Relevant Skills and Experience ● Leadership Experience – Mr. Clark brings over three decades of leadership experience to the Board, serving as Co-Founder and Managing Partner of WatermanCLARK, as well as having served in various senior leadership roles, including Chairman and Chief Executive Officer of Brookfield Property Group, Brookfield Property Partners and Brookfield Office Properties. During his time at Brookfield, he spearheaded the repositioning of the company into a global business with multiple strategic acquisitions. ● Real Estate Experience – Mr. Clark has a proven track record in the real estate industry, particularly as the Co-Founder and Managing Partner of WatermanCLARK, a real estate investment partnership. Additionally, as Chairman and Chief Executive Officer of Brookfield Property Group, he was responsible for growing assets under management from $5 billion to more than $200 billion and expanding its capabilities beyond the office sector into the multifamily, industrial, hotel and retail sectors. He has also served on several real estate executive committees, including as Chairman of the Alliance for Downtown New York and the Downtown-Lower Manhattan Association, on the Executive Committee of the Real Estate Board of New York and the Board of Directors of the Real Estate Roundtable. ● Finance Experience – Mr. Clark has capital markets and mergers and acquisitions experience. Under his leadership, Brookfield made a series of major strategic acquisitions, including the recapitalization of General Growth Properties, the U.S.’s second largest mall company, the acquisition of the Trizec and a number of international transactions, which accelerated the Company’s global expansion. | |

|

| ||

18 |

|

ITEM 1: ELECTION OF DIRECTORS

| ||

Deirdre P. Connelly Former President, North American Pharmaceuticals of GlaxoSmithKline Independent Age: 63 Director Since: 2008 Race/Ethnicity: Hispanic/Latino Committees: ● CMD ● NCG (Chair) Other Current Public Directorships: Lincoln National Corporation Genmab A/S | Professional Background ● President, North American Pharmaceuticals of GlaxoSmithKline, (2009 to retirement in 2015) ● President, U.S. Operations, Eli Lilly and Company (2005 to 2009) ● Senior Vice President, Human Resources, Eli Lilly and Company (2004 to 2005) ● President, Women’s Health Business, U.S. Operations, Eli Lilly and Company (2001 to 2003) Relevant Skills and Experience ● Leadership Experience – Ms. Connelly possesses many years of leadership experience as a senior executive of large publicly traded companies with global operations. Notably, she served in senior leadership roles at global pharmaceutical companies including Eli Lilly, where her responsibilities included leading an R&D global product development organization, and GlaxoSmithKline, where she also served as Co-Chair of the Global Product Investment Board for six years. For nine consecutive years, Ms. Connelly was recognized by Fortune magazine as one of the 50 most powerful women in business and was listed on Forbes 100 World’ Most Powerful Women in 2011. ● Sales and Marketing Experience – Ms. Connelly’s decades of experience in senior executive positions provide her with extensive knowledge and expertise in strategy, operations, product development, brand marketing and merchandising. From her roles at Eli Lilly and GlaxoSmithKline, she has gained deep insight into building strong organizations and marketing to defined customer segments. ● R&D and Product Development – Ms. Connelly led an R&D global product development organization at Eli Lilly and Co-Chaired the Global Product Investment Board at GlaxoSmithKline for six years. ● Human Capital Management and ESG Experience – As a former Human Resources executive, Ms. Connelly has valuable insight in compensation/benefits oversight and managing a large-scale, diverse workforce along with experience in identifying, assessing and managing risk exposure at public companies. | |

|

| ||

MACY’S, INC. | 19 |

ITEM 1: ELECTION OF DIRECTORS

| ||

Jill Granoff Senior Advisor, Eurazeo Brands Independent Age: 62 Director Since: 2022 Race/Ethnicity: White Committees: ● CMD (Chair) ● Finance Previous Public Directorships During Unibail-Rodamco-Westfield SE | Professional Background ● Senior Advisor, Eurazeo Brands (2024 to current); Managing Partner, Eurazeo (2020 to 2024), Chief Executive Officer, Eurazeo Brands (2017 to 2024) ● Chief Executive Officer, Vince Holding Corp. (2013 to 2015), Chief Executive Officer, Kellwood Company, LLC (2012 to 2013) ● Chief Executive Officer, Kenneth Cole Productions, Inc. (2008 to 2011) ● Executive Vice President, Direct Brands, Liz Claiborne, Inc. (2007 to 2008), Group President, Direct to Consumer (2006 to 2007) ● Various senior leadership positions, L Brands Inc. (1999 to 2006), including President and Chief Operating Officer, Victoria’s Secret Beauty (2005 to 2006) and Co-Leader and Chief Operating Officer, Victoria’s Secret Beauty (2004 to 2005) ● Various senior leadership positions, The Estée Lauder Companies Inc., including Senior Vice President, Strategic Planning, Finance and IT (1990 to 1999) Relevant Skills and Experience ● Leadership Experience – Ms. Granoff has over 30 years of experience leading large consumer-driven organizations. She is currently Senior Advisor to Eurazeo Brands, a global consumer growth equity platform, following her successful tenures as its Chief Executive Officer and as Managing Partner of Eurazeo. Ms. Granoff is a two-time public company Chief Executive Officer, including of Vince Holding Corp., where she led the company’s IPO, and Kenneth Cole Productions. Ms. Granoff is a long-standing member of Fortune’s Most Powerful Women and has received numerous awards for her visionary leadership. She has extensive experience on audit, compensation, nominating and governance, and strategic planning committees, having served on the boards of Unibail-Rodamco-Westfield, Demandware, Cosmetic Executive Women, and the Fashion Institute of Technology. ● Industry Knowledge and Experience – Ms. Granoff is widely known as a strategist, operator and brand builder in the beauty, fashion and retail industries. She brings a unique ability to recognize and position companies to meet evolving consumer needs and has successfully driven profitable growth for numerous brands including Estee Lauder, Victoria’s Secret, Vince, Kate Spade and Juicy Couture. Ms. Granoff has managed over 1000 retail stores and websites and has a deep understanding of omni-channel business dynamics. ● Finance Experience – As Managing Partner of Eurazeo, a leading global investment group with a diversified portfolio of $35 billion in assets under management, Ms. Granoff was responsible for leading investment activities and overseeing the performance of the firm’s Brands portfolio globally. Her tenure included a review more than 2,000 investment opportunities in beauty, fashion, food and beverage and home. |

|

| ||

20 |

|

ITEM 1: ELECTION OF DIRECTORS

| ||

William H. Lenehan President and Chief Executive Officer of Four Corners Property Trust, Inc. Independent Age: 47 Director Since: 2016 Race/Ethnicity: White Committees: ● Audit ● Finance Other Current Public Directorships: Four Corners Property Trust, Inc. | Professional Background: ● President and Chief Executive Officer, Four Corners Property Trust, Inc. (2015 to current) ● Special Advisor to the Board of Directors of EVOQ Properties, Inc. (2012 to 2014) ● Interim Chief Executive Officer of MI Developments, Inc. (now known as Granite Real Estate Investment Trust) (2011) ● Investment Professional, Farallon Capital Management LLC (2001 to 2011) Relevant Skills and Experience: ● Leadership Experience – Mr. Lenehan brings valuable experience as a two-time public company Chief Executive Officer and six-time public company board member, with specific expertise in strategy, finance, M&A and corporate governance through his many years of service on board committees. He currently serves as President and Chief Executive Officer of Four Corners Property Trust, overseeing a portfolio of over 1,000 commercial properties across the U.S. ● Real Estate Experience – Mr. Lenehan has extensive real estate investment expertise, both with public companies and private assets. In his role at Four Corners Property Trust, Mr. Lenehan has overseen the company’s acquisition of more than 700 buildings and the management of its portfolio that encompasses retail, restaurants, auto-service, medical retail and more, and includes outparcels to malls and shopping centers. Mr. Lenehan’s approximately 25 years in the real estate industry also includes a decade of experience specific to companies with an Operating Company / Property Company structure and experience in monetizing real estate held by operating companies. ● Finance Experience – Mr. Lenehan brings considerable experience in finance as an asset manager, including serving as a real estate investment professional for the first decade of his career. During his tenure at Farallon Capital Management LLC, Mr. Lenehan was involved with numerous public and private equity investments in the real estate sector and helped execute the approximately $8 billion take-private transaction of one of the largest public mall companies, The Mills, by Simon Property Group. | |

|

| ||

MACY’S, INC. | 21 |

ITEM 1: ELECTION OF DIRECTORS

| ||

Sara Levinson Retired Director of Katapult Independent Age: 73 Director Since: 1997 Race/Ethnicity: White Committees: ● CMD ● NCG Other Current Public Directorships: Harley Davidson, Inc. | Professional Background ● Co-Founder and a Director, Katapult, formerly known as Kandu (2013 to 2023) ● Non-Executive Chairman, ClubMom, Inc. (2002 to 2008) ● Chairman and Chief Executive Officer, ClubMom, Inc. (2000 to 2002) ● President, Women’s Group of publisher Rodale, Inc. (2002 to 2005) ● President, NFL Properties, Inc. (1994 to 2000) ● Co-President and Executive Vice President, MTV: Music Television (division of Viacom) (1990 to 1994) ● Executive Vice President, MTV Networks (Division of Viacom) (1986 to 1990) Relevant Skills and Experience ● Leadership Experience – Ms. Levinson possesses over three decades of leadership experience, serving as a senior executive at major consumer-oriented companies in the entertainment, media, sports and technology industries. She co-founded Katapult, a digital entertainment company, and has worked with iconic brands including the NFL, MTV and Showtime to produce innovative strategies that resonate with diverse audiences. At the NFL, Ms. Levinson oversaw a $3 billion licensing consumer products and e-commerce division, corporate sponsorship, marketing, special events, club services, and publishing. Ms. Levinson also brings experience serving as a director on public company boards and expertise in strategy, governance and executive compensation through her service on board committees. ● Industry Knowledge and Experience – Ms. Levinson brings deep expertise in social networking, e-commerce and technology innovation through her more than ten years as Co-founder and Director of Katapult and her tenure as Chairman and Chief Executive Officer of ClubMom, Inc. (later named Café Media), an online social networking community for mothers. ● Sales and Marketing and Technology Experience – Ms. Levinson has extensive knowledge and expertise in marketing, merchandising and trademark licensing. As Co-President of MTV Networks, Ms. Levinson led the company’s global expansion, bringing the network to almost every continent and into publishing, merchandising, and licensing. Ms. Levinson also built the NFL’s first marketing and research departments and is credited with expanding the league’s fan development and marketing, targeting women and children for the first time in League history. |

|

| ||

22 |

|

ITEM 1: ELECTION OF DIRECTORS

| ||

Richard L. Markee Former Chief Executive Officer, Vitamin Shoppe, Inc. and Director of Five Below, Inc. Independent Age: 70 Director Since: 2024 Race/Ethnicity: White Committee: ● Finance Other Current Public Directorships: Five Below, Inc. | Professional Background ● Non-Executive Chairman, Vitamin Shoppe, Inc. (2007 to 2009, 2016); Executive Chairman, Vitamin Shoppe, Inc. (2011 to 2016); Chief Executive Officer and Chairman of the Board, Vitamin Shoppe, Inc. (2009 to 2011) ● Senior management positions, Toys “R” Us, Inc. (1990 to 2006), including Vice Chair of Toys “R” Us, Inc. and President of the Babies “R” Us and the Toys “R” Us U.S. and international operation divisions (2004 to 2006) ● Operating Partner, Irving Place Capital Management, L. P. (2008 to 2009 ● Operating Partner, Bear Stearns Merchant Banking (2006 to 2008) ● Various positions at Target Corporation, including buyer, Director Internal Operations and Vice President Divisional Merchandise Manager, (1981 to 1990) Relevant Skills and Experience ● Leadership Experience – Mr. Markee brings over 30 years of leadership experience to the Board, having served in various leadership roles at large public companies. Throughout his time at Toys “R” Us, Mr. Markee developed a new business in Babies “R” Us and at Vitamin Shoppe led the organization through an IPO. He has extensive private and public company experience and has also previously served as a director of Collective Brands, Inc., The Sports Authority, Inc., Dorel Industries, Toys “R” Us, and Pets Supplies Plus. ● Industry Knowledge and Experience – Mr. Markee has deep expertise and insight in leading large retail organizations, including serving as CEO of Vitamin Shoppe, Inc. where he was responsible for the day-to-day operations, including its retail and direct businesses. Mr. Markee, during his 16 years at Toys “R” Us was responsible for each division of the company as President of Kids “R” Us, Babies “R” Us and Toys “R” Us domestic and international. Additionally, Mr. Markee served as an Operating Partner at Irving Place Management and Bear Stearns Merchant Banking, two private equity firms focused on growth capital investments in companies in the consumer and retail industries. ● Sales and Marketing Experience – Mr. Markee’s decades of experience in senior executive positions within the retail industry provide him with extensive knowledge and expertise in strategy, operations, sales and marketing. Mr. Markee has been involved in the development and implementation of numerous business strategies while serving as a Director and as the leader of multiple business units. | |

|

| ||

MACY’S, INC. | 23 |

ITEM 1: ELECTION OF DIRECTORS

| ||

Douglas W. Sesler Founder and President, Fair Street Partners Independent Age: 62 Director Since: 2024 Race/Ethnicity: White Other Current Public Directorships: Urban Edge Properties Previous Public Directorships During Last Five Years: Gazit Globe Ltd., now G City | Professional Background: ● Founder and President, Fair Street Partners (2021 to Current) ● Head of Real Estate, Macy’s, Inc. (2016 to 2021) ● President, True Square Capital LLC (2011 to 2016) ● Co-Head, Global Real Estate Investment Banking and Global Head of Real Estate Principal Investments, Bank of America Merrill Lynch (2005 to 2011) ● Managing Director, Global Real Estate Investment Bank Group, Citigroup (1994 to 2005) Relevant Skills and Experience: ● Leadership Experience – Mr. Sesler brings over 35 years of leadership experience, having served in senior roles at Macy’s, Inc., True Square Capital LLC and Bank of America Merrill Lynch and Citigroup, leading domestic and global real estate and investment teams. As founder of Fair Street Partners, a private real estate investment and development platform, Mr. Sesler has actively invested in real estate developments, including conversion of retail real estate into alternative uses, and acted as financial advisor in the restructuring of real estate investments. ● Real Estate Experience – Mr. Sesler’s real estate industry expertise spans real estate advisory, investing, finance and restructuring. Prior to founding Fair Street Partners, Mr. Sesler was responsible for Macy’s, Inc.’s real estate portfolio totaling over 100 million square feet, including overseeing the overall strategy to enhance real estate value and the completion of over 160 transactions to monetize and develop over $2 billion of real estate. During his time at Bank of America Merrill Lynch, he managed an $8 billion portfolio of opportunistic real estate for the firm's balance sheet and for third party fund investors. Mr. Sesler has also served as a member of the Real Estate Roundtable, Urban Land Institute, the National Association of Real Estate Investment Trusts, and ICSC. ● Finance Experience – Mr. Sesler led Macy’s, Inc.’s financial restructuring during the COVID-19 pandemic, raising $4.5 billion to recapitalize the Company. Mr. Sesler has been responsible for hundreds of M&A transactions, initial public offerings and capital raising efforts throughout his career, including the sale of Archstone, the $18 billion multifamily platform owned by the Lehman Brothers Estate and the $40 billion sale of Equity Office Properties to Blackstone, numerous acquisitions on behalf of New Plan Realty and Brookfield Properties and IPO's for DLF (India's largest real estate company), Digital Realty and Douglas Emmett. | |

|

| ||

24 |

|

ITEM 1: ELECTION OF DIRECTORS

| ||

Tony Spring Chairman and Chief Executive Officer, Macy’s, Inc. Age: 59 Director Since: 2023 Race/Ethnicity: White | Professional Background ● Chairman and Chief Executive Officer, Macy’s, Inc. (2024 to current) ● President and CEO-Elect, Macy’s, Inc. (2023 to 2024) ● Executive Vice President, Macy’s, Inc. (2021 to 2023) ● Chairman and Chief Executive Officer Bloomingdale’s (2014 to 2023) ● President and Chief Operating Officer, Bloomingdale’s (2008 to 2014) ● Executive Vice President, Bloomingdale’s (2004 to 2008) Relevant Skills and Experience ● Leadership Experience – Mr. Spring has over three decades of experience with Macy’s, Inc. and currently serves as Chairman and Chief Executive Officer of the company. He is a proven, results-oriented leader, who has been instrumental in the development and execution of the company’s transformation as a key member of the executive leadership team. Prior to being appointed Chief Executive Officer and Chair-Elect of Macy’s, Inc., Mr. Spring served as Chairman and Chief Executive Officer of Bloomingdale’s. Previously, he served as Executive Vice President of Macy’s. Inc. and oversaw Bluemercury. ● Industry Knowledge and Experience – Mr. Spring has extensive knowledge of merchandising, marketing, and operations for brick-and-mortar and online retail, having worked across functions at Bloomingdale’s for over 25 years, most recently serving as Chairman and Chief Executive Officer from 2014 to 2023. Mr. Spring serves as a member of the Executive Committee of the National Retail Federation and the board chair for the National Retail Federation Foundation. ● Sales and Marketing Experience – Mr. Spring has been a customer-focused innovator during his more than three decades with Macy’s, Inc., known for his brand-building and merchandising talents. As Chairman and Chief Executive Officer of Bloomingdale’s, he drove the successful transformation of the nameplate, leading the business to record sales volumes and customer engagement. Mr. Spring was responsible for the introduction and growth of luxury brands and accelerated growth of Bloomingdale’s Digital business, expanding brands, functionality, and launching marketplace. He also repositioned Bluemercury into a vibrant and growing nameplate for the company. | |

|

| ||

MACY’S, INC. | 25 |

ITEM 1: ELECTION OF DIRECTORS

| ||

Paul C. Varga Former Chairman and Chief Executive Officer of Brown-Forman Corporation Lead Independent Director Age: 60 Director Since: 2012 Race/Ethnicity: White Committees: ● CMD ● Finance (Chair) Other Current Public Directorships: Churchill Downs Incorporated Previous Public Directorships During Brown-Forman Corporation | Professional Background: ● Chairman and Chief Executive Officer, Brown-Forman Corporation (2007 to retirement in 2019) ● President and Chief Executive Officer, Brown-Forman Beverages, a division of Brown-Forman Corporation (2003 to 2005) ● Global Chief Marketing Officer, Brown-Forman Spirits (2000 to 2003) Relevant Skills and Experience: ● Leadership Experience – Mr. Varga brings tremendous leadership experience as the former Chief Executive Officer of a global, publicly traded consumer products company. At Brown-Forman, he significantly expanded the company’s global presence, initiated meaningful brand innovations, and oversaw some of the highest and most consistent growth rates in the distilled spirits industry. He also brings valuable experience gained as a public company board member. ● Sales and Marketing Experience – Mr. Varga brings extensive knowledge and expertise in strategy, building brand awareness, product development, marketing, distribution and sales, all of which complements our Board’s diverse skillset. Upon his retirement at Brown Forman in 2018, the company’s 3, 5, and 10 year total shareholder returns were 18%, 17%, and 17%, respectively due to active portfolio management, successful American whiskey innovation on the Jack Daniel’s, Woodford Reserve, and Old Forester trademarks, and investments in distillery homeplaces, brand packaging, and value-adding sponsorships. ● Finance Experience – At Brown Forman, Mr. Varga produced an industry-leading 20% Return on Invested Capital through excellent capital deployment, regular reinvestment in the business, targeted acquisitions and dispositions, conservative debt profile, share repurchases, and dividend consistency as evidenced by the company’s standing as a S&P Dividend Aristocrat. Mr. Varga currently serves as a Member of the Audit Committee on the Churchill Downs Incorporated board. ● ESG Experience – During his time as CEO, Mr. Varga was a champion of corporate responsibility and diversity and inclusion initiatives at Brown-Forman. He oversaw the launch of the company’s seven Employee Resource Groups and spearheaded programs intended to enhance employee engagement and employee safety. | |

|

| ||

26 |

|

ITEM 1: ELECTION OF DIRECTORS

| ||

Tracey Zhen Former President, Zipcar, a subsidiary of Avis Budget Group, Inc. Independent Age: 47 Director Since: 2021 Race/Ethnicity: Asian Committees: ● Audit ● NCG | Professional Background: ● President, Zipcar (2017 to 2022) ● Various senior positions at TripAdvisor, Inc., including Vice President and General Manager, Housetrip and Vice President, Vacation Rental Supply and Vice President and General Manager, FlipKey (2012 to 2016) ● Various senior positions at Expedia, Inc., including General Manager, Emerging Markets, Head of Strategy, EMEA, and Finance Director, Expedia UK (2006 to 2011) ● Various senior roles at IAC, Inc. including Director, FP&A and Associate Director, Strategic Planning (2000 – 2006) ● Analyst, Investment Banking, Bears Stearns & Co., Inc. (1998 to 2000) Relevant Skills and Experience ● Leadership Experience – Ms. Zhen brings over 25 years of experience in consumer technology across the mobility, travel, and media industries. She has a track record of building and scaling leading global consumer brands at Zipcar, TripAdvisor and Expedia. Under Ms. Zhen’s leadership, Zipcar was named one of the Top 100 Women-Led Businesses in Massachusetts by The Boston Globe and The Women’s Edge. Ms. Zhen also serves on the Board of Trustees (Executive Committee member) of the Mass Technology Leadership Council. ● Technology Experience – Ms. Zhen has a track record of fueling innovation and strategically applying technology to deliver growth and transformation. In her role as President of Zipcar, she oversaw all facets of the business with a focus on platform innovation and leveraging technology to expand Zipcar’s position as a category leader within the fast-growing mobility sector. ● Sales and Marketing Experience – Ms. Zhen brings unique expertise in product innovation, technology platform development, strategy, and consumer marketing and finance. She also has a proven track record of leading international business growth and solidifying strategic partnerships, all of which bring tremendous value to the Board. | |

|

| ||

MACY’S, INC. | 27 |

FURTHER INFORMATION CONCERNING THE BOARD OF DIRECTORS

Further Information Concerning the Board of Directors

Director Independence

Our Corporate Governance Principles require that a majority of the Board consist of directors who the Board has determined are independent under the independence standards adopted by the Board, which comply with the listing standards of the New York Stock Exchange (NYSE). Accordingly, the Board has adopted Standards for Director Independence to assist the Board in determining director independence, which require that the Board consist of directors who the Board has determined do not have any material relationship with the Company and who are otherwise independent. Listed below are the Board’s independence standards, which are also disclosed on our website at www.macysinc.com/investors/corporate-governance/governance-documents:

| ● | The director may not be an employee and no member of the director’s immediate family may be an executive officer of Macy’s or any of its subsidiaries, currently or within the preceding 36 months. For purposes of the standards, “immediate family” includes a person’s spouse, parents, children, siblings, mothers and fathers-in-law, sons and daughters-in-law, brothers and sisters-in-law, and anyone (other than domestic employees) who shares the person’s home. |

| ● | The director or any member of his or her immediate family may not receive, or have received, during any 12-month period within the preceding 36 months, direct compensation of more than $120,000 per year from Macy’s or any of its subsidiaries. Exceptions include director and committee fees and pension or other forms of deferred compensation for prior service that is not contingent on continued service or, in the case of an immediate family member, compensation for service as a non-executive employee. |

| ● | The director is not a current partner or employee of a firm that is Macy’s internal or external auditor; no member of the director’s immediate family is a current partner of such firm, or an employee of such a firm and personally works on Macy’s audit; or neither the director nor any member of his or her immediate family was within the last three years a partner or employee of such a firm and personally worked on Macy’s audit within that time. |

| ● | The director is not a current employee and no member of his or her immediate family is a current executive officer of a company that makes payments to, or receives payments from, Macy’s for property or services in any of the last three fiscal years in an amount which exceeds the greater of $1 million or 2% of the other company’s consolidated gross revenues. |

| ● | The director does not serve as an executive officer of a charitable or non-profit organization to which Macy’s has made contributions that, in any of the last three fiscal years, exceed the greater of $1 million or 2% of the charitable or non-profit organization’s consolidated gross revenues. |

| ● | Neither the director nor a member of the director’s immediate family is employed as an executive officer (and has not been employed for the preceding 36 months) by another company where any of Macy’s present executive officers at the same time serves or served on that company’s compensation committee. |

Our Board has determined that each of the following Non-Employee Director nominees qualifies as independent under NYSE rules and satisfies our Standards for Director Independence: Emilie Arel, Torrence Boone, Ashley Buchanan, Marie Chandoha, Naveen Chopra, Richard Clark, Deirdre Connelly, Jill Granoff, William Lenehan, Sara Levinson, Richard L. Markee, Douglas Sesler, Paul Varga and Tracey Zhen. Our Board also previously determined that Francis Blake, John Bryant and Leslie Hale, who served as directors during 2023, each qualify as independent under NYSE rules and satisfy our Standards for Director Independence. Tony Spring is employed by Macy’s and therefore he does not meet the independence standards set forth under the NYSE rules and our Standards for Director Independence.

|

| ||

28 |

|

FURTHER INFORMATION CONCERNING THE BOARD OF DIRECTORS

As part of its independence determination, the NCG Committee reviewed each director’s employment status and other board commitments and, where applicable, each director’s (and his or her immediate family members’) affiliation with consultants, service providers or suppliers of the Company and transactions, relationships, and arrangements with the Company. With respect to each Non-Employee Director, the NCG Committee determined that neither the director nor any immediate family member was employed by a company providing goods or services to Macy’s or the amounts involved were below the monetary thresholds set forth in the Standards for Director Independence.

Board Leadership Structure

Our Corporate Governance Principles provide that our Board is free to select its Chairman and the Chief Executive Officer (CEO) in the manner the Board considers to be in the best interests of the Company at any given point in time. These positions may be filled by one individual or by two different individuals. If the Chairman is not an independent director, the Board will designate an independent director to serve as lead independent director pursuant to the Company’s Lead Independent Director Policy.

Our Chairman and CEO functions historically have been performed by a single individual. In February 2024 the Board elected Mr. Spring as Chief Executive Officer and Chairman of the Board-Elect to succeed Mr. Gennette following his retirement as Chief Executive Officer on February 3, 2024. Mr. Gennette continued to serve as Non-Executive Chairman to assist in the leadership transition. On April 10, 2024, Mr. Gennette retired from his position as Non-Executive Chairman, and Mr. Spring began serving as Chairman of the Board. Collectively with the current composition of the Board, the use of a lead independent director, and the other elements of our corporate governance structure, the combined CEO and Chairman position strikes an appropriate balance between strong and consistent leadership and independent and effective oversight of our business and affairs.

Mr. Spring is an experienced retail executive and long-time employee of Macy’s. As CEO, Mr. Spring has the primary responsibility for developing corporate strategy and managing our day-to-day business operations. As a board member, he will continue to 1) chair regular Board meetings; 2) provide direction to management regarding the needs, interests and opinions of the Board; and 3) monitor key business issues and shareholder matters that are brought to the attention of the Board. Mr. Spring promotes unified leadership and direction for the Board and management. In addition, strong corporate governance structure and process enables our independent directors to continue to effectively oversee management and key issues such as strategy, risk and integrity. Board committees are comprised solely of independent directors. As such, independent directors oversee critical matters, including the integrity of our financial statements, the compensation of our CEO and management executives, the financial commitments for capital projects, the selection and annual evaluation of directors, and the development and implementation of corporate governance programs.

Our Board and each Board committee have access to any member of management and the authority to retain independent legal, financial and other advisors as appropriate. The Non-Employee Directors, all of whom are independent, meet in executive session without management either before or after regularly scheduled Board and Board committee meetings to discuss various issues and matters including the effectiveness of management, as well as our performance and strategic plans. Paul C. Varga, our Lead Independent Director, presides at these executive sessions.

FURTHER INFORMATION CONCERNING THE BOARD OF DIRECTORS

Lead Independent Director

Since our Chairman is not an independent director, the Board elected Paul Varga to serve as Lead Independent Director for a two-year term commencing in May 2023.

Under our Lead Independent Director Policy, the lead independent director has the following responsibilities:

FUNCTIONS AS LIAISON WITH THE CHAIRMAN AND/OR THE CEO | BOARD MEMBERSHIP AND PERFORMANCE EVALUATION |

● Serves as liaison between the independent directors and the Chairman and/or the CEO (although all directors have direct and complete access to the Chairman and/or CEO at any time as they deem necessary or appropriate) | ● Provides input, when appropriate, to the chair of the NCG Committee with respect to the annual Board and committee evaluation process |

● Communicates Board member feedback to the Chairman and/or CEO | ● Advises the NCG Committee and Chairman on the membership of the various Board committees and the selection of committee chairpersons |

Meetings of Independent Directors | Shareholder Communication |

● Has the authority to call meetings of the independent directors | ● Is regularly apprised of inquiries from shareholders and involved in correspondence responding to these inquiries, when appropriate |

● Approves the agenda for executive sessions of the independent directors | ● If requested by shareholders or other stakeholders, ensures that he/she is available, when appropriate, for consultation and direct communication |

Presides at Executive Sessions | Approves Appropriate Provision of Information to the Board such as Board Meeting Agendas and Schedules |

● Presides at all meetings of the Board at which the Chairman is not present, including executive sessions of the independent directors | ● Consults with the Chairman on, and approves when appropriate, the information sent to the Board, including the quality, quantity and timeliness of such information, as well as approving meeting agendas |

● Facilitates the Board’s approval of the number and frequency of Board meetings, and approves meeting schedules to ensure there is adequate time for discussion of all agenda items |

The Lead Independent Director is selected from among the Non-Employee Directors who satisfy the independence criteria of the NYSE and Macy’s Inc.’s Standards for Director Independence. The Chair of the NCG Committee and management discuss candidates for the Lead Independent Director position and consider many of the same types of criteria as candidates for the chair of Board committees, including, among other things:

| ● | Tenure |

| ● | Previous service as a Board committee chair |

| ● | Diverse experience |

| ● | Participation in and contributions to activities of the Board |

| ● | Time commitment |

The Chair of the NCG Committee recommends for consideration by the NCG Committee a nominee for Lead Independent Director every two years (or as required to address any vacancy in the position). If the NCG Committee approves the nominee, it will recommend the Board elect the nominee as Lead Independent Director at its next regularly scheduled meeting.

|

| ||

30 |

|

FURTHER INFORMATION CONCERNING THE BOARD OF DIRECTORS

Board Evaluations

The Board and each Board committee conducts a self-evaluation each year. In 2023, the evaluation process was conducted under the leadership of the Lead Independent Director and Chair of the NCG Committee. Periodically, the Board may engage an independent third-party to assist in the evaluation process.

Evaluation Process

Survey | Each Board and committee member completes a comprehensive survey regarding the Board and each committee on which they serve. |

| |

Compile Results and Solicit Feedback | The survey responses are compiled and provided to the Lead Independent Director and Chair of the NCG Committee. The Lead Independent Director conducts follow-up conversations with each Board member with respect to survey responses. |

| |

Lead Independent Director and NCG Chair Discuss | The Lead Independent Director and NCG Chair discuss survey results and feedback received during the individual calls. |

| |

NCG Committee Reviews in Executive Session | NCG Chair leads a discussion at the March NCG Committee meeting, in executive session, to: ● review and discuss observations from the survey responses and the interviews conducted; and ● agree on any follow-up by the NCG Committee or management on the evaluation results. |

| |

Board Reviews in Executive Session | The NCG Chair reports to the Board, in executive session, on any matter arising from the Board/committee evaluations. Following the March meeting, the NCG Chair meets with the Board Chair to discuss any follow-up on the Board/committee evaluations. |

CEO Succession Planning

The Board, together with the CMD Committee, regularly conducts a detailed review of management development and short-term and long-term succession plans. The Board and the CMD Committee are focused on ensuring that top management positions, including the CEO position, can be filled without undue interruption and that the leadership composition reflects the subject-matter experts required to deliver on our strategic priorities.

Macy’s successfully completed a leadership transition this year that was carefully planned over a multi-year period. See “Compensation Discussion and Analysis – Leadership Transitions.”

|

| ||

MACY’S, INC. | 31 |

FURTHER INFORMATION CONCERNING THE BOARD OF DIRECTORS

Board Risk Oversight

Enterprise Risk Assessment

We have an enterprise risk management program that identifies and prioritizes enterprise risks. Enterprise risks are categorized and evaluated using risk scoring based on weighted impact, likelihood and velocity, both before and after application of control measures, to indicate the Company’s current risk posture. An annual risk review schedule is prepared for updates to the full Board or assigned committee. At Board and committee meetings throughout the year, management discusses the risk exposures identified as being most significant to the Company and actions that management may take to monitor or mitigate the exposures. Overall risk outlook is evaluated at least biannually at these meetings. The program utilizes a network of functional experts with managerial responsibility for various aspects of enterprise risk management.

The Audit Committee is responsible for discussing policies with respect to the Company’s risk assessment and risk management, including possible risks related to data privacy, computerized information controls and cybersecurity, and to consider any recommendations for improvement of such controls. The Chair of the Audit Committee updates the full Board on these discussions.

The Audit Committee, and the Board when appropriate, receive regular updates from management on IT security, internal and external security reviews, data protection, risk assessments, breach preparedness, systems disruption risk, threat assessments, response plans and consumer privacy compliance in overseeing our cybersecurity risk management program. The NCG Committee oversees risks related to governance matters, as well as the Company’s programs, policies and practices relating to charitable, political, environmental and human rights issues, impacts and strategies, and the CMD Committee oversees human capital-related risks.

|

| ||

32 |

|

FURTHER INFORMATION CONCERNING THE BOARD OF DIRECTORS

Our Board’s risk oversight strategy is further described as follows:

BOARD OF DIRECTORS REVIEW OF | |||||||

● Corporate Strategy ● Enterprise Risk Management Framework ● Talent Review and Succession Planning |  | ||||||

|

| ||||||

BOARD COMMITTEES |

| MANAGEMENT | |||||

| |||||||

AUDIT | COMPENSATION AND MANAGEMENT | FINANCE |

| ● Design and execute risk management program ● Identify, analyze, mitigate and escalate risks ● Evaluate and prioritize risks into tiers, further escalating to our CEO, Committees and/or Board, as appropriate ● Ongoing engagement with Committee Chairs on areas of primary risk oversight | |||